Support and resistance indicator tradingview

This indicator provides you with 55 levels!

The ICT Killzones Toolkit is a comprehensive set of tools designed to assist traders in identifying key trading zones and patterns within the market. In the event of a Liquidity Sweep a Sweep Area is created which may provide further areas of interest. This would now be looked upon for potential support or resistance. Mitigation occurs when the The All Time High ATH Levels indicator displays a user-set amount of historical all-time high levels made on the user's chart, highlighting potential key price levels.

Support and resistance indicator tradingview

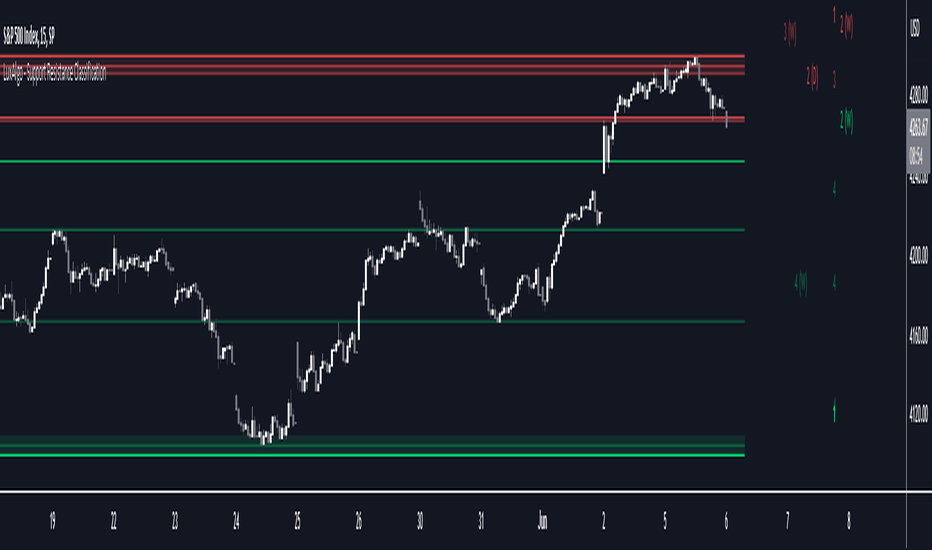

In true TradingView spirit, the author of this script has published it open-source, so traders can understand and verify it. Cheers to the author! You may use it for free, but reuse of this code in a publication is governed by House Rules. You can favorite it to use it on a chart. The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use. EN Get started. Support and Resistance. It determines the zones where the price leaves with a big candle after going horizontal for a while as support or resistance zones according to the price movement direction. Red zones represent resistance and green zones represent support.

Release Notes: Minor update. By default the filter isn't enabled but when it is enabled it allows for a less noisy experience at the expense of precision. Finding the most important ones can take many hours of practice.

In true TradingView spirit, the author of this script has published it open-source, so traders can understand and verify it. Cheers to the author! You may use it for free, but reuse of this code in a publication is governed by House Rules. You can favorite it to use it on a chart. The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView.

In true TradingView spirit, the author of this script has published it open-source, so traders can understand and verify it. Cheers to the author! You may use it for free, but reuse of this code in a publication is governed by House Rules. You can favorite it to use it on a chart. The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView.

Support and resistance indicator tradingview

Access to this script is restricted to users authorized by the author and usually requires payment. You can add it to your favorites, but you will only be able to use it after requesting permission and obtaining it from its author. Contact PatternAlpha for more information, or follow the author's instructions below. In many cases you can find a good open-source alternative for free in our Community Scripts. The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use. Warning: please read before requesting access.

Armpit job

Release Notes: Version 6. Essentially, this indicator uses order blocks and suggests that a swift price movement away from these levels, breaking the current market structure, This innovative script refines the traditional concept of VWAP by eliminating volume from the equation, offering a unique perspective on price movements and market trends. The fact that these levels flip roles between support and resistance can be used to determine the range of a market, trade reversals, bounces or breakouts. Order Blocks Flux Charts. EN Get started. This option is going to be especially useful when using the feature described next. You do not need to add a title as the correct alert messages are already built-in. In response to the many comments from people who thought the indicator wasn't working on certain symbols, I have decided to add warning label to chart if the symbol does not have volume data. Credit to both of them for most of the logic behind this script. Release Notes: color option added.

I am going to reveal a powerful fibonacci trading strategy that I learned many years ago. It combines structure analysis, fibonacci retracement and extension levels and candlestick analysis. Step 1 Find a trending market - the market that is trading in a bullish or in a bearish trend on a daily time frame.

TradingView has a smart drawing tool that allows users to visually identify these levels on a chart. Areas with many aggregated pivots are marked using the High Color, indicating strong support or resistance. The resistance levels are based on the all-time high and the subsequent lowest low. It identifies price levels where historically the price reacted either by reversing or at least by slowing down and prior price behavior at these levels can leave clues for future price behavior. Trading Rules for Sells, Buys are reversed 1. It helps SMD traders to identify fake or weak zones in the chart, So they can avoid taking position in this zones. Release Notes: Fixed bug that caused "Pine cannot determine the referencing length of a series" error. EN Get started. Cheers to the author! Support and Resistance levels can be identifiable turning points, areas of congestion or psychological levels round numbers that traders attach significance to. Identifying a trending market, where today's price is making a day high day

The properties turns out

Bravo, brilliant phrase and is duly

In my opinion you commit an error. I can prove it. Write to me in PM, we will communicate.