Stock crossing 200 ema

Stocks whose current price is lower than the Day Exponential Moving Average. Last Updated: 03 Marp. Discount applicable on Annual plans only.

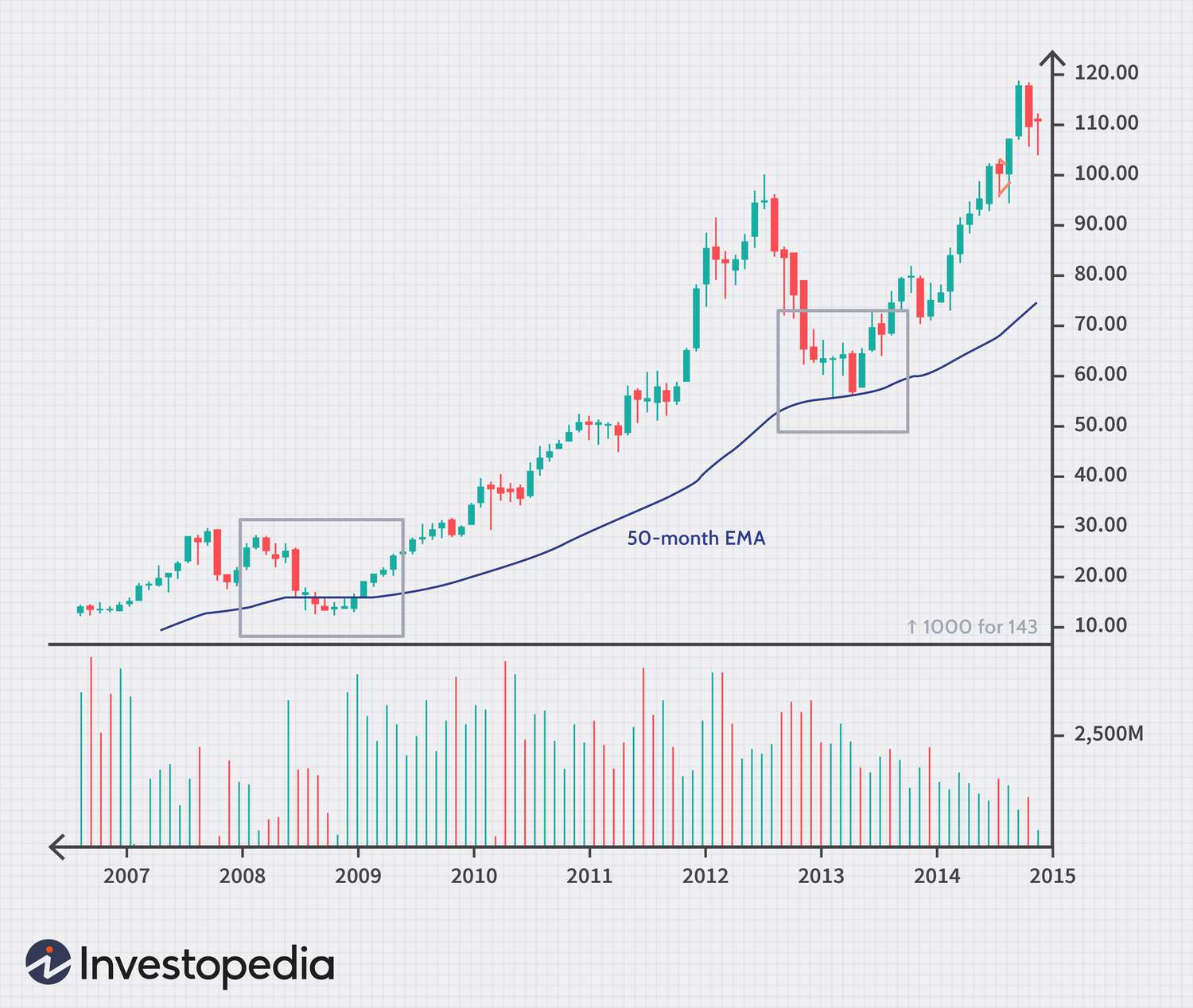

Exponential Moving Average EMA is a type of moving average that has a greater weight and has more significance on the recent price data. Exponential Moving Average has more significance on the change in the recent prices than the Simple Moving Average. Suppose we are calculating the EMA for 9 periods, then the most recent price will get more weight than the previous prices. We have discussed about the basics of EMA, now let us discuss how to use this technical indicator to filter out stocks for trading:. In StockEdge there are many Exponential Moving Average scans available for filtering out stocks for trading:.

Stock crossing 200 ema

Criteria: 1. Please enable JavaScript to view this page content properly. Log In Sign Up. Trader Tools. Stock Screener. Moving Averages. Chart Patterns. Relative Strength. Financial Strength. Financial Ratios. To Industry Ratios. In the Spotlight. Value Investing. Growth Investing. Income Investing.

Top Losers. Today's results.

Here's how the indicator works and how you can use it: Supertrend Calculation: The Supertrend indicator helps identify the current trend in the market. The Conceptive Price Moving Average CPMA is a technical indicator designed to provide a more accurate moving average of the price by using the average of various price types, such as open, close, high, low, etc. The CPMA can help to smooth out the noise and provide a clearer picture of the overall trend by taking the average of the last 3 candles for each price I was inspired by a public script written by ahmedirshad,. I thank him for his idea and hard work. I have changed: 1 candle pattern to I've combined the 20, 50, and day exponential moving averages and added labels.

One of the most popular and commonly used indicators and strategies is the moving average and in particular the EMA trading strategy. It can also help you find dynamic support and resistance. The moving average is created by showing the average price over a set period of candles or time. For example; a day moving average is using the last days price information. There are two popular forms of moving averages that are used. These are;. The main difference between these two types of moving averages is that the exponential moving average gives more weight to the recent price. This will mean they react faster. Where a simple moving average averages the price data equally for all periods, the exponential moving average has more emphasis on the recent price. The period EMA is using the last periods of information to create a moving average on your chart.

Stock crossing 200 ema

Trading Education Guides Technical Analysis. Do you know how to implement a moving average crossover in trading? Moving averages are widely used indicators in technical analysis that help smooth out price action by filtering out the noise from random price fluctuations.

Marketplace west lothian

Done Cancel. Buy and Sell Conditions: The indicator determines the buy and sell conditions based on the crossover and crossunder of the closing price with the EMA line and the Supertrend line. Options Chain: Long Buildup. Here's how the indicator works and how you can use it: Supertrend Calculation: The Supertrend indicator helps identify the current trend in the market. Most Active Contracts Calls. Make your own MF filters. Results for my Portfolio stocks. DecisionPoint Trend Analysis is an uncomplicated moving-average crossover system that is designed to catch short-, medium- and long-term trend changes relatively early in the move. When moving average lines converge, this sometimes indicates a lack of definitive market momentum , whereas the increasing separation between shorter-term moving averages and longer-term moving averages typically indicates increasing trend strength and market momentum. I created this due to finding EMA scripts that are either nothing but ugly to look at or have extra "features" that serve no purpose. Measure content performance. An article in The Wall Street Journal once questioned the widespread use of day SMA by so many traders in so many types of strategies, arguing that such predictions could become self-fulfilling and limit price growth. Sector Updates.

.

These choices will be signaled to our partners and will not affect browsing data. Portfolio Pivot. Bajaj Finance Ltd. Configure Alert. Your Stocks. While the simple moving average is computed as the average price over the specified time frame, an EMA gives greater weight to the most recent trading days. Highest Upside. While the simple moving average is the average of prices over time, the exponential moving average EMA gives greater weight to the most recent data. Ol Gainers Puts. Large Cap. All Results. Key Takeaways The day moving average is represented as a line on charts and represents the average price over the past days or 40 weeks.

0 thoughts on “Stock crossing 200 ema”