Tfsa calculator rbc

Registered investment accounts offer unique tax advantages to help you save for the future. Tfsa calculator rbc features, benefits and rules for registered accounts are determined by the Government of Canada, tfsa calculator rbc. How it works, who can open one and the investments you can hold. TFSAs are designed to help you save for both short-term goals like a new car or a home—and long-term goals, such as retirement.

Use our retirement calculators and tools to help guide your conversation with a financial planner. OAS is a monthly benefit available to most Canadians age 65 or older. So, if you retire early, you will have to wait to receive this income source in retirement. Here are some other income options you can explore. Get more insights from this RRIF guide. True or False?

Tfsa calculator rbc

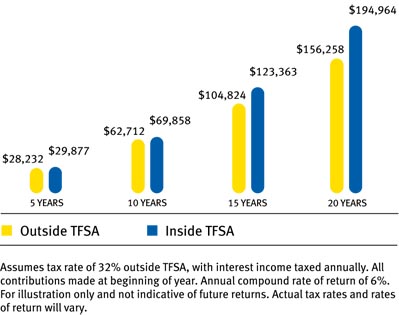

Use this calculator to understand how much more you could save in a TFSA compared to a regular savings account where earnings are taxable. Your TFSA lifetime contribution limit is. Save even more with your TFSA by changing your contribution frequency to biweekly. Your contribution frequency has changed to biweekly. Making more frequent contributions can make a difference over time compared to less frequent monthly lumps sum installments. That is - - more than you would have saved in a savings account where earnings are taxable. Complete the fields to see how your money can grow in a TFSA, and the tax dollars you could save. Watch your personalized video to understand how your money could grow faster in a TFSA compared to a savings account where earnings are taxable, and get insight on how to save even more. Taxes are based on the annual income entered with no additional deductions or earnings. This tool assumes the client was 18 years or older in , otherwise the contribution limit will be lower. Annual income assumes this is your taxable income before taxes and deductions. Tax-free and taxable investment results are approximations and do not reflect actual returns. This tool assumes a marginal tax rate based on the annual income you provided and an average rate of all Canadian provinces.

RMFI is licensed as a financial services firm in the province of Quebec.

If you like more flexibility and less taxes, consider opening a TFSA. Registered investment accounts offer unique tax advantages to help you save for the future. The features, benefits and rules for registered accounts are determined by the Government of Canada. From opening an account—to withdrawing money—here's how a TFSA can help you reach your goals:. A TFSA is a type of registered investment account, which means you can hold income-generating investments in it versus just cash like a savings account.

If you like more flexibility and less taxes, consider opening a TFSA. Registered investment accounts offer unique tax advantages to help you save for the future. The features, benefits and rules for registered accounts are determined by the Government of Canada. From opening an account—to withdrawing money—here's how a TFSA can help you reach your goals:. A TFSA is a type of registered investment account, which means you can hold income-generating investments in it versus just cash like a savings account. The types of investments you can buy in your TFSA depend on where you open an account.

Tfsa calculator rbc

Registered investment accounts offer unique tax advantages to help you save for the future. The features, benefits and rules for registered accounts are determined by the Government of Canada. How it works, who can open one and the investments you can hold. TFSAs are designed to help you save for both short-term goals like a new car or a home—and long-term goals, such as retirement.

When does return of the jedi take place

Contact Me. Quota sampling and weighting are employed to balance demographics to ensure that the sample's composition reflects that of the adult population according to Census data and to provide results intended to approximate the sample universe. All sample surveys and polls may be subject to other sources of error, including, but not limited to coverage error, and measurement error. How contribution room and carry-forward works. Financial institutions pay us for connecting them with customers. Personal Banking. When it comes to mortgages, Ratehub. Any withdrawal is added back to your TFSA contribution room the following year. That is - - more than you would have saved in a savings account where earnings are taxable. In the event this fee changes or new fees are introduced, RBC will notify clients by mail or electronically at least 30 days before the effective date of the change. Have a Financial Planner contact me. Your best course of action is to withdraw the excess amount from your TFSA as soon as possible.

Use our retirement calculators and tools to help guide your conversation with a financial planner. OAS is a monthly benefit available to most Canadians age 65 or older. So, if you retire early, you will have to wait to receive this income source in retirement.

You should review the Privacy and Security policies of any third-party website before you provide personal or confidential information. Plus you'll see how much your tax savings add up to. Want to Save Even Faster? If you are unsure of your lifetime contribution limit, contact the Canada Revenue Agency for help. Your TFSA contribution room represents the maximum amount of funds you can contribute. The material is intended as a general source of information only, and should not be construed as offering specific tax, legal, financial, investment or other advice. Discover the benefits of flexible, tax-free withdrawals and penalty-free re-contributions. Contributions are automatically debited from your bank account at RBC or another financial institution You can change how much you want to save, how often you contribute, and stop or pause your contributions at any time. So, if you turned 18 in but become a resident of Canada in , your total contribution room would start accumulating from the year Withdrawals can be made tax-free and will not increase your income for the year. This tool assumes the client was 18 years or older in , otherwise the contribution limit will be lower. Fortunately, TFSA contribution room is cumulative, which means any unused room from previous years is added to your current room—also known as your carry-forward amount. Have a Financial Planner contact me. Halfway there! The first recurring contribution does not hit the account until the first day of the second month.

0 thoughts on “Tfsa calculator rbc”