Vanguard etf performance history

Correlation measures to what degree the returns of the two assets move in relation to each other, vanguard etf performance history. Columns are sortable click on table header to sort. If you want to learn more about historical correlations, you can find out here how the main asset class are correlated to each other. A drawdown refers to the decline in value from a relative peak value to a relative trough.

Thank you for checking out our new page. To compare other funds please go back to the original tool. Select up to 5 products and compare their characteristics—including performance and risk measures. The investments or benchmarks you chose fall into different investing categories. The expense ratios of exchange-traded funds ETFs often are lower than corresponding mutual funds because ETFs are traded through brokerage firms, alleviating administrative costs.

Vanguard etf performance history

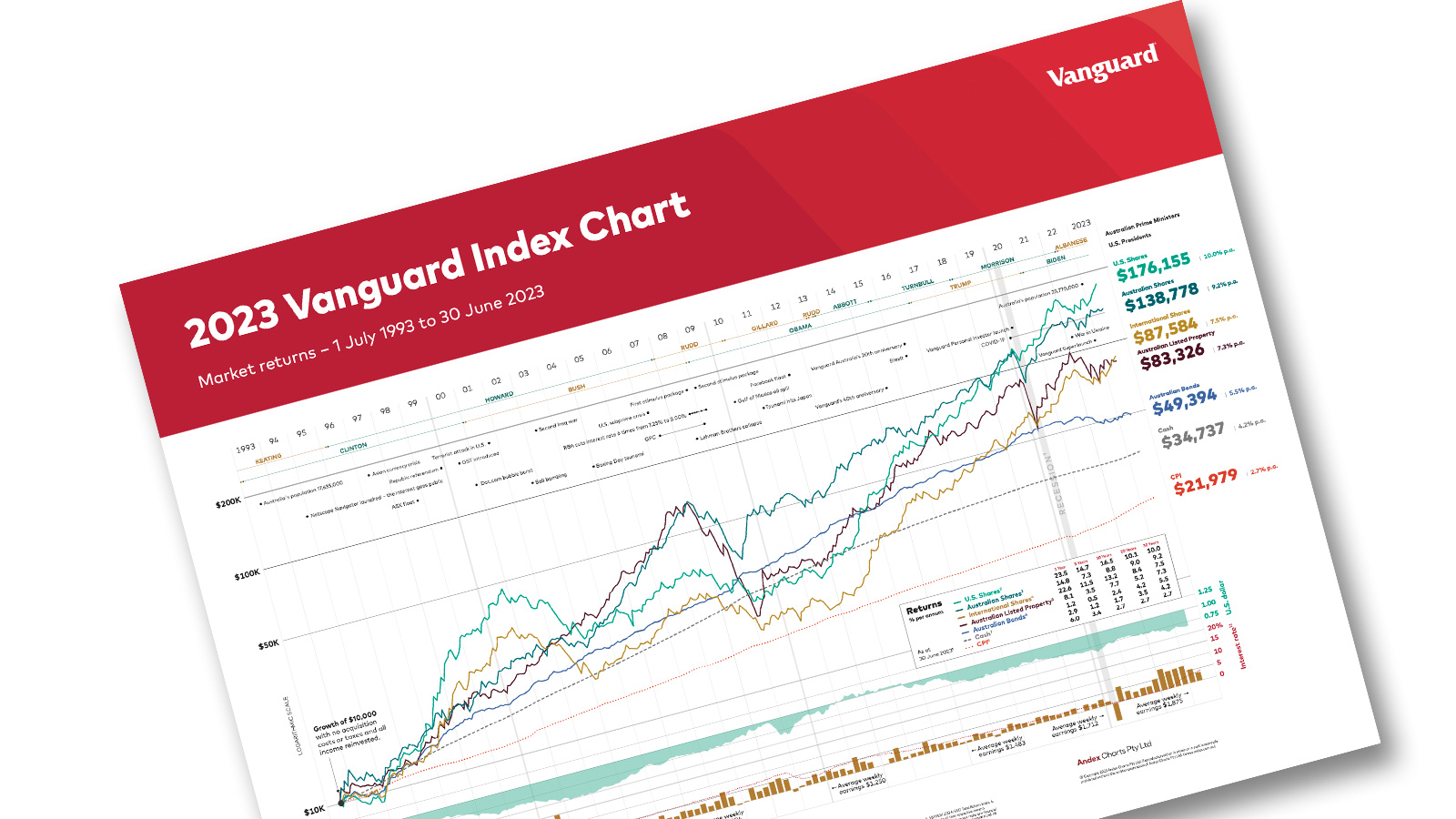

Help your clients stay the course with this simple but powerful tool. The Vanguard Index Chart powerfully illustrates how sticking to a long-term investment plan, with diversification across a range of asset classes, may allow your clients to grow their wealth over time. Even in the face of market crises and short-term volatility. Capturing 30 years of Australian and global investment market history, the Index Chart can help you navigate conversations around investing and keep your clients focused on their long-term goals. Order hard copies. Read article. Explore now. Skip to main content. It's the long-term story that really counts. Helping your clients stay the course is challenging, especially when markets are volatile. Download poster Download brochure. Explore our Index Chart tools and resources.

Over all the available data source Jan - Feb A drawdown refers to the decline in value from a relative peak value to a relative trough. Asset allocation.

An ETF is a collection of hundreds or thousands of stocks or bonds, managed by experts, in a single fund that trades on major stock exchanges, like the New York Stock Exchange, Nasdaq, and Chicago Board Options Exchange. ETFs offer diversification, low costs, and the ability to trade shares live during the trading day. If you're not yet an investor with us, you can open an account and begin investing through the link below. A strategy is the general or specific approach to investing based on your goals, risk tolerance, and time horizon. See what's best for you. View our full line-up.

An ETF is a collection of hundreds or thousands of stocks or bonds, managed by experts, in a single fund that trades on major stock exchanges, like the New York Stock Exchange, Nasdaq, and Chicago Board Options Exchange. ETFs offer diversification, low costs, and the ability to trade shares live during the trading day. If you're not yet an investor with us, you can open an account and begin investing through the link below. A strategy is the general or specific approach to investing based on your goals, risk tolerance, and time horizon. See what's best for you.

Vanguard etf performance history

Thank you for checking out our new page. To compare other funds please go back to the original tool. Select up to 5 products and compare their characteristics—including performance and risk measures.

Alb target

Mutual funds Learn more about mutual funds. Get a side-by-side comparison of up to 5 mutual funds or ETFs. Mutual funds. Download poster Download brochure. The fund may impose a fee upon sale of your shares or may temporarily suspend your ability to sell shares if the fund's liquidity falls below required minimums because of market conditions or other factors. Asset correlations are calculated based on monthly returns. Returns are calculated in USD, assuming: no fees or capital gain taxes. For years the Vanguard Index Chart has helped advisers tell the story about investing over the long-term. You should choose ETFs that fit your investment goals and risk tolerance and help you achieve the desired asset mix in your portfolio. Learn about other investments. Choose a goal Employ the best metrics to evaluate it Join the passive investing strategy. The data is provided by Morningstar and is only as current as the information supplied to Morningstar by third parties. If you're not yet an investor with us, you can open an account and begin investing through the link below. Includes market orders entered from January 3, , through December 30, , during market hours with share sizes from 1 to 1, Giving you more time and more value to pass on to your clients.

.

A strategy is the general or specific approach to investing based on your goals, risk tolerance, and time horizon. This chart shows the performance of various asset classes over the past 30 years. Compare advice services. Commission-free at Vanguard. For further information about the seasonality, check the Asset Class Seasonality page. There may be other material differences between products that must be considered prior to investing. Average maturity. Quotes delayed at least 15 minutes. The yield for a money market fund more closely reflects the current earnings of the fund than its total return does. Learn more about our core ETFs.

I better, perhaps, shall keep silent

I confirm. It was and with me. We can communicate on this theme.