Td checking account

Open a TD Checking Account online in minutes — it's easy and secure.

What can a TD personal bank account do for you? From chequing accounts with unlimited transactions and monthly fee rebates, to savings accounts that may help you achieve your financial goals, TD offers a range of personal bank accounts to help you manage your money. Compare the differences between a chequing and savings account so you know which type of bank account is best suited for you. View Details. Paired with your TD app, instantly keep track of your monthly spending. Get text messages right to your mobile when we detect suspicious activity made with your TD Access Card for your personal banking accounts.

Td checking account

A chequing account is the most basic transactional account you can have. You can use your chequing account to conduct the following transactions: Deposits cash and cheques , withdraw money at ATMs, bank tellers, etc. View Details. Just answer a few simple questions. Certain conditions may apply. Chequing accounts are usually used for day-to-day banking needs while savings accounts can help you achieve your savings goals. Depending on the chequing account type you open, your new chequing account may include free cheques. To view which accounts waive specified cheque fees, please visit the TD Public Site — Personal Bank Accounts page to view account features. Conditions apply. Daily Interest Chequing Account. All TD chequing accounts come with a debit card. You can also add your debit card to your digital wallet. Certain chequing accounts also allow you to make unlimited transactions with your debit card.

The Bonus Savings Interest Rate is an annualized rate, and the interest is calculated daily and paid monthly. Home equity rate discounts 2.

Students and young adults ages 17 through 23 have no minimum balance requirement and no monthly maintenance fee. Need something a little different? Take a look at our other checking accounts. You're bound to find something that works for you. But heads up—these accounts don't include the bonus. Here are just a few of the perks that come with every TD Bank checking account. Learn about your flexible overdraft options, 6 including Grace Period, 7 which gives extra time to fix an overdraft.

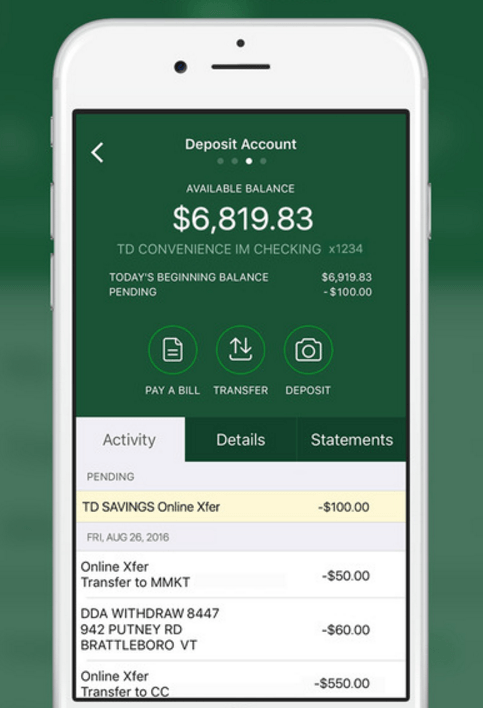

Personal Banking. Small Business Banking. Commercial Banking. Private Client Group. Personal Financial Services. Your new TD Bank Checking account is packed with features that make banking easier and more convenient. Start taking advantage of your account today with our built-in no-cost services and other benefits. Make the most out of your new TD Bank checking account — switching is convenient with our easy switch checklist. TD Checking customers get special rates on savings accounts and discounts on home lending solutions. Access your account online anytime, anywhere and get real-time account information and online statements, track debit transactions, pay bills and more.

Td checking account

Cash a birthday check, pay the babysitter or keep tabs on your spending. However you like to bank, we're on it. Stop by or call for that human touch.

Fire mage bis wotlk

This relationship discount may be terminated and the interest rate on your Home Equity Line of Credit account may increase by 0. Online statements. The following are not eligible to earn the offer: 1. We found a few responses for you:. New checking Customers: See limited-time special offer. Sorry, we didn't find any results. The institution that owns the terminal or the network may assess a fee surcharge at the time of your transaction, including balance inquiries. There is no fee to participate in the Offer. We matched that to:. How can I close a TD chequing account? Transactions between enrolled users typically occur in minutes. Earning bonus points: When you meet the terms set out in this Offer, select eligible TD Credit Cards set out below can earn bonus points on Eligible Purchases. Reach your goals faster with a high interest rate. Open a TD Checking Account online. Deposit cheques as soon as you receive them so you can spend more time doing the things you want.

Personal Banking. Small Business Banking. Commercial Banking.

Each account holder must be age of majority in their province of residence to apply for ODP and is subject to credit approval. Pre-authorized Debit must occur either weekly, biweekly, monthly, or twice per month. Most perks : Get the best of the best—an account loaded with benefits. Learn more. Rate discounts Get a 0. For any New Chequing Account that is a joint account, at least one account holder on the New Chequing Account must meet the eligibility requirements. Learn more. Certain conditions may apply. You should review the Privacy and Security policies of any third-party website before you provide personal or confidential information. TD ATMs 4. Learn more about Pre-Authorized Debit Whether or not a recurring Direct Deposit is acceptable for this offer is subject to our approval. TD MySpend. There are many different types of bank accounts. All other fees and charges applicable to the selected and approved TD Credit Card Account continue to apply.

0 thoughts on “Td checking account”