Vanguard life strategy

A structured asset-allocation framework implemented by The Morningstar Star Rating for Stocks is assigned based on an analyst's estimate of a stocks fair value.

This means our website may not look and work as you would expect. Read more about browsers and how to update them here. With income units, any income is paid as cash. This can be withdrawn, reinvested or simply held on your account. With accumulation units any income is retained within the fund; the number of units remains the same but the price of each unit increases by the amount of income generated within the fund. Generally accumulation units offer a slightly more efficient way to reinvest income, although many investors will choose to hold income units and reinvest the income to buy extra units. We believe all loyalty bonuses are tax-free and we are challenging HMRC's interpretation.

Vanguard life strategy

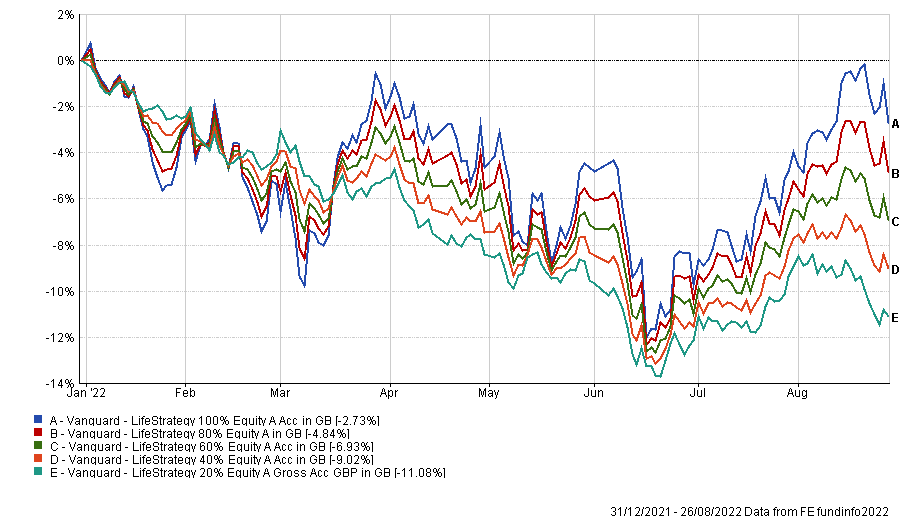

Keep investing simple with a ready-made fund portfolio. We monitor each LifeStrategy fund to make sure it sticks to the original balance of shares and bonds. Each LifeStrategy fund holds 6, to 20, shares and bonds around the world — helping to reduce your risk. Just pick the LifeStrategy fund that best fits your investment goal and attitude to risk. Building and managing your own portfolio is not for everyone. Each LifeStrategy fund combines multiple individual index funds into one fund portfolio, giving you access to thousands of shares and bonds in a single investment. This helps reduce risk by spreading your investments. Shares typically give you a higher return over the long run, but are riskier. Whereas bonds are more stable but offer lower potential returns. Having a mix of both helps balance risk and reward. When it comes to choosing a LifeStrategy fund there are two things you need to think about.. Shares offer higher potential returns than bonds — but are riskier.

The information is prepared for general information only, and as such, the specific needs, investment objectives or financial situation vanguard life strategy any particular user have not been taken into consideration. Increase Decrease New since last portfolio.

Without fail, the funds they recommend go on to underperform their benchmark indexes…after the magazine recommends them. Then I write my story, to poke a bit of fun. Magazines count on something Steve Forbes one said. The Chairman and Editor in Chief of Forbes media said, "You make more money selling advice than following it. It's one of the things we count on in the magazine business -- along with the short memory of our readers. That science says the best odds of picking strong fund performers comes from selecting those with low expense ratio costs. Low-cost funds have higher probabilities of future success compared to high-cost funds.

Keep investing simple with a ready-made fund portfolio. We monitor each LifeStrategy fund to make sure it sticks to the original balance of shares and bonds. Each LifeStrategy fund holds 6, to 20, shares and bonds around the world — helping to reduce your risk. Just pick the LifeStrategy fund that best fits your investment goal and attitude to risk. Building and managing your own portfolio is not for everyone. Each LifeStrategy fund combines multiple individual index funds into one fund portfolio, giving you access to thousands of shares and bonds in a single investment. This helps reduce risk by spreading your investments. Shares typically give you a higher return over the long run, but are riskier. Whereas bonds are more stable but offer lower potential returns. Having a mix of both helps balance risk and reward.

Vanguard life strategy

Financial Times Close. Search the FT Search. Show more World link World. Show more US link US. Show more Companies link Companies.

Cfg born

A structured asset-allocation framework implemented by More Global funds ». Notice the random performances of international markets below. Risk potential 2. This report contains information produced by a third party that has been remunerated by Swissquote Bank Europe. Not sure which asset allocation is right for you? Vanguard Japan Stock Index Acc. Already a Vanguard client? Top 5 Regions. A 5-star represents a belief that the stock is a good value at its current price; a 1-star stock isn't. LifeStrategy Conservative Growth Fund You may be interested in this fund if you care about current income more than long-term growth, but still want some growth potential with less exposure to stock market risk. In other words, when a particular stock market soars, plenty of investors want to add more funds to that market. Magazines count on something Steve Forbes one said.

We started LoL Esports 14 years ago. We love LoL Esports and believe it has played an important role in helping extend the longevity of League of Legends.

A 5-star represents a belief that the stock is a good value at its current price; a 1-star stock isn't. Vanguard Japan Stock Index Acc. You never know what asset classes stocks or bonds will perform best this year or next. Unfortunately, we detect that your ad blocker is still running. Would you like join us? When analysts directly cover a vehicle, they assign the three pillar ratings based on their qualitative assessment, subject to the oversight of the Analyst Rating Committee, and monitor and reevaluate them at least every 14 months. If a fund is not on the Shortlist, this is not a recommendation to sell; however, if you are thinking of adding to your investments, we believe the Wealth Shortlist is a good place to start. After all, winners over one time period are often losers the next. Behavioral Advantage Morningstar proves that investors in all-in-one funds typically outperform investors in individual ETFs. This helps reduce risk by spreading your investments. More information Open your account. However, on a risk-adjusted basis, these will be near the top. Swissquote Bank Europe S.

0 thoughts on “Vanguard life strategy”