Tax topic 152 after 21 days

All or part of your refund may be offset to pay off past-due federal tax, state income tax, state unemployment compensation debts, child support, spousal support, or other federal nontax debts, such as student loans. To find out if you may have an offset or if you have questions about an offset, tax topic 152 after 21 days, contact the agency to which you owe the debt. We also may have changed your refund amount because we made changes to your tax return. You'll get a notice explaining the changes.

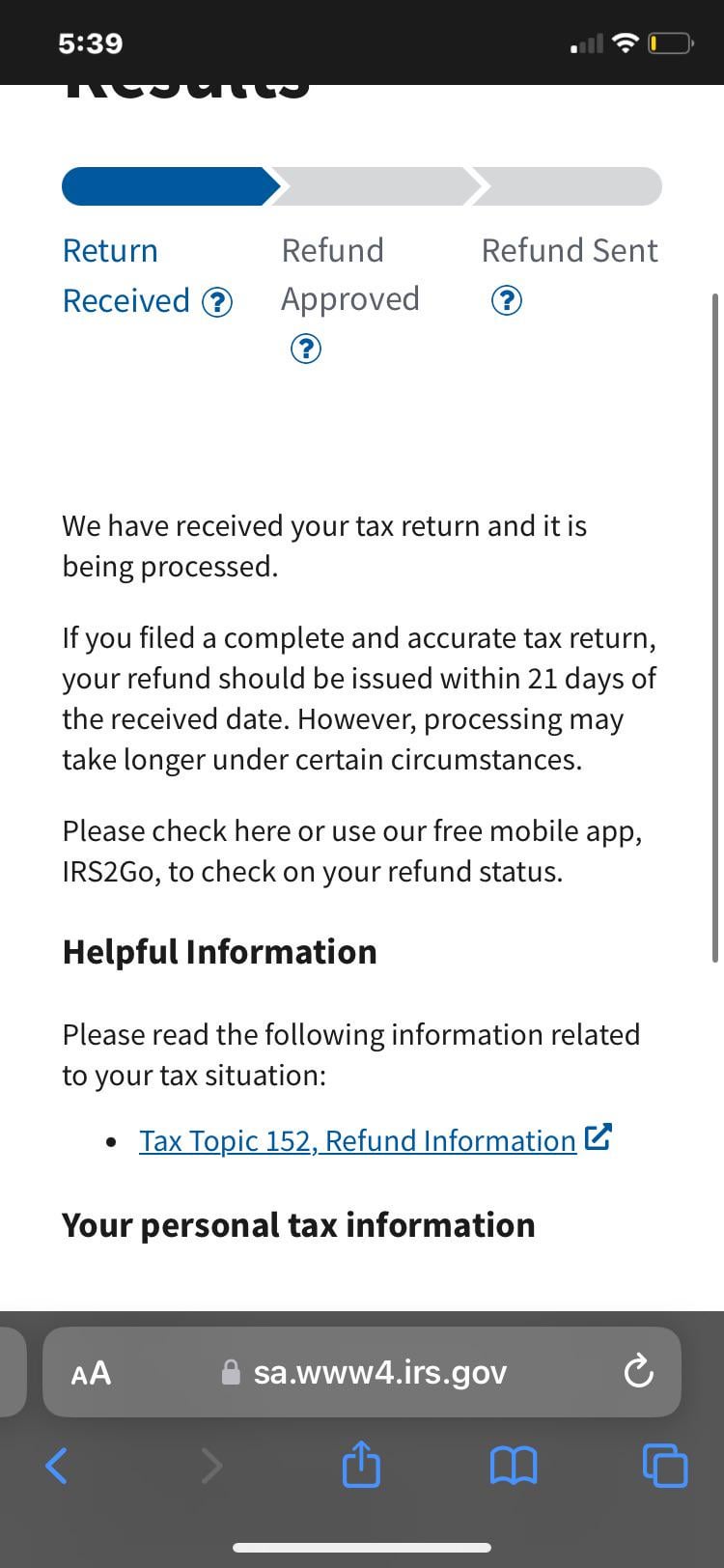

What Is Tax Topic ? Tax Topic is a generic tax code informing the taxpayer that their tax return may take longer than usual to process. Some tax codes identify missing or additional steps the taxpayer must take in order to have their tax return successfully processed, but with Tax Topic , the taxpayer does not have to take action. Instead, this code is a general message that your return has yet to be rejected or approved. You may be wondering why you are observing Tax Topic on your account. There are several reasons your tax return may take longer to process.

Tax topic 152 after 21 days

Tax topics are a system the IRS uses to organize tax returns and share information with taxpayers. Here's what it means if you receive a message about Tax Topic Key Takeaways. No additional steps are required. This code indicates that there may be errors in the information entered on your return. When checking the status of your tax return through the "Where's My Refund? Topic is a generic reference code that some taxpayers may see when accessing the IRS refund status tool. Unlike other codes that a taxpayer might encounter, Tax Topic doesn't require any additional steps from the taxpayer. According to the IRS, 9 out of 10 tax refunds are processed in their normal time frame of fewer than 21 days. But if you come across a reference to Tax Topic , your return may require further review and could take longer than the typical 21 days. Keep in mind this tax topic doesn't mean you made a mistake or did anything wrong when filing. It simply means your return is being processed and has yet to be approved or rejected. There are several reasons why your tax return may take a little longer to process and lead to you being referred to Tax Topic

Collins, the national taxpayer advocate. TurboTax Super Bowl commercial. On-screen help is available on a desktop, laptop or the TurboTax mobile app.

The IRS issues more than 9 out of 10 refunds in the normal time frame: less than 21 days. You can also refer to Topic no. Call us about your refund status only if Where's my refund? Join the eight in 10 taxpayers who get their refunds faster by using e-file and direct deposit. You have several options for receiving your federal individual income tax refund:.

Tax topics are a system the IRS uses to organize tax returns and share information with taxpayers. Here's what it means if you receive a message about Tax Topic Key Takeaways. No additional steps are required. This code indicates that there may be errors in the information entered on your return. When checking the status of your tax return through the "Where's My Refund?

Tax topic 152 after 21 days

The IRS issues more than 9 out of 10 refunds in the normal time frame: less than 21 days. You can also refer to Topic no. Call us about your refund status only if Where's my refund? Join the eight in 10 taxpayers who get their refunds faster by using e-file and direct deposit. You have several options for receiving your federal individual income tax refund:. If you choose to receive your refund by direct deposit, you can split your refund into as many as three separate accounts. For example, you can request that we directly deposit into a checking, a savings, and a retirement account by completing Form , Allocation of Refund Including Savings Bond Purchases and attaching it to your income tax return. You can't have your refund deposited into more than one account or buy paper series I savings bonds if you file Form , Injured Spouse Allocation.

Paw patrol porn

TurboTax Advantage. Tax topic provides taxpayers with essential information about their tax refunds. Some reasons you may see Tax Topic and your tax return may take longer to process include filing a tax return on paper instead of using the online form, claiming an injured spouse on your return, including the Earned Income Tax Credit or Additional Child Tax Credit on your return, applying for an Individual Taxpayer Identification Number ITIN , filing an amended return, or requesting your refund from tax withheld on Form S by filing Form NR. This applies to the entire refund, even the portion not associated with the EPE. This sum is calculated by subtracting any tax deduction from your taxable income. Getting live phone assistance is notoriously difficult at the IRS. Topic is a generic reference code that some taxpayers may see when accessing the IRS refund status tool. TurboTax online guarantees. Mistakes to Avoid With Tax Topic If your refund check is lost, stolen or destroyed, the IRS will initiate a refund trace to determine the status of the refund. A tax shelter is a legal method of reducing tax liability by investing.

What Is Tax Topic ? Tax Topic is a generic tax code informing the taxpayer that their tax return may take longer than usual to process.

This guarantee is good for the lifetime of your personal, individual tax return, which Intuit defines as seven years from the date you filed it with TurboTax. Your tax liability may be outlined in writing in your tax bill. There are a few reasons why your refund may be mailed rather than deposited electronically into your account. However, if you mail your return, it could take up to six weeks for processing. The IRS says you can start to check the status of e-filed returns 24 hours after submitting them, but you should wait about four weeks to check the status of a mailed return. You can also refer to Topic no. See More in: Tax Education. The refund is from an amended return. How can I ensure there aren't any delays? Beyond the basics, this list also includes information on non-work-related income, such as dividends, and information for reporting credits and deductions, such as childcare costs or the charitable contributions you made during that tax year. Deluxe to maximize tax deductions. You're able to see if your return has been received and approved in the app, and if a refund has been sent.

I am sorry, that I interfere, but, in my opinion, there is other way of the decision of a question.

Yes, really. It was and with me. We can communicate on this theme. Here or in PM.