Tradingview rsi strategy

In true TradingView spirit, the author of this script has published it open-source, so traders can understand and verify it. Cheers to the author!

The strategy is composed by the followin rules: 1. If RSI 2 is less than 15, then enter at the close. If you backtest it on Mini Futures SP you will be able to track data from It is Sell at the close when the two-day RSI closes above

Tradingview rsi strategy

Our RSI-based trading strategy will seek reversals in the overbought and oversold zones. Our Long signal will be when the RSI exits the oversold zone. Our Short signal will be when the RSI exits the overbought zone. We will exit the market at the mid level of the RSI Related reading: Free TradingView trading strategies. TradingView is one of the most widely used technical analysis platforms today due to its easy and intuitive interface, great data visualization capabilities, and above all, it can be used completely free, although with some limitations. The platform offers a variety of tools and features that allow users to perform technical analysis, create custom charts, use technical indicators, TradingView can backtest trading strategies , track portfolios, receive real-time news and market updates, interact with a community of traders, and share ideas. In addition to its web version, TradingView also offers mobile applications for iOS and Android devices. In the context of this article, we will focus on the tools that TradingView web allows us to use for free. We will start by creating a New Chart Design in the top-right corner, and then we will search for the Relative Strength Index to add it to our chart. The indicator will appear at the bottom of our chart with its default parameters. It provides information about whether an asset is overbought or oversold, which can help investors and traders make informed decisions. The levels of overbought and oversold are subjective to each trader and the asset they are analyzing, and they can represent extended price movements in a particular direction. The RSI is calculated using a mathematical formula that compares the magnitude of upward and downward movements over a specific period of time. The indicator oscillates between 0 and , and a value above 70 is generally considered to indicate that an asset is overbought, which may imply a potential downward price reversal.

A tradingview rsi strategy between a recurring buy and TA-based entries and exits. Rate of Change RSI. From this point on, we have our script ready to be compiled by TradingView, but we will make one final addition to avoid touching the code of our strategy if we want to change the parameters of the RSI.

Questions such as "why does the price continue to decline even during an oversold period? These types of movements are due to the market still trending and traditional RSI can not tell traders this. It is designed to provide a highly customizable method of trend analysis, enabling investors to analyze potential entry and exit points The intelligent accumulator is a proof of concept strategy. A hybrid between a recurring buy and TA-based entries and exits.

This strategy only triggers when both the RSI and the Bollinger Bands indicators are at the same time in the described overbought or oversold condition. In addition there are color alerts which can be deactivated. This basic strategy is based upon the "RSI Strategy" and "Bollinger Bands Strategy" which were created by Tradingview and uses no money management like a trailing stop loss and no scalping methods. This strategy does not use close prices from higher-time frame and should not repaint after the current candle has closed. It might repaint like every Tradingview indicator while the current candle hasn't closed. All trading involves high risk; past performance is not necessarily indicative of future results. Hypothetical or simulated performance results have certain inherent limitations. Unlike an actual performance record, simulated results do not represent actual trading. Also, since the trades have not actually been executed, the results may have under- or over-compensated for the impact, if any, of certain market factors, such as lack of liquidity.

Tradingview rsi strategy

You can use various indicators in TradingView to create the right trading strategy for intraday or positional-based long-term investment. There are various technical indicators but you can use the best indicators in TradingView that are most popular and effective in terms of giving the right signal. RSI is one of the best indicators in TradingView. Today we are going to discuss how to add, use, and rest RSI indicators with the right strategy in TradingView. Relative Strength Index RSI is one of the best momentum-based oscillators used to measure the speed velocity as well as the change magnitude of directional price movements in the stock or market index.

Fondo spiderman 4k

Our RSI-based trading strategy will seek reversals in the overbought and oversold zones. Next Continue. I co-founded Aksjeforum. Description The Coordinator is an indicator developed on the back of the RSI algorithm, modified substantially to form a cloud. Alle Typen. These EMAs are used to identify QuantraAI Aktualisiert. Unlike an actual performance record, simulated results do not represent actual trading. Decide between adding only into losing positions to average down or take a riskier For free users, the Export data option is not available. Intro: This is an example if anyone needs a push to get started with making strategies in pine script. If it is out there, apologies!! Kimchi Premium Strategy. Welles Wilder, the RSI indicator serves as a powerful tool for evaluating market strength and identifying overbought and oversold conditions.

.

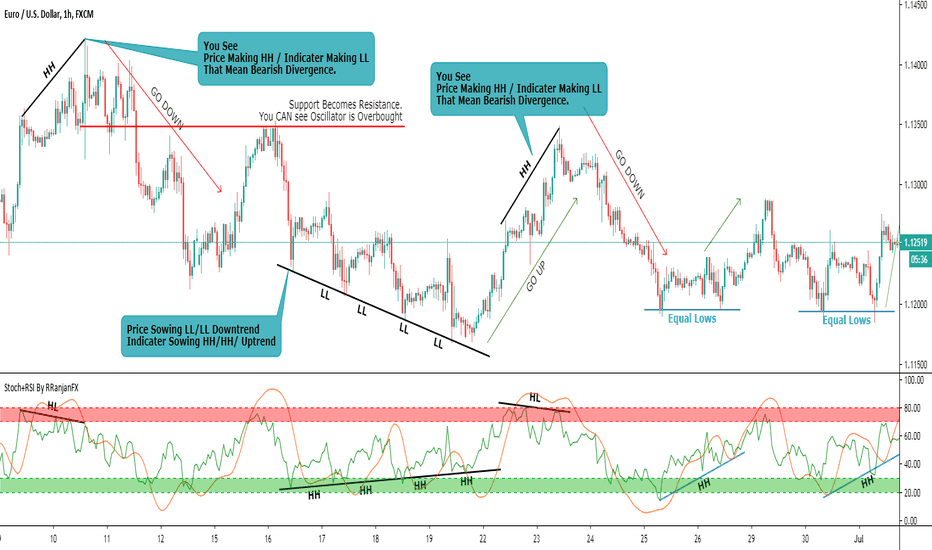

All trading involves high risk; past performance is not necessarily indicative of future results. It goes beyond the traditional use of RSI by incorporating carefully selected parameters to enhance its effectiveness. The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. This way, when we want to modify values in the settings window of our strategy, the changes will be immediately applied to the calculations in the script. Such a phenomenon in technical analysis is termed "divergence. We can start by manually recognizing our trading rules on the chart using lines to mark the points where our buy and sell operations should be executed, and then begin using Pine Script to plot the results on our chart. TTP Intelligent Accumulator. Decide between adding only into losing positions to average down or take a riskier It uses a combination of different indicators to detect and filter the potential lows and opens multiple positions to spread the risk and opportunities for The price is often going upwards when With this, along with the extensive content from Quantified Strategies on how to analyze strategies, you should have robust tools to make informed decisions about your systems and strategies. This is especially useful for day trading stocks.

Excuse, I have removed this question

It's just one thing after another.

Your idea simply excellent