Swing trading screener

Understanding the Importance of Stock Swing trading screener. Key Features to Look for in a Stock Screener. Analyzing Technical Indicators with a Stock Screener. Swing trading is a popular trading strategy that aims to capture short-term price movements in the market.

A stock screener narrows thousands of stocks down to a manageable handful. This is how pro traders find promising stocks and build strong watchlists. Swing traders can take weeks or months to let a move play out. In swing trading, you get more time to think about your process and research stocks. Taking too much time to research might mean missing out on great trading opportunities.

Swing trading screener

.

In swing trading, traders aim to capture short-term price movements in stocks or other financial instruments. Fundamental analysis also involves evaluating industry and market trends.

.

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content. Measure advertising performance. Measure content performance. Understand audiences through statistics or combinations of data from different sources. Develop and improve services.

Swing trading screener

In the ever-evolving world of swing trading, the quest for the next big opportunity can be as challenging as it is thrilling. Amidst a sea of stocks, identifying those poised for significant moves often feels like searching for a needle in a haystack. Enter the game-changing utility of a swing trade scanner. A swing trading screener sifts through endless market data to spotlight high-potential stocks, transforming a daunting task into a manageable one. In essence, the right scanner can save you time and stress while helping you win more trades. It tells you when to buy it and when to sell it. Read on below to discover how to make scanning for stocks straightforward and effective with VectorVest! Decisions are made in the blink of an eye in the fast-paced world of swing trading.

Babypeachhead leaked

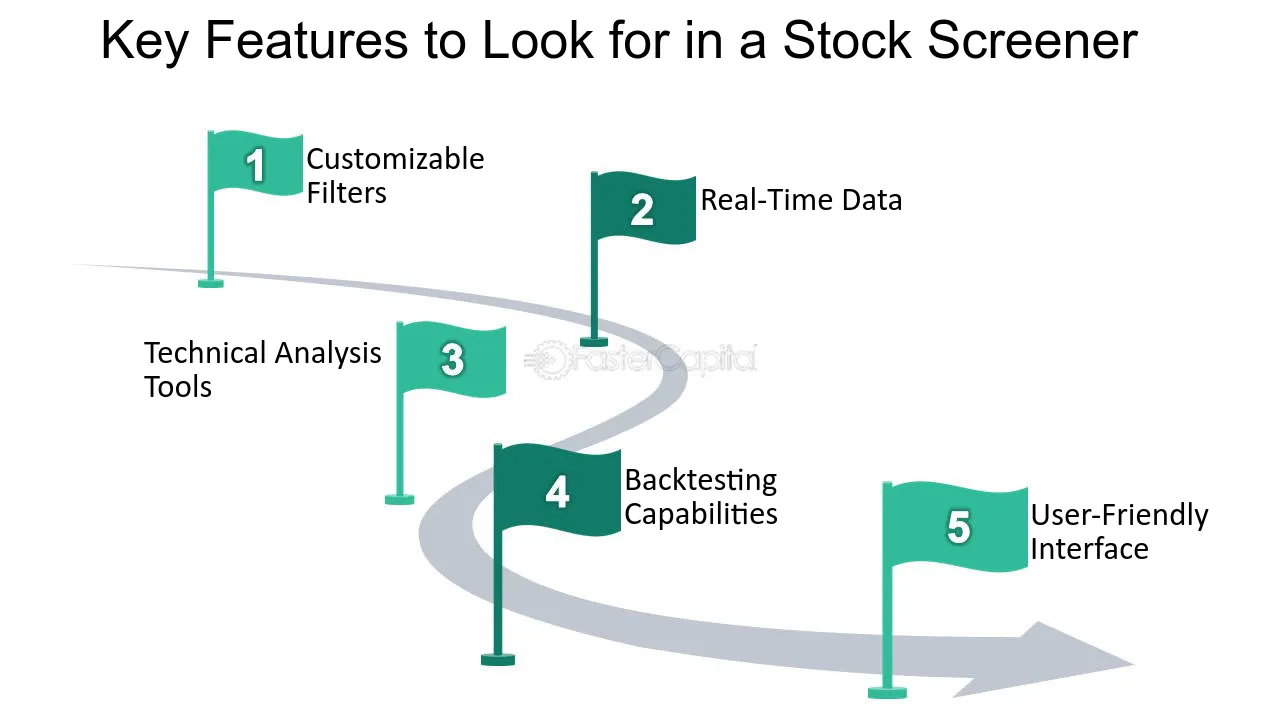

Every swing trader has their own unique set of criteria for identifying potential trades, and a good stock screener should allow you to tailor the filters to match your specific strategy. A stock screener can help swing traders identify stocks that exhibit specific technical patterns or have specific indicator values. Utilizing a stock screener can greatly enhance your swing trading strategy by helping you identify potential setups that meet your specific criteria. It provides over 30 fundamental data screener filters and multiple pre-configured templates to assist in fundamental analysis. Analyzing Technical Indicators. Overall, Finviz is a comprehensive stock screener that offers a wealth of information to assist swing traders in making informed trading decisions. By utilizing these indicators, you can identify stocks that are exhibiting specific patterns or signals that align with your trading strategy. By understanding the intrinsic value of a stock, identifying catalysts, assessing value, evaluating industry trends, and using stock screeners, swing traders can gain a competitive edge and potentially increase their profitability. It ranges from 0 to and is commonly used to identify overbought and oversold conditions in a stock. Try them all and use the ones that work best for you! The platform also provides access to real-time quotes, advanced charting capabilities, and a wide range of research tools. Customizable Filters: One of the key features to look for in a stock screener is the ability to customize filters. The main advantage of swing trading stock screeners is that it helps you identify the right stocks to trade according to your strategy. While technical analysis is a primary tool for swing traders, incorporating fundamental analysis into swing trading strategies can provide valuable insights and enhance trading decisions. Many good stock scanners key you into news catalysts and provide strong charting capabilities to help you make informed trading decisions.

A stock screener narrows thousands of stocks down to a manageable handful. This is how pro traders find promising stocks and build strong watchlists.

With thinkorswim, swing traders can filter stocks based on various criteria, including technical indicators, fundamental data, and market trends. Additionally, a user-friendly interface makes it easier to navigate and utilize the screener efficiently, saving you time and effort. Using Stock Screeners to Enhance swing Trading strategies :. Whether you opt for a free or paid screener, incorporating this tool into your trading routine can greatly improve your chances of success in the dynamic world of swing trading. When it comes to stock screeners, there are both paid and free options available. Additionally, real-time data and the ability to save and track your scans over time are important features to consider. This ranking lists the stocks most recommended by Zacks financial analysts — the stocks ranked are recommended buys. Experiment with different indicators to see which ones align with your trading strategy. Analyzing Technical Indicators. This is where a stock screener can be an invaluable tool, helping traders filter through a vast universe of stocks to find those that meet their specific criteria. In this section, we will explore how to effectively use a stock screener to identify potential swing trading setups. This allows you to analyze how stocks that meet your criteria have performed in the past. Traders aim to capture price movements, and higher volatility often presents more significant trading opportunities.

In my opinion you have misled.