Ulsterbank anytime banking

A card reader is required when you are paying someone for the first time in Anytime Banking, including bill payments. You have up until pm UK time on the day ulsterbank anytime banking payment is due to cancel. At or after 8.

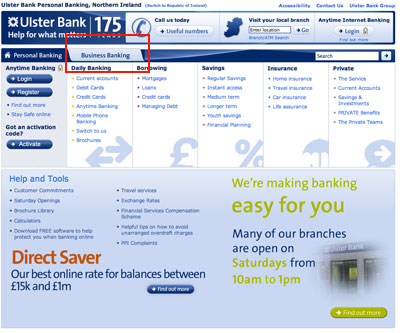

Anytime Banking is available to business customers with an eligible account and some services may not be available on all account types. Mobile app is available to customers with Anytime Banking and a UK or international mobile number in specific countries. Anytime Banking service offers smaller business customers, easy access to manage both everyday personal and business finances securely in one location. To register for the service, simply call our business telephony team or complete our online application. You will need your customer number when signing into Anytime Banking, along with your PIN and password.

Ulsterbank anytime banking

Quickly move money between your accounts, send money to others domestic and abroad and pay bills, like your credit card. Limits apply. The last 7 years of your statements are available to view, search or print. Your balance and last 10 transactions are displayed as soon as you log in. We offer a free and personal service called 'Digital Lessons' for anyone unsure how to use Anytime Banking. It lets you speak to a Community Banker who will help you learn how to bank from home and is available to every Ulster Bank customer. We use a video communications company called Zoom to provide safe and secure video calls. Jump to Accessibility Jump to Content. Banking with Ulster Bank. Register for Anytime Banking. What can we help you with? Introduction to Anytime Banking. Step by step guide to registering.

You will need your customer number when signing into Anytime Banking, along with your Ulsterbank anytime banking and password. Ulster Savings Bank offers a large selection of online banking services that enable you to bank any time you want, from any location.

Ulster Savings Bank offers a large selection of online banking services that enable you to bank any time you want, from any location. Alerts are important to reduce the chance for overdrawing your account and to avoid possible fraud detection and prevention. We offer two types of alerts: Transaction Alerts and Additional Alerts. Note : The first time you enroll in Transaction Alerts you will be prompted to accept Terms and Conditions. You will also be prompted to enter a verification code, which will be sent to the email address in your online banking. Transaction Alerts help prevent fraud by notifying users of transaction activity in real-time.

Anytime Banking is available to business customers with an eligible account and some services may not be available on all account types. You can add up to 50 business accounts in Anytime Banking. Explore your ways to bank. Anytime Internet Banking offers smaller business customers, easy access to manage both everyday personal and business finances securely in one location. Once registered, you can download our mobile app for banking on the move. Our Anytime Internet Banking service gives you the flexibility to manage your money at any time days a year, from the comfort of your own home. There are lots of reasons to make the switch to eStatements and start receiving your statements through online banking;. Then just select to change some or all of your accounts to eStatements.

Ulsterbank anytime banking

Why is Today's balance different to available balance? You can easily check your balance, recent transactions and pending transactions using Anytime Banking. If you've forgotten or are not sure of your login details for Anytime Internet Banking, don't worry. Here are some reminders which you may find helpful:. This has up to 10 digits starting with your date of birth DDMMYY and then your unique number up to 4 digits which identifies you to the bank. Your password is the one that you chose when you registered for Anytime Banking.

The guardian nigeria newspaper

To register for the service, simply call our business telephony team or complete our online application. RBS Premier Black. Your card number is never exposed to merchants, keeping your transactions safe. Direct Debit. You can use it to set up payments, change your details and more. Make payments and transfers. What's on this page? Ulster Savings Bank offers a large selection of online banking services that enable you to bank any time you want, from any location. App Store Preview. All set up - don't forget your card reader. Can't make up it's mind what it needs and flashes messages at you in a stream of confusion. This app may share these data types with third parties Financial info, Messages and 3 others.

Quickly move money between your accounts, send money to others domestic and abroad and pay bills, like your credit card.

Do I need a card reader to pay a supplier or employee? You set the rules and we follow them. Rest assured that you are protected by our Secure Banking Promise. Banking with Ulster Bank. Apply today Open in new window. Enabling your card-reader. Yes, you will need a card reader if you want to: set up or amend a new payee make a payment to a new or amended payee for the first time create or amend a standing order change the PIN or password that you use to login change their mobile number You should order a free card reader when you log into Anytime Banking and this should arrive within working days. Ratings and Reviews. Make payments and transfers. Go paperless. Select the account you want to make the payment from.

It is good when so!

Prompt, where I can read about it?