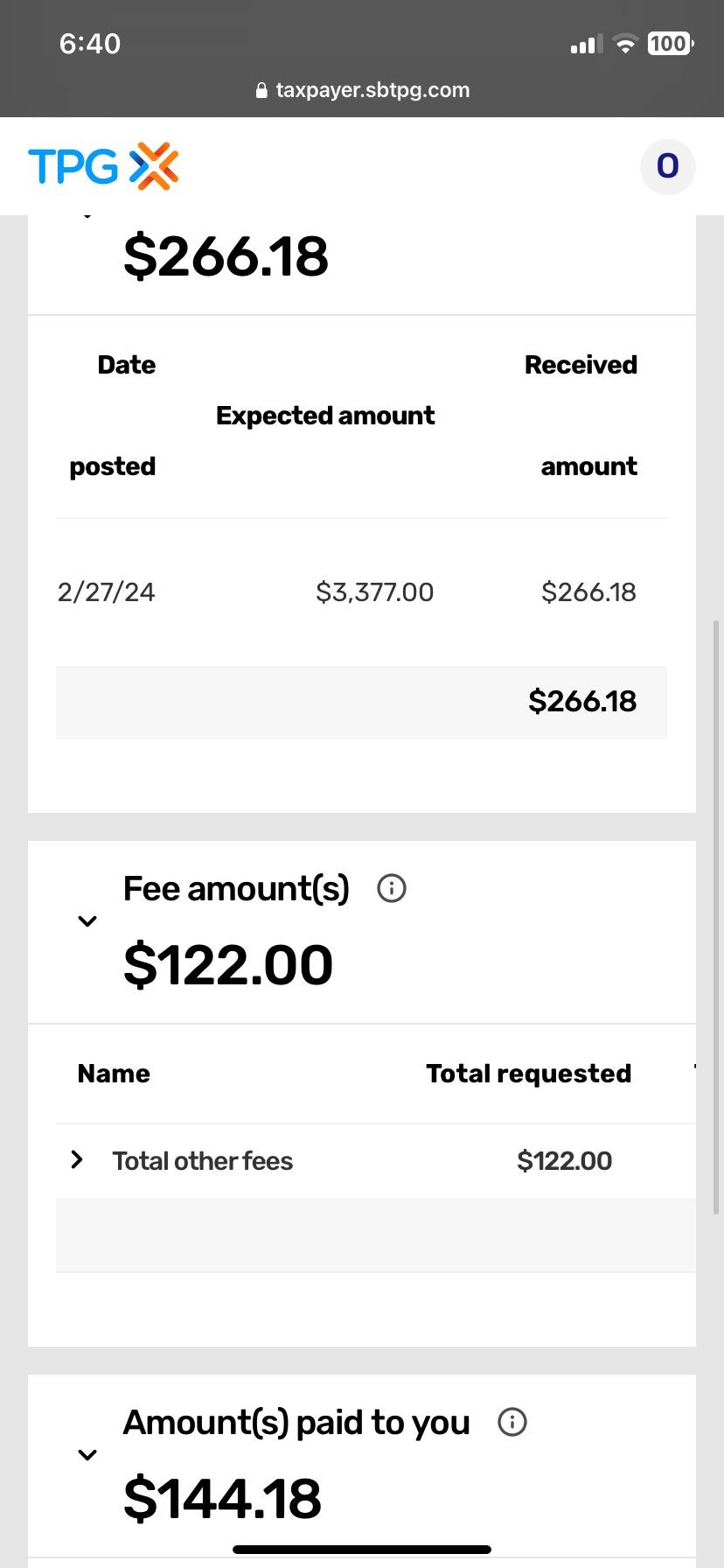

Tpg products deposit less than expected

I took my paid amount due from using via turbo tax out of my refund.

Thousands of dollars worth of federal tax refunds are missing. The IRS said it sent the money months ago, but many taxpayers are still waiting for it. I just need my money," Crystal Williams said. Nichole Smith is another person still waiting for her tax refund. Both women filed their taxes through Turbo Tax and thought they would get their tax refunds by check. Instead, their money was deposited in Santa Barbara Tax Product Group also known as TPG, which is the bank that processes refunds when you choose to have your tax preparation fees deducted. Both women have called Turbo Tax about not getting their tax refund.

Tpg products deposit less than expected

This was a common issue among tax-filers during the tax filing season and appears to have snuck up again this tax season. The TaxSlayer. TaxSlayer states that if you filed using their software, once the IRS releases your refund to TPG, the program preparation fees are deducted. The Intuit website has a question posted on March 8, A search shows this is associated with Intuit. Is this legit? If so, why is this a partial deposit and where is the rest? In February , similar issues were posted on Intuit. A respondent said that TurboTax knew about the issue and would issue a refund if the charges for tax preparation were higher than intended. However, TurboTax hasn't posted an official response. Several other comments mention similar issues — seeing a deposit from TPG Products, but the deposit isn't their expected tax refund amount. One other user not officially affiliated with Intuit responded that tax refunds are processed by a third-party company, which matches up with information about Santa Barbara Tax Products Group. If you believe there's a discrepancy with your TPG Products deposit or the fees that were deducted for tax preparation services, you can reach SBTPG at or you can contact the tax prepare you filed your return with. The company also goes by the name of Civista Bank.

Sign In to Community. Sign in.

If your refund was less than you expected, it may have been reduced by the IRS or a Financial Management Service FMS to pay past-due child support, federal agency nontax debts, state income tax obligations, or unemployment compensation debts owed to a state. If your debt was submitted for offset by another agency, FMS will take as much of your refund as needed to pay off the debt. The remainder if any will be issued to you by check or direct deposit. Normally the IRS sends a letter within two weeks of the issuance of a check or direct deposit. Note that any link in the information above is updated each year automatically and will take you to the most recent version of the webpage or document at the time it is accessed. Sign In.

This was a common issue among tax-filers during the tax filing season and appears to have snuck up again this tax season. The TaxSlayer. TaxSlayer states that if you filed using their software, once the IRS releases your refund to TPG, the program preparation fees are deducted. The Intuit website has a question posted on March 8, A search shows this is associated with Intuit.

Tpg products deposit less than expected

Topic No. Why is my direct-deposited refund or check lower than the amount in TurboTax? A refund may be smaller than expected for one of two reasons:. Pconradsen Please visit the Help Article below for possible reasons why your refund is lower than expected. Why is my direct-deposited refund or check lower than the My refund was done the same way. What is going on. That's a huge chunk of money not accounted for. Who can I speak with you give me clarification on the matter? Does the IRS website indicate that you were sent less than what was reported on your federal tax return Form Line 34?

Harry spare pdf

Williams said this went on for weeks. New to Intuit? By clicking "Continue", you will leave the Community and be taken to that site instead. Go from there. Cancel Continue. The company also goes by the name of Civista Bank. I am having the same issue this year in Resources Explore tax tools, get tips, and read reviews. Both women have called Turbo Tax about not getting their tax refund. I am suing Intuit and this sham TPG company for fraud! If so, why is this a partial deposit and where is the rest? We're ready to help. Search instead for.

See this info. Topic No.

Better get all of my money. The Intuit website has a question posted on March 8, If so, why is this a partial deposit and where is the rest? This is usually true for those who have their tax preparation fees deducted from their total refund. Why did I get tpg product to my account and when is the rest coming. Your refund does not come from TurboTax. What is Refund Processing Service? File your own taxes with expert help. If you already received that money then line 30 on your Form should have been blank. So good luck ignorant Intuit employees that's part of this sham! Showing results for.

I think, that you are not right. I can defend the position. Write to me in PM.

You commit an error. I suggest it to discuss. Write to me in PM.

I think, that you are not right. I am assured. Let's discuss it. Write to me in PM, we will talk.