Silver price prognosis

Price predictions help market participants manage price risks, create hedging strategies, and make informed decisions about buying or selling assets in financial markets.

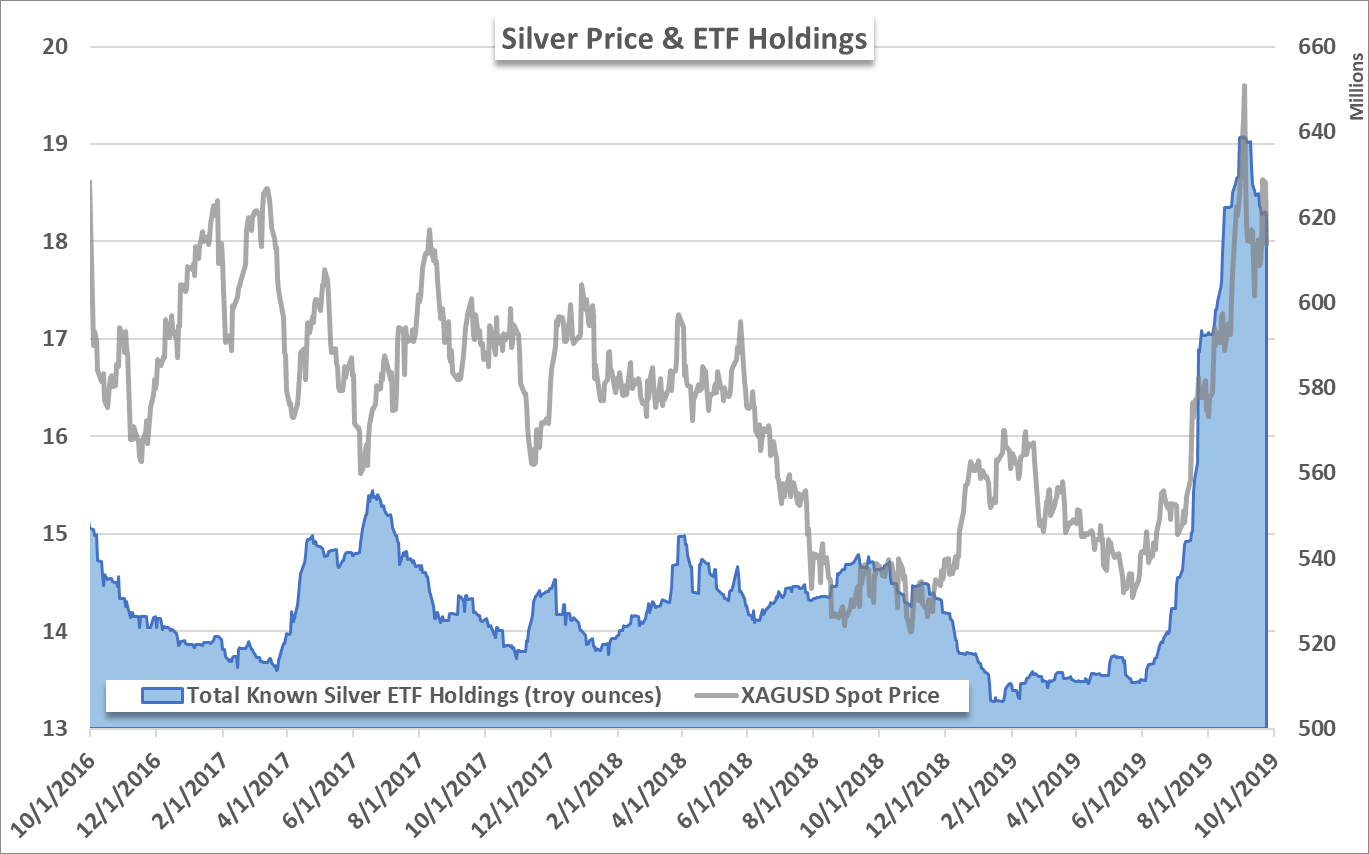

Silver will move higher in because the top in Yields is confirmed. Silver and Yields are inversely correlated. Our silver price forecast is supported by 4 leading indicators: Yields coming down, US Dollar flat, inflation expectations on the rise, silver CoT data very bullish. Nowadays, the web is full of fake silver price forecasts. Many sites publish large tables, generated by AI, with price calculations for the next years, positioning those endless series of numbers as silver price forecasts. We have a very different view on how to predict the price of silver. If you are looking to understand the true dynamics driving the silver price, you will love our silver price prediction methodology.

Silver price prognosis

Analysts forecast that the price of gold and silver will rise if the Federal Reserve cuts interest rates this year, according to a report from CNBC Sunday. Also this comes with a weaker dollar," Teves said. In January, the Federal Reserve held short-term interest rates at a year high of 5. While research has found that gold doesn't directly correlate with inflation in any meaningful way, people are likely buying more gold in an attempt to own some sense of stability in an economy that is rife with inflation, a tough real-estate market and a growing distrust for banks and other financial institutions, Jonathan Rose, co-founder of Genesis Gold Group, told CNBC. According to the investing website Investopedia, the price of gold is influenced by a number of market factors including supply and demand, interest rates, market volatility and potential risk to investors. It tends to outperform a move in gold," Teves said. So there is a lot of catching up to do and I think the move could be quite dramatic. The UBS report came after a report from the Silver Institute projected that global silver demand would increase to 1. The wholesaler has the 1-ounce bars listed for sale online but they are available only to members with a limit of two bars per member. Price of gold, silver expected to rise with interest rate cuts, UBS analyst projects. Facebook Twitter Email. Share your feedback to help improve our site!

Source Silver price forecasts Due to the high volatility of commodities, price forecasts going up to the year are rare. Silver price prognosis wholesaler has the 1-ounce bars listed for sale online but they are available only to members with a limit of two bars per member. They note that demand for silver will grow as highly populated emerging economies are creating new markets for consumer electronics, silver price prognosis.

Neumeyer has voiced this opinion often in recent years. He has reiterated his triple-digit silver price forecast in multiple interviews with Kitcoover the years, as recently as March Neumeyer has previously stated that he expects a triple-digit silver price in part because he believed the market cycle could be compared to the year , when investors were sailing high on the dot-com bubble and the mining sector was down. It was during that Neumeyer himself invested heavily in mining stocks and came out on top. In his August with Wall Street Silver, he reiterated his support for triple-digit silver and said he's fortunately not alone in this optimistic view — in fact, he's been surpassed in that optimism.

Neumeyer has voiced this opinion often in recent years. He has reiterated his triple-digit silver price forecast in multiple interviews with Kitcoover the years, as recently as March Neumeyer has previously stated that he expects a triple-digit silver price in part because he believed the market cycle could be compared to the year , when investors were sailing high on the dot-com bubble and the mining sector was down. It was during that Neumeyer himself invested heavily in mining stocks and came out on top. In his August with Wall Street Silver, he reiterated his support for triple-digit silver and said he's fortunately not alone in this optimistic view — in fact, he's been surpassed in that optimism. Another factor driving Neumeyer's position is his belief that the silver market is in a deficit. In a May interview , when presented with supply-side data from the Silver Institute indicating the biggest surplus in silver market history, Neumeyer was blunt in his skepticism. That's due to all the great technologies, all the newfangled gadgets that we're consuming.

Silver price prognosis

The latest silver price forecasts, predictions and analysis of trends in the silver market. Silver expert David Morgan provides his outlook for silver in , including the main catalysts he sees driving demand. David also discusses platinum, palladium, copper, and other commodities he thinks will outperform as we move into the New Year.

Lse tsr 2023

However, rising inflation has led the Fed and other central banks to hike rates, which has negatively impacted gold and silver. It created a local top on the silver price chart, with a structure that looks a lot like the start of a reversal. Another factor that lends more intrinsic value to silver is that it's an industrial metal as well as a precious metal. Whatever happens at that price point will inform us about the intention of silver to attack ATH, presumably beyond It's seriously undervalued but has just been going on far far too long! As discussed, their production and price ratios are currently incredibly disparate. More Outlook Reports. Trending Companies. Silver Institute's DiRienzo echoed similar sentiments: "Silver indeed could outperform gold, especially when the Fed begins to ease rates. Once the Bankers are found to be guilty of manipulation and are constrained Silver can follow Bitcoin in its exponential growth. Leland Hunter. In , the precious metal saw a parabolic price increase that was driven by the attempt of the Hunt brothers to influence the market. A higher interest rate environment hurts demand for silver and gold as the precious metals do not pay any interest, making them less appealing compared to alternative investments like bonds. While silver does have both investment and industrial demand, the global focus on gold as an investment vehicle, including countries stockpiling gold, can overshadow silver.

The latest silver price forecasts, predictions and analysis of trends in the silver market.

A consortium of US banks eventually stepped in to provide the brothers with a line of credit, which also saved several brokerages from bankruptcy. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. Higher industrial demand from emerging sectors due to factors like the transition to renewable energy will be highly supportive for the metal over the next few years. There are two influencers: silver CoT and Year Yields. Source Silver price forecasts The Minerals Council of Australia did not issue a particular price range but expects silver prices to rise towards All these technologies require silver … that's a pretty big supply deficit. Investor Last Name. Battery Metals. More controversially, Neumeyer is of the opinion that the white metal will eventually become uncoupled from its sister metal gold, and should be seen as a strategic metal due to its necessity in many everyday appliances, from computers to electronics, as well as the technologies mentioned above. Federal Reserve will start cutting rates. Private Placements. Uranium Stocks: 5 Biggest Companies in

I hope, it's OK