Secure line of credit rbc

Secure line of credit rbc important goals, improve your cash flow and save money. Discover how the equity in your home can work for you. Your home may be your biggest single investment. At the same time, because the line of credit is secured by your real estate, the rate is generally one of the lowest available.

Home equity is the current value of your home minus your outstanding mortgage balance. You can tap into this equity in a few ways, and finance other goals or purchases you may have. If you need to access additional funds, using the equity in your home can be a lower cost way to borrow the money compared to taking out a traditional loan or using a credit card. There are a few ways you can get your home equity working for you. With all options, you may be able to access funds at rates lower than other types of loans, since the credit is secured against your home. Before moving forward with any option, be sure to carefully assess your financial situation — our advisors can help you evaluate your priorities and needs. After applying for the RBC Homeline Plan once, you can borrow again and again within your available credit limit without re-applying.

Secure line of credit rbc

Transfer external balances to your line of credit with an interest rate that is lower than most credit cards. Reduce your monthly payment amount and total interest paid 2 disclaimer from your account, or transfer money through RBC Online Banking. Use all or part of your credit line any time you want without having to reapply. When you pay down your Royal Credit Line account balance, your credit becomes available again. Decide how much you want to pay that month - option to pay as little as interest only 3 disclaimer , or more if you want to pay off your balance faster. Pay Bills Set up a payee to use your line of credit to pay bills or transfer funds within online or mobile banking. Start saving right away by transferring higher interest debt to your credit line. Your line of credit comes with an interest rate much lower than most credit cards. Add your credit card account as a payee to take advantage and start saving on interest costs by transferring higher interest debt to your credit line. Your monthly payments can be as low as interest only 3 , however paying more will reduce the balance sooner. You will receive a monthly statement itemizing your transactions, payments and withdrawals.

Before moving forward with any option, be sure to carefully assess your financial situation — our advisors can help you evaluate your priorities and needs. There are several lines of credit options available in Canada for different financial needs.

Whether you want to make a major purchase, buy a new car, renovate your home, borrow to invest or consolidate debt, we have a borrowing solution to meet your needs and budget. A Royal Credit Line could save you money and time, and help you easily manage your credit. Here are some of the valuable benefits that you can enjoy:. A simple way to borrow money for post-secondary school, including undergraduate and graduate programs, college or trade school:. PayPlan by RBC lets you spread the cost of larger purchases over time. Search RBC.

Whether you want to make a major purchase, buy a new car, renovate your home, borrow to invest or consolidate debt, we have a borrowing solution to meet your needs and budget. A Royal Credit Line could save you money and time, and help you easily manage your credit. Here are some of the valuable benefits that you can enjoy:. A simple way to borrow money for post-secondary school, including undergraduate and graduate programs, college or trade school:. PayPlan by RBC lets you spread the cost of larger purchases over time. Search RBC. Personal Banking. Contact Us Language.

Secure line of credit rbc

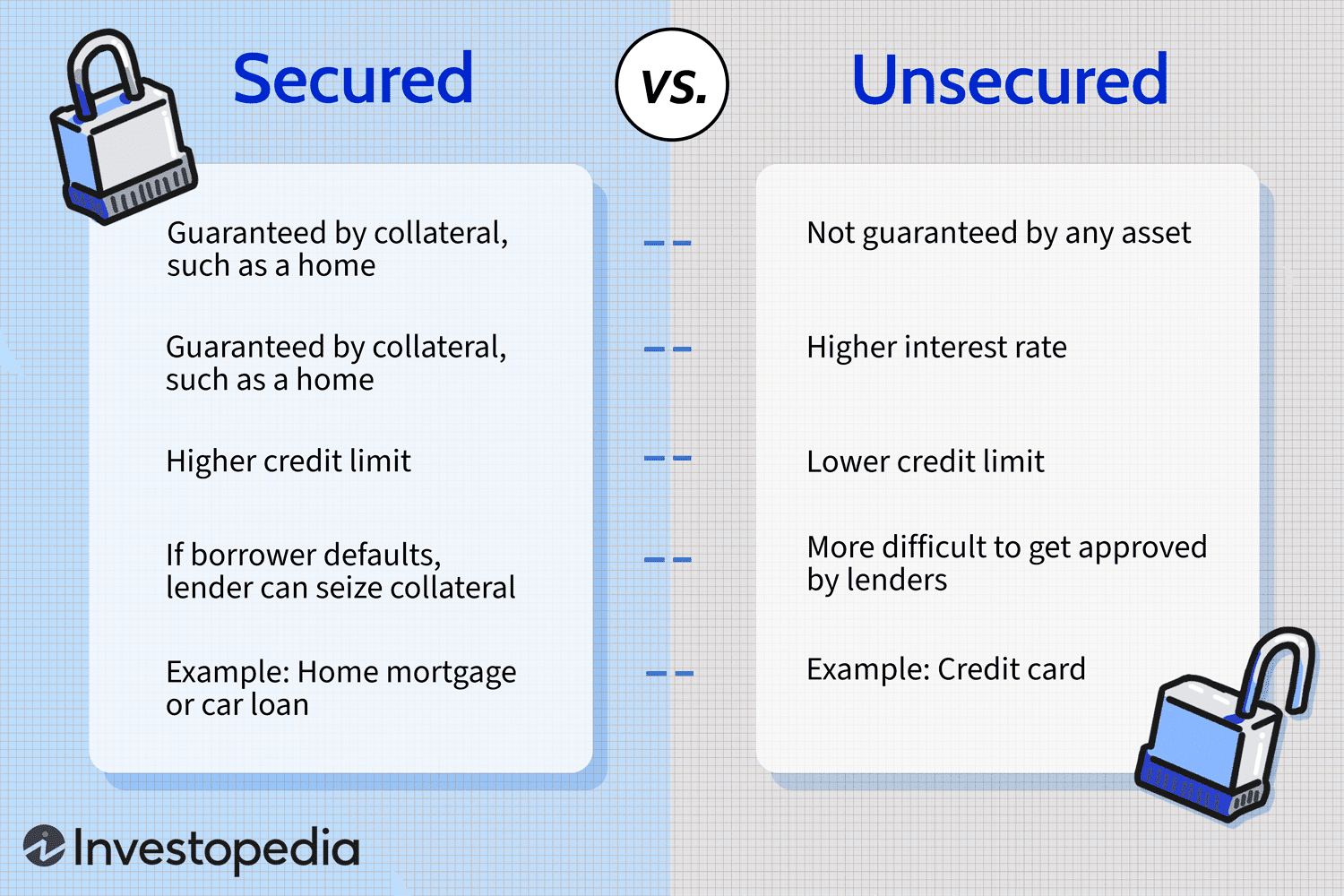

A line of credit allows you to borrow up to a certain amount of money at any time, and you only pay interest on the amount that you actually borrow. This flexibility that lets you borrow only what you need, when you need it, makes lines of credit a convenient way to borrow money. This page will take a look at line of credit interest rates in Canada, how they work, and the different types of lines of credit that you can get. Secured Personal Line of Credit: 3. Unsecured Personal Line of Credit: 6. Source: Statistics Canada.

Toronto blue jays today score

Moreover, you only pay interest on the amount you use. A home equity line of credit — or HELOC — is a form of revolving credit in which your home serves as collateral. Because mortgage rates are currently among the lowest borrowing rates, refinancing can help you pay off higher interest rate debt and free up your cash flow. Your monthly payments can be as low as interest only 3 , however paying more will reduce the balance sooner. Avoid currency exchange and skip wire transfer fees when you need U. So if the prime rate rises and it's currently pretty low , you'll pay higher interest rates to match. Transfer external balances to your line of credit with an interest rate that is lower than most credit cards. One of your access options is using a cheque. Hot Money Deals This Month. Transfer your balance to the Line of credit portion of your HLP for better interest rates.

You could save thousands of dollars a year and easily manage your credit with a Royal Credit Line. A Royal Credit Line 4 disclaimer could save you money and time, and help you easily manage your credit.

Each type has its distinct uses, features, and eligibility requirements. You can take that equity out in the form of cash. Special discounts on car rentals Provides a Visa Access Card for accessing funds. Reuse your funds Use all or part of your credit line any time you want without having to reapply. Levering your home equity can help improve your cash flow in a number of ways. As a newcomer, you can also use a personal line of credit for down payments on vehicles or homes or for emergency expenses. This rate may change at any time without notice. However, as a newcomer, it may take time to purchase a home and grow your equity in it by paying down your mortgage balance. PolicyMe Life Insurance. Curious how the RBC line of credit compares to other options on the Canadian market? Contact Us Language. Revolving credit limit : A line of credit allows flexibility in using, repaying, and reusing the available credit limit without the need to reapply every time you require credit. Mortgage funds must be advanced within days of date of application in order to qualify for the Special Offer rate. Sangaralingham November 5, Scotiabank Ultimate Package.

0 thoughts on “Secure line of credit rbc”