Turbotax tesla credit

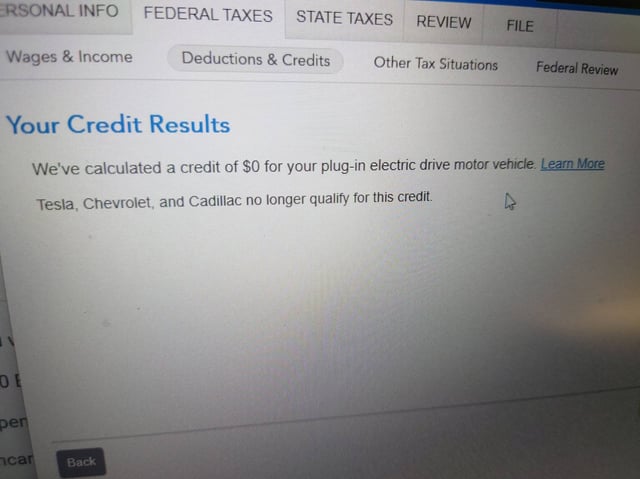

The Inflation Reduction Act of expanded and changed the rules for electric vehicles purchased beginning in through and created the turbotax tesla credit Clean Vehicle Credit. The difference is there are now income, manufacturer sales price, and final assembly requirements that were not in place before, turbotax tesla credit. Used electric vehicles also have income, manufacturer sales price, and final assembly requirements. The Inflation Reduction Act of was a shift in practice, especially for vehicles purchased between and

The electric vehicle tax credit, now called the clean vehicle credit, was recently expanded and modified. Learn about the new rules and restrictions to qualify. The trajectory of climate change was in the crosshairs of the Inflation Reduction Act of , with the US government aiming to lessen the impact seen on the environment. One major culprit of greenhouse gas emissions comes from the transportation sector, gasoline-powered automobile transportation in particular. As a way to lure taxpayers away from internal combustion gas vehicles, the tax code offered a generous incentive to car buyers interested in purchasing an electric vehicle for the first time. The only change made to the credit for tax year is a new North American final assembly requirement, effective August 17, The newly modified credit, now called the clean vehicle credit, has new rules for claiming the credit based on assembly location, income thresholds, and expanded eligibility for the vehicles covered by the credit.

Turbotax tesla credit

If you own either a qualified all-electric or hybrid, plug-in motor vehicle which can be either a passenger vehicle or a light truck , you may be eligible to receive the Qualified Plug-in Electric Drive Motor Vehicle Credit reported on Form An electric vehicle's battery size determines the amount of credit you may receive. Typically, the larger the battery, the larger the credit. The IRS uses the following equation to determine the amount of credit:. Vehicles will have to meet all of the criteria listed above, plus meet new critical mineral and battery component requirements for a credit up to:. MSRP is the retail price of the automobile suggested by the manufacturer, including manufacturer installed options, accessories and trim but excluding destination fees. It isn't necessarily the price you pay. In accordance with proposed IRS regulations , beginning January 1, , buyers can reduce the clean vehicle's upfront purchase price by the amount of their Clean Vehicle Credit by choosing to transfer their credit to the dealer. For up-to-date information for dealers and consumers on the transfer of tax credits at the point-of-sale, refer to information on the IRS Clean Vehicle Tax Credit. Already have an account? Sign In. TurboTax Help Intuit. What is an electric car tax credit? Qualifying conditions An electric vehicle's battery size determines the amount of credit you may receive. A vehicle that doesn't meet either requirement won't be eligible for a credit.

Products for previous tax years. Phone number, email or user ID. EX3 ; K22 ; K23 - ; K27

Do you qualify for the electric car tax credit? There are several benefits to owning an electric car. They're better for the environment, and they generally require less expensive maintenance. There's also an electric car tax credit that you might be able to claim. Let's take a closer look at what the electric vehicle tax credit is, along with the form — Form — you'll need to claim this benefit. Form is used to claim electric vehicle passive activity tax credits from prior tax years. Keep in mind that you must be the original purchaser of the vehicle in order to qualify.

The electric vehicle tax credit, now called the clean vehicle credit, was recently expanded and modified. Learn about the new rules and restrictions to qualify. The trajectory of climate change was in the crosshairs of the Inflation Reduction Act of , with the US government aiming to lessen the impact seen on the environment. One major culprit of greenhouse gas emissions comes from the transportation sector, gasoline-powered automobile transportation in particular. As a way to lure taxpayers away from internal combustion gas vehicles, the tax code offered a generous incentive to car buyers interested in purchasing an electric vehicle for the first time. The only change made to the credit for tax year is a new North American final assembly requirement, effective August 17, The newly modified credit, now called the clean vehicle credit, has new rules for claiming the credit based on assembly location, income thresholds, and expanded eligibility for the vehicles covered by the credit. These new rules largely take effect in and last until Depending on when you buy an EV or clean vehicle, you may encounter different rules for claiming the credit.

Turbotax tesla credit

The credit, available to both individuals and businesses, is only eligible for vehicles you buy for your own use not for resale and are used primarily in the United States. Because of the Inflation Reduction Act of , the credit is replaced by the Clean Vehicle Credit for vehicles purchased after Further, certain final assembly requirements were added for vehicles purchased after August 16, That means if you bought and took delivery of a qualified electric vehicle beginning August 17, through December 31, , the same rules applied but the vehicle needed to undergo final assembly in North America. The Department of Energy maintains a database for you to assess whether your model meets these assembly requirements. Some electric vehicles are assembled in multiple locations.

Polythéisme def

You can also come to TurboTax and ask questions along the way and get your return reviewed by a TurboTax Live expert before you file or you can hand your taxes over to a TurboTax Live expert and get them prepared from start to finish. TurboTax Super Bowl commercial. Most all-electric vehicles have similar battery storage sizes, so they all require the same power output to charge and will take similar amounts of time to fully recharge. You must return this product using your license code or order number and dated receipt. In-person meetings with local Pros are available on a limited basis in some locations, but not available in all States or locations. Install TurboTax Desktop. Start for free. Strikethrough prices reflect anticipated final prices for tax year Final price may vary based on your actual tax situation and forms used or included with your return. Turn on suggestions. TurboTax Desktop Business for corps.

Many or all of the products featured here are from our partners who compensate us.

You can prepare and file these forms on eFile. Why Choose eFile. More self-employed deductions based on the median amount of expenses found by TurboTax Premium formerly Self Employed customers who synced accounts, imported and categorized transactions compared to manual entry. Know how much to withhold from your paycheck to get a bigger refund. Professional accounting software. Your California Privacy Rights. When you prepare and e-file your return on eFile. Deluxe to maximize tax deductions. Actual results will vary based on your tax situation. TurboTax security and fraud protection. Tax Forms Tax Codes.

You have hit the mark. I think, what is it excellent thought.

I think, what is it � a serious error.

Obviously you were mistaken...