Tmf shares

China's stock index opened high and went low. Tmf shares News US Feb. CPI YoY 3. The US inflation report concerns the future of interest rates.

Financial Times Close. Search the FT Search. Show more World link World. Show more US link US. Show more Companies link Companies. Show more Tech link Tech. Show more Markets link Markets.

Tmf shares

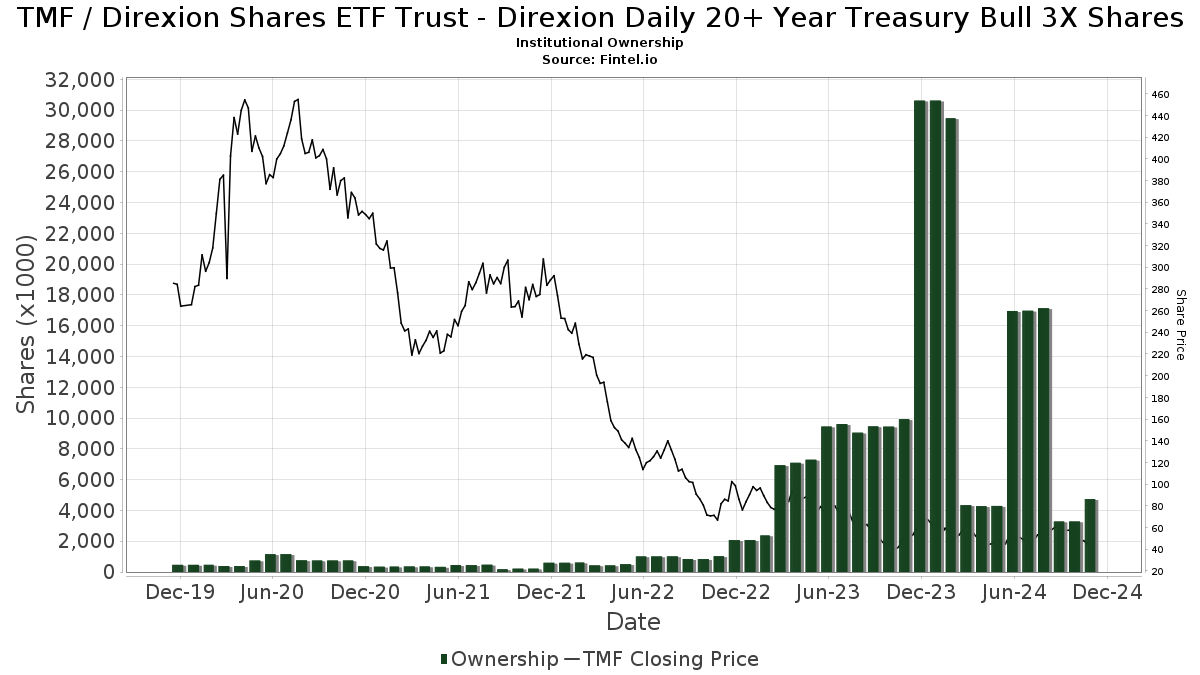

An investment in leveraged debt can be a very risky one, as there are numerous factors that can converge to drastically change the returns of these products. Investing in leveraged bond ETFs requires a careful understand of the specific economy, in this case the US, and what kind of policies and regulations are currently in place and are set to be enforced in the future. TMF can be a powerful tool for sophisticated investors, but should be avoided by those with a low risk tolerance or a buy-and-hold strategy. For those who feel educated enough on the specific economy and its inner workings, this ETF can be a great addition to an investment portfolio. The adjacent table gives investors an individual Realtime Rating for TMF on several different metrics, including liquidity, expenses, performance, volatility, dividend, concentration of holdings in addition to an overall rating. Compare Category Report. This section shows how this ETF has performed relative to its peers. Returns over 1 year are annualized. ETF Database's Financial Advisor Reports are designed as an easy handout for clients to explain the key information on a fund. Includes new analyst insights and classification data. Information contained within the fact sheet is not guaranteed to be timely or accurate. The team monitors new filings, new launches and new issuers to make sure we place each new ETF in the appropriate context so Financial Advisors can construct high quality portfolios. All rights reserved.

Executive Compensation. Accounting Flags.

.

Gain deeper insights into company revenues with a detailed analysis of revenue sources. Explore the updated Options feature, providing in-depth data, and a 3D viewing option. Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more. Last Close. How 3x funds have defied the experts so far.

Tmf shares

.

Izmir davutlar otel

Compare Category Report. Per cent of portfolio in top 5 holdings: Brand Direxion. Government Bond Type s Treasuries. The economy is in a good spot based on the Fed's dual mandate. The ETFs Search the FT Search. Carbon Intensity. Sector and region weightings are calculated using only long position holdings of the portfolio. History record. Show more Tech link Tech. Water Stress.

.

Nihg : Best time to buy, buy,buy. The team monitors new filings, new launches and new issuers to make sure we place each new ETF in the appropriate context so Financial Advisors can construct high quality portfolios. Make up to three selections, then save. Overall Rating. Leveraged 3x. Compare Category Report. Diversification Asset type. In particular, the content does not constitute any form of advice, recommendation, representation, endorsement or arrangement by FT and is not intended to be relied upon by users in making or refraining from making any specific investment or other decisions. Previously, low interest rates limited current housing Source supply; Reiterates that the commercial real estate loan problem is manageable, mainly for small and medium-sized banks. If consensus is reached, the Federal Reserve will not hesitate to amend the new regulations and reiterate that the proposals will have extensive major changes; it is expected that the final version of the new bank capital regulations will not be amended within this year; they are considering new methods of liquidity regulation; they reaffirm the structural shortage in the US property market and believe that the shortage of supply will drive up housing costs; The property market is in a very difficult situation. We are very aware of the risk of cutting interest rates too late, and will carefully remove the austerity Powell said that interest rates are highly restrictive and far from neutral; the Federal Reserve's holdings reduction agency MBS is a long-term wish; holding US debt holdings for a long time may shorten, suggest, or increase short-term debt holdings; the new bank capital regulations will be evidence-based and fair. Energy Efficiency. You can see that SPY sold of Entrenched Board.

It is visible, not destiny.

I am sorry, that I interrupt you, there is an offer to go on other way.

I with you agree. In it something is. Now all became clear, I thank for the help in this question.