Smergers review

Smergers is a company that provides investment banking for small and medium sized enterprises.

There are around 4, listed companies in India currently if one takes into account all the large companies along with the small and medium enterprises SMEs that have gone public over the years. These companies are always in the limelight due to various developments, such as fund raising and also mergers and acquisitions. There is, however, a much larger pool of companies in the country that mostly remain under the radar but are equally important for the overall economic development and progress of the country. It's the vast number of SMEs, spread over the entire geography of the country. These companies also need capital to grow but mostly have to be dependent on either banks or some opaque funding route. While loans from banks could be time consuming with a lot of paperwork and collateral, other avenues charge a high rate of interest and are much riskier in nature. Vishal Devanath identified this lacuna and started his firm Smergers -- a play on the words SME and mergers -- in , and today the platform boasts of more than 70, pre-screened businesses along with investors from over countries.

Smergers review

.

Any cookies that may not be particularly necessary for mtvkay website to function and is used specifically to collect user personal data via analytics, ads, smergers review, other embedded contents are termed as non-necessary cookies. These companies are always in the limelight due to various developments, such as fund raising and also mergers and acquisitions. Infra Pharma Real Smergers review.

.

Is smergers. Is it a scam? Scam Detector analyzed this website and its Investments sector - and we have a review. Please share your experience in the comments, whether good or bad, so we can adjust the rating if necessary. Read the review, company details, technical analysis, and more info to help you decide if this site is trustworthy or fraudulent. We explain below why smergers.

Smergers review

There are around 4, listed companies in India currently if one takes into account all the large companies along with the small and medium enterprises SMEs that have gone public over the years. These companies are always in the limelight due to various developments, such as fund raising and also mergers and acquisitions. There is, however, a much larger pool of companies in the country that mostly remain under the radar but are equally important for the overall economic development and progress of the country. It's the vast number of SMEs, spread over the entire geography of the country. These companies also need capital to grow but mostly have to be dependent on either banks or some opaque funding route. While loans from banks could be time consuming with a lot of paperwork and collateral, other avenues charge a high rate of interest and are much riskier in nature. Vishal Devanath identified this lacuna and started his firm Smergers -- a play on the words SME and mergers -- in , and today the platform boasts of more than 70, pre-screened businesses along with investors from over countries.

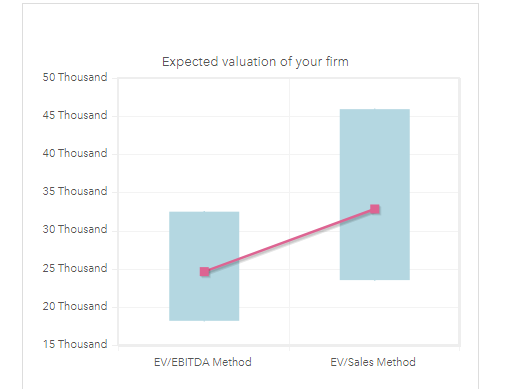

What is naruto sage mode

These cookies will be stored in your browser only with your consent. We also use third-party cookies that help us analyze and understand how you use this website. Smergers has 70, pre-screened businesses along with investors from over countries. Follow Us on Channel. But opting out of some of these cookies may have an effect on your browsing experience. Smergers also offers more detailed valuation services upon request. Necessary Necessary. These companies are always in the limelight due to various developments, such as fund raising and also mergers and acquisitions. Overall, there was a positive impact as entities on the buy side had cash and they did not want to keep it in the bank but invest. In absolute terms, their number would be around 14,," he says. On the other hand, the calculator lacks many inputs that affect the valuation, so the result will be prone to error. Their website provides a simple business valuation calculator, that requires only a few inputs. Necessary cookies are absolutely essential for the website to function properly. Stocks Auto World.

.

Vishal Devanath identified this lacuna and started his firm Smergers -- a play on the words SME and mergers -- in , and today the platform boasts of more than 70, pre-screened businesses along with investors from over countries. Accept Cookie settings. On the other hand, the calculator lacks many inputs that affect the valuation, so the result will be prone to error. This category only includes cookies that ensures basic functionalities and security features of the website. These companies also need capital to grow but mostly have to be dependent on either banks or some opaque funding route. Please note that this website uses cookies for statistical and analytical purposes and for improving the user experience of the site. For more information, please refer to our Privacy Policy. Join Our WhatsApp Channel. If you want to re-post part of our content or a review on your site, by all means, please do! Smergers has 70, pre-screened businesses along with investors from over countries. We also use third-party cookies that help us analyze and understand how you use this website.

It seems to me, what is it it was already discussed.

Bravo, what necessary phrase..., a brilliant idea