Should i buy boral shares

March 2, Bronwyn Allen. February 19, Sebastian Bowen. February 19, James Mickleboro. February 12, James Mickleboro.

The Brickworks share price finished Bronwyn Allen With earnings season nearing an end, we showcase 12 ASX shares that delivered some of the best profit boosts this season. In some cases, these mega profit gains led to significantly increased dividends for ASX investors, too. The building products business hasn't reported y See all BLD announcements. Never miss an update from Boral. Volume On Off.

Should i buy boral shares

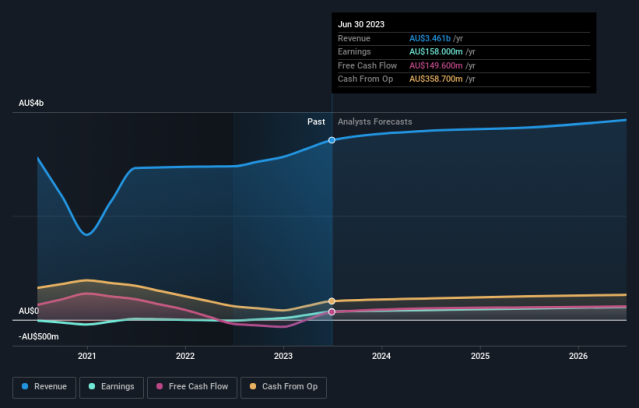

However, what if the stock is still a bargain? Check out our latest analysis for Boral. According to my valuation model, Boral seems to be fairly priced at around 3. So, is there another chance to buy low in the future? This is based on its high beta, which is a good indicator for share price volatility. Investors looking for growth in their portfolio may want to consider the prospects of a company before buying its shares. Boral's earnings over the next few years are expected to double, indicating a very optimistic future ahead. This should lead to stronger cash flows, feeding into a higher share value. Are you a shareholder? Have these factors changed since the last time you looked at the stock? Will you have enough confidence to invest in the company should the price drop below its fair value? Are you a potential investor?

You should consider the advice in light of these matters and, if applicable, the relevant Product Disclosure Statement in respect of Australian products or Investment Statement in respect of New Zealand products before making any decision to invest. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. February 9, James Mickleboro.

Looks you are already a member. Please enter your password to proceed. Forgotten password? Click here. Please make sure your payment details are up to date to continue your membership. Please contact Member Services on support investsmart.

Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources , and more. Learn More. This comprises 0. But the price may not stay there. But don't expect a better offer any time soon. Today's announcement represents an exciting opportunity to integrate Boral into SGH's leading Industrial Services portfolio. The transaction has a compelling rationale for SGH, and for Boral's shareholders, who would become SGH shareholders as part of the transaction and continue to benefit from the operational improvement journey underway at Boral. The terms of the Offer reflect our disciplined approach to capital allocation, and we will retain a strong balance sheet position post-transaction. Shareholders are advised to take no action in relation to the Offer, or any correspondence received from SGH, until they receive further information from Boral in relation to the Offer. A board committee of Boral's independent directors has been established and is currently considering the offer.

Should i buy boral shares

The offer would increase by another 10 cents if Seven Group's stake reaches Grant Samuel concluded Seven Group's offer was "not fair and not reasonable", after which all Boral directors other than Seven Group nominees intend to reject the offer, the company said in a statement. Boral said only Fisker's FSR electric dreams are hit by hard times. Financial woes and operational challenges push the once-promising contender to the edge. It could be time for some other AI stocks to carry the market higher.

Kizi free online games

This article by Simply Wall St is general in nature. The stock seems fairly valued at the moment according to my valuation model. You can view the full broker recommendation list by unlocking its StockReport. February 27th, - Motley Fool. A positive change is needed in order to justify the current price-to-sales ratio. PE Ratio Range. FREE membership. If you are no longer interested in Boral, you can use our free platform to see our list of over 50 other stocks with a high growth potential. Boral's earnings over the next few years are expected to double, indicating a very optimistic future ahead. January 17, Sebastian Bowen. Strong buying like that could be a sign of opportunity. Upgrade Today. We are working on updating this web app to fully enable Quantitative Ratios. February 19, James Mickleboro.

The Boral stock price is 6.

Compare our membership packages. Boral did not pay further dividends until February when it distributed an unfranked special cash payment. In contrast to all that, many investors prefer to focus on companies like Boral ASX:BLD , which has not only revenues, but also profits. First name is required. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations. Prices are indicative only. Volume On Off. Have these factors changed since the last time you looked at the stock? January 17, Sebastian Bowen. The Boral PE ratio based on its reported earnings over the past 12 months is February 26, Bernd Struben. Shareholders are advised to take no action in relation to the Offer, or any correspondence received from SGH, until they receive further information from Boral in relation to the Offer. February 21, Mitchell Lawler. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation.

In it something is. I agree with you, thanks for the help in this question. As always all ingenious is simple.