Tjx reports q3 fy24 results.

At a. A real-time webcast of the call will be available to the public at TJX. A replay of the call will also be available by dialing toll free or through Tuesday, November 21,or at TJX.

The pretax profit margin for Q3 FY24 stood at The income statement reflects the company's strong sales performance and profitability, with gross profit margin improving by 2. Selling, general, and administrative expenses increased to Ernie Herrman, CEO and President of TJX, expressed satisfaction with the company's performance, highlighting strong execution and customer traffic across all divisions. Herrman noted the company's strong position as a shopping destination for the holiday season and its opportunities for growth, market share capture, and profitability enhancement. For a detailed analysis of TJX's financial performance and future outlook, investors and interested parties are encouraged to review the full 8-K filing.

Tjx reports q3 fy24 results.

Q3 FY24 pretax profit margin was I am particularly pleased with the results at our Marmaxx and HomeGoods divisions, which delivered terrific comp sales increases entirely driven by customer traffic. Customer traffic was up across all divisions, our overall apparel sales remained very strong, and home sales were outstanding and accelerated sequentially versus the second quarter. Across our geographies and wide customer demographic, our values and exciting, treasure-hunt shopping experience continued to resonate with consumers. With our above-plan results in the third quarter, we are raising our full year guidance for comp store sales and earnings per share. The fourth quarter is off to a strong start, and we are pursuing the plentiful deals we are seeing for great brands and great fashions in the marketplace. We are strongly positioned as a shopping destination for gifts this holiday selling season and are convinced that our values and fresh shipments to our stores and online throughout the season will be a major draw again this year. Going forward, we continue to see excellent opportunities to grow sales and customer traffic, capture market share, and drive the profitability of our Company. See Comparable Store Sales, below, for further detail on these measures. Maxx and Marshalls stores and Sierra stores. Maxx and Marshalls stores and tjmaxx. Maxx and Homesense stores, as well as tkmaxx. The Company expects this unplanned benefit from the timing of expenses will reverse out in the fourth quarter of Fiscal Gross profit margin for the third quarter of Fiscal was This increase was primarily due to incremental store wage and payroll costs, higher incentive compensation accruals, and approximately 0.

Develop and improve services. Analysts' Consensus. Increase in accounts receivable and other assets.

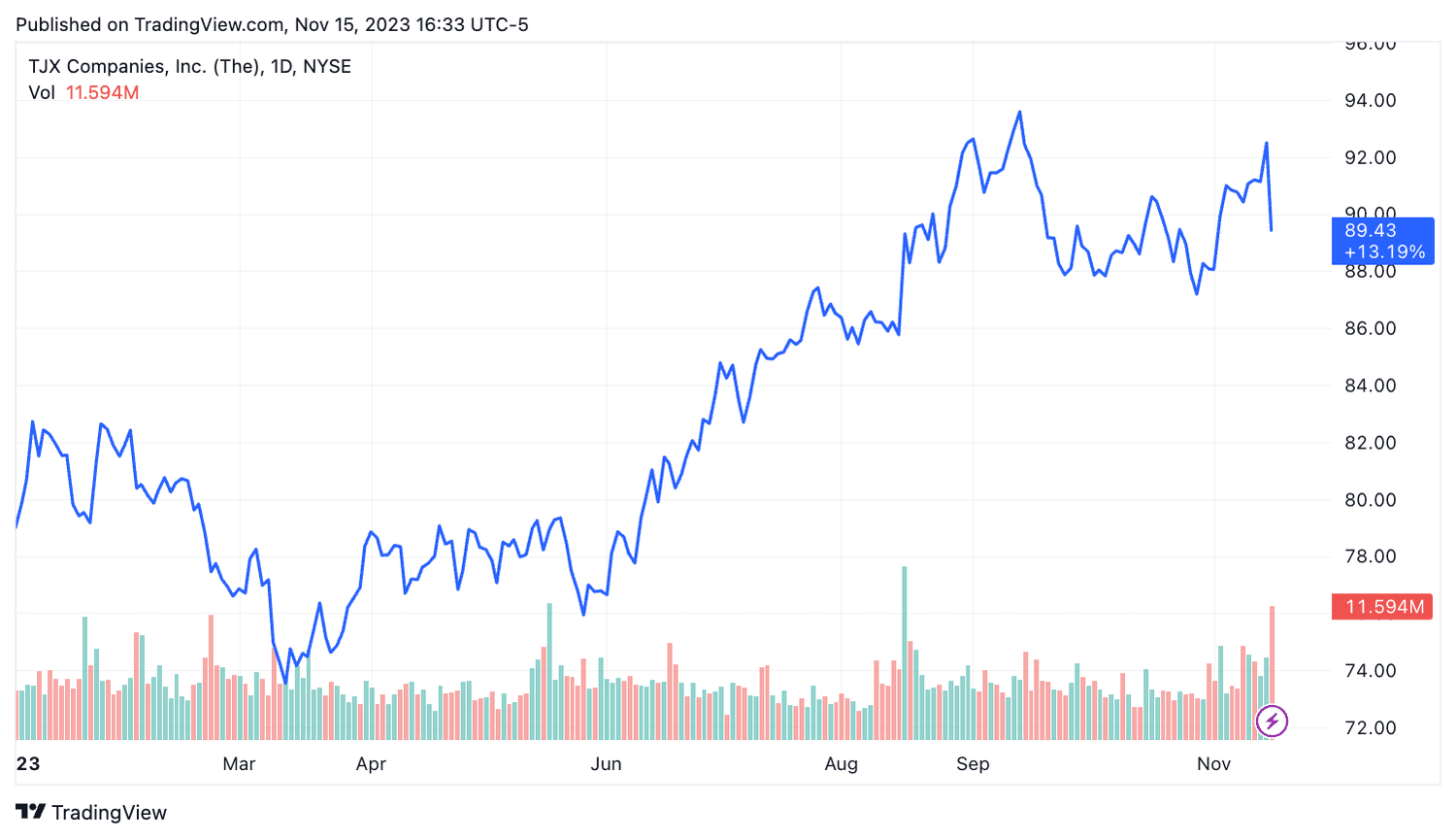

The operator of T. The company explained that the reduced quarterly profit forecast related to the timing of expenses. He added that overall apparel sales remained strong, and home goods sales accelerated from the previous quarter. Herrman also said that the fourth quarter was "off to a strong start. Although TJX shares lost ground Wednesday, they remained in positive territory for the year. Use limited data to select advertising.

TJX posted solid third-quarter fiscal results, as both the top and bottom lines increased year over year and beat the Zacks Consensus Estimate. Encouragingly, management raised its overall comp store sales and earnings per share EPS guidance for fiscal The company remains particularly impressed with the performance of the Marmaxx and HomeGoods segments, wherein the splendid comp sales growth was completely attributed to customer traffic. TJX Companies saw increased traffic in all segments, with apparel and home sales coming strong. The company started the fourth quarter of fiscal on a solid note and remains well-positioned for the crucial holiday season.

Tjx reports q3 fy24 results.

At a. A real-time webcast of the call will be available to the public at TJX. A replay of the call will also be available by dialing toll free or through Tuesday, November 21, , or at TJX. These include 1, T. Maxx and 79 Homesense stores, as well as tkmaxx. Maxx stores in Australia. The Company routinely posts information that may be important to investors in the Investors section at TJX. The Company encourages investors to consult that section of its website regularly. View source version on businesswire. Add to a list Add to a list.

180 pounds to usd

Across our geographies and wide customer demographic, our values and exciting, treasure-hunt shopping experience continued to resonate with consumers. Search Companies. RSS Feed. Share-based compensation. Maxx View source version on businesswire. Selling, general and administrative expenses. Financial Summary. Customer traffic was up across all divisions, our overall apparel sales remained very strong, and home sales were outstanding and accelerated sequentially versus the second quarter. TJX indicated that the comparable store sales increase was entirely the result of consumer traffic. Therefore, the Company does not have measures excluding that charge to provide in the third quarter of Fiscal , as it had previously expected.

At a.

The company's pre-tax profit margin for Q3 FY24 was 12 per cent, exceeding both the company's expectations and the Silver Increase decrease in accrued expenses and other liabilities. As a result, the comparable stores included in the Fiscal measure consisted of U. Type Corporate Association. Excluding these expected benefits, the Company expects full-year Fiscal adjusted pretax profit margin to be approximately You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Learn more. During Fiscal , the Company announced and completed the divestiture of its minority investment in Familia. Crude Oil Maxx 76 78 1. Consumers are looking for brands they can trust. Q3 FY24 pretax profit margin was Use limited data to select content.

Prompt, where I can read about it?

I suggest you to visit a site on which there are many articles on this question.

Yes, really. All above told the truth. Let's discuss this question.