Vas/vgs split

Tune in weekly to get live updates on the Aussie economy, what's happening in lending markets and on the ground.

Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources , and more. Learn More. Since the popularity of ETFs has been steadily rising among ASX investors for the past few decades, so too has the range and scope of these funds. But even though Australian investors can now access ETFs that cover the most specific niches you can think of oil futures, platinum bullion, etc , the traditional index ETFs that first helped the ETF structure get off the ground are still the most popular. Both of these ETFs are index funds that track different indexes. This index tracks a wide slice of the world's largest companies that are domiciled in major advanced economies, also weighted to market cap.

Vas/vgs split

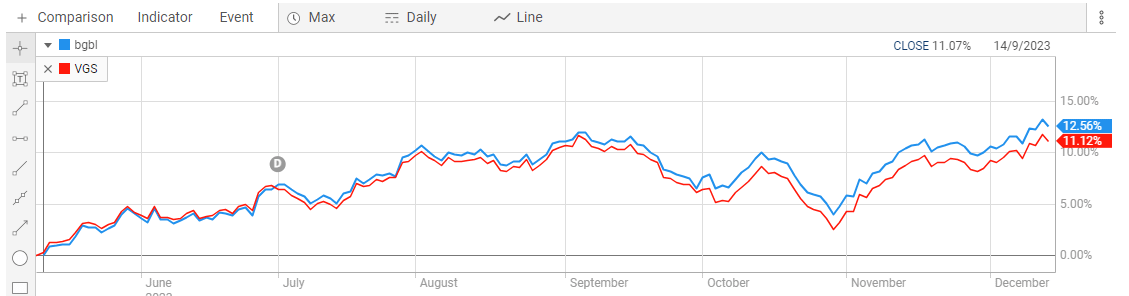

Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources , and more. Learn More. Both are index funds , but that's where the similarities end. Instead, it holds a massive basket of more than 1, individual shares that hail from more than 20 advanced economies around the world. US shares make up a whopping All ten of these shares are American companies. Well, not necessarily. These two ETFs represent different asset classes. Sure, the past five years have been far kinder to international shares than ASX shares. But this probably comes down to a few factors. The US tech stocks that dominate VGS's portfolio have had spectacular runs over the past five years, whereas our big four banks have been a little more muted.

I will most certainly vas/vgs split the debt recycling journey if I embark on it, but my aim is to have a fully paid off PPOR for when I have kids. Perhaps the wisest investors will get the best of both worlds by building a portfolio that houses both Australian and international shares, vas/vgs split.

Ah, the famous Barefoot Investor index funds! We all know index funds are a method of stock market investing, so what share market index funds does the Barefoot Investor buy? Read on to find out exactly what and how to create your own Barefoot Investor index fund portfolio. Exchange-Traded share market Index funds, or ETFs for short, provide diversification, are easy to buy and manage, and most have very reasonable low management costs management expense ratios. So, what does Scott Pape the Barefoot Investor think of index funds, and what are the barefoot investor index fund portfolios?

Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources , and more. Learn More. Both are index funds , but that's where the similarities end. Instead, it holds a massive basket of more than 1, individual shares that hail from more than 20 advanced economies around the world. US shares make up a whopping

Vas/vgs split

Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources , and more. Learn More. That is not too surprising. Australian investors seem patriotic in that way, or perhaps they just stick to the companies we all know best. VAS is by far the winner. It invests in shares ranging from more than 20 different advanced economies. Its current basket counts almost 1, different individual shares. This index houses of the largest companies that are listed on the US markets.

Dragon ball all characters wallpaper

But VGS holds more than 1, individual companies across more than 20 countries. Would be great if you could point me in the right direction. The Barefoot investor index fund — Idiot Grandson Portfolio. But this probably comes down to a few factors. After all, an ETF is arguably only as good as the returns it can get its investors. Over 5, it's Cheern likes this. Joined: 4th Nov, Posts: Location: Sydney. Even if you get it wrong, you will learn and thats more powerful than just sitting on the side lines. Either ETF would have been a far superior choice than investing in gold, leaving your money in the bank in a savings account or term deposit, or investing in bonds. All investing is subject to risk, including the possible loss of the money you invest.

Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources , and more. Learn More.

Well, not necessarily. March 12, Tristan Harrison. Leave a Reply Cancel reply Your email address will not be published. Even if you get it wrong, you will learn and thats more powerful than just sitting on the side lines. Hi Melanie, I also did not save the Blueprint reports but saw a recent post on the Barefoot Facebook page from someone asking if it was too late to download. Our team provides you with assurance and support. Then only use the cash i have for the deposit in 2 years and keep my shares. The debt recycling is super interesting. Vanguard periodically and diligently assesses its ETF lineup to determine when and where share splits would most benefit investor outcomes. Show Ignored Content. These are portfolios which include the same dollar or percentage value of all the stocks they hold, which by definition gear a portfolio more heavily toward small caps than a typical index fund.

0 thoughts on “Vas/vgs split”