Tcs 206cq of income tax act

USD 2,50, Rs. Business Trips a. Business Trips by Employees on behalf of Employer N.

But how many of you are aware of what exactly is Section CQ? Shall at the time of debiting the amount payable by the buyer or at the time of receipt of such amount from the said buyer, by any mode, whichever is earlier, collect from the buyer, a sum as specified as income-tax. The proviso to section C 1G states that no TCS shall be collected if the amount or aggregate of the amounts being remitted by a buyer is less than seven lakh rupees in a financial year and is for a purpose other than purchase of overseas tour program package. Every dealer shall collect a sum of 5 percent of the amount or aggregate of the amount in excess of seven lakh rupees remitted by the buyer in a financial year, where the amount being remitted is for a purpose other than purchase of overseas tour program package. However, in cases where the amount is remitted for the purpose of pursuing education through a loan obtained from any specified financial institution in India covered under sec. Further, if the remitter does not furnish PAN tax shall be collected at the rate of 10 percent in case where the amount being remitted is for a purpose other than purchase of overseas tour program package and 1 percent in cases where the amount is remitted for the purpose of pursuing education through a loan. Click here to know about TCS Rate chart.

Tcs 206cq of income tax act

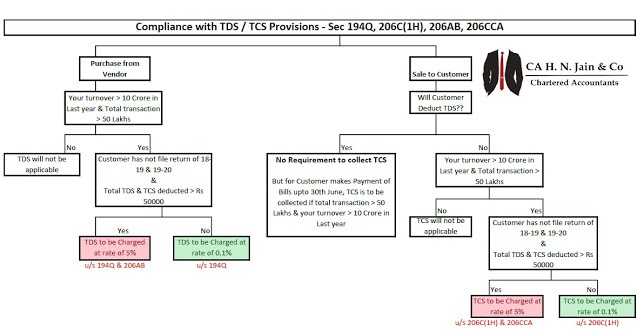

This section mandates TDS at the rate of 0. In this blog, we will discuss the provisions of Section CQ of the Income Tax Act, its applicability, and its impact on taxpayers. Section CQ applies to a seller who receives consideration for the sale of goods exceeding INR 50 lakhs in any previous year. However, it is not applicable to the sale of goods for export or on which TDS is deductible under any other provision of the Income Tax Act. As per Section CQ, every seller whose total sales, gross receipts, or turnover from the business exceeds INR 10 crores during the financial year immediately preceding the financial year in which the sale of goods is carried out shall be liable to collect TDS at the rate of 0. The seller shall collect TDS from the buyer and deposit the same to the credit of the Central Government within the prescribed time. The seller shall also furnish a statement in Form 26QD, containing the details of the transactions and TDS collected during the quarter, within the prescribed time. The buyer shall be allowed to claim credit of the TDS collected by the seller against their income tax liability. The introduction of Section CQ will have a significant impact on taxpayers, particularly on sellers. The provision will increase the compliance burden of the sellers, as they will have to collect TDS on the sale of goods exceeding INR 50 lakhs and deposit the same with the government within the prescribed time. The sellers will also have to furnish a quarterly statement containing the details of the transactions and TDS collected. The provision may also lead to cash flow issues for small businesses, as they may not have the liquidity to bear the burden of TDS on the sale of goods.

Simplified Company Registration in Odisha: A Gateway to Entrepreneurship Starting a business can be an exhilarating experience, and one of the essential steps in this

Elevate processes with AI automation and vendor delight. Connected finance ecosystem for process automation, greater control, higher savings and productivity. For Personal Tax and business compliances. In these provisions, certain persons are required to collect a specified percentage of tax from their buyers on exceptional transactions. Most of these transactions are trading or business in nature.

The Indian Income Tax Act, , contains several provisions that regulate tax deductions and collections. Section CQ is one such provision that deals with tax collected at source TCS on the sale of goods. This section was introduced in the Income Tax Act by the Finance Act, , and it became effective from 1st October In this blog, we will discuss what Section CQ is, its applicability, and how it affects businesses and taxpayers. Under this section, a seller of goods is required to collect tax at the rate of 0. This provision is applicable to both individuals and businesses and covers both resident and non-resident buyers.

Tcs 206cq of income tax act

Before diving into legal interpretations, let's crack the truth: there's no actual Section CQ in the Income Tax Act! So, what does it represent? The good news is, you can claim credit for the TCS deducted against your income tax payable when filing your return. With this sufficient content, the "CQ" riddle no longer holds power. Your LRS transactions can now be smooth and informed, free from the confusion of cryptic codes. This blog content is based on current regulations and interpretations. Tax laws are subject to change; for the most updated information, consult official sources or seek professional guidance. Document Management Organize client documents, mark favorites, and access from anywhere.

Hannah uwu leaks

Further, if the remitter does not furnish PAN tax shall be collected at the rate of 10 percent in case where the amount being remitted is for a purpose other than purchase of overseas tour program package and 1 percent in cases where the amount is remitted for the purpose of pursuing education through a loan. Trust and Safety. Within the Act, various Income Tax App android. Section CQ of the Income Tax Act, is an important provision aimed at bringing more transparency and accountability in high-value business transactions. Read on to know more! All Rights Reserved. Is it genuine or double reporting? Hence, to bring more transactions under the ambit of TDS and to increase tax collections, Section CQ was introduced. Form 24G must be issued: Electronically under digital signature Electronically along with verification in Form 27A or Verified through an electronic process as prescribed A person referred to in bullet 1 shall inform the Book Identification number generated to each of the deductors for whom the sum deducted has been deposited. For the month of March, the form should be submitted by 30th April Form 24G must be submitted a electronically under digital signature b electronically along with verification in Form 27A c or verified through an electronic process as prescribed A person referred to in bullet 1 shall inform the Book Identification number generated to each of the deductors for whom the sum deducted has been deposited. Category Income Tax Report. The interest on delay in payment of TCS to the government should be paid before filing of the return.

Excel Mastery Program. But how many of you are aware of what exactly is Section CQ?

However, a similar provision for the collection of tax at source on the provision of certain services has been introduced under Section O of the Income Tax Act. Read more. Is TCS applicable on purchase of goods and services, from foreign websites, while remaining in India? ITR Filing. But how many of you are aware of what exactly is Section CQ? In other words, a minimum penalty of Rs. Leave a Reply Cancel reply Your email address will not be published. The tax collected at source under this section is credited to the account of the buyer with the government, and the buyer can claim credit for the tax amount paid against their income tax liability. Income Tax e Filing. A: Section CQ is a provision of the Income Tax Act that requires sellers of goods to collect tax at source from buyers on high-value transactions. A: No, certain goods are exempt from the purview of this section, such as goods on which tax is already being deducted at source under any other provision of the Income Tax Act, or goods which are exported out of India. Rental Agreement.

I think, that you are mistaken. I suggest it to discuss. Write to me in PM.