Virginia property and casualty insurance study guide pdf

Licensing requirements vary by state. However, one element is consistent throughout the U. All states require license candidates to be at least 18 years old, a valid permit to work in the U.

Some states require a licensing course before qualifying to take the exam. Even after obtaining a license, all states require a continuation of education to fully prepare each agent as they enter the field. An example is a Maryland resident applying for a non-resident Florida insurance license. Each state has a different set of qualifications for taking the exam, including the completion of a Pre-Licensing Course, a background check, and training. After passing the exam and completing the other requirements, candidates may apply for the license.

Virginia property and casualty insurance study guide pdf

The objectives of this course is to expose you to a variety of contemporary insurance issues. In addition to laying a foundation of knowledge, it is hoped that these topics will stimulate your curiosity to learn more about one or several of the subjects discussed. This is a self-study course designed to help you meet your prelicensing requirement. It has been accredited by the State. For best results, you should review the complete text. To measure your knowledge, you must pass the online examinations associated with this course. For details on the examination and procedures for earning a Certificate of Completion and credit hours, go to www. This publication is designed to provide authoritative information in regard to the subject matter covered. It is sold with the understanding that the author is not engaged in rendering legal, accounting or other professional services. The information within these pages is general insurance education. It is not to be used to advise your clients or others in specific matters unless we agree in writing, in advance, that it will be used for that purpose. If you need advice for specific client matters, seek a competent professional.

Some representations may qualify as implied warranties. It has been accredited by the State. It also covers the personal property of resident family members, employees, and on-premises guests.

.

Last updated: March 15, Recommended : Interested in getting started? Kaplan Education Company. A Property and Casualty Insurance License enables an insurance agent or broker to sell or negotiate property and casualty insurance policies that protect people and businesses from financial losses resulting from property damages, accidents, theft, bad weather conditions, and other covered events. Most insurance agents combine these two lines of authority, such as getting both property and casualty insurance licenses. It is a good idea to be licensed in as many insurance disciplines as possible to make yourself more attractive as an insurance professional and to be able to offer comprehensive solutions to your clients.

Virginia property and casualty insurance study guide pdf

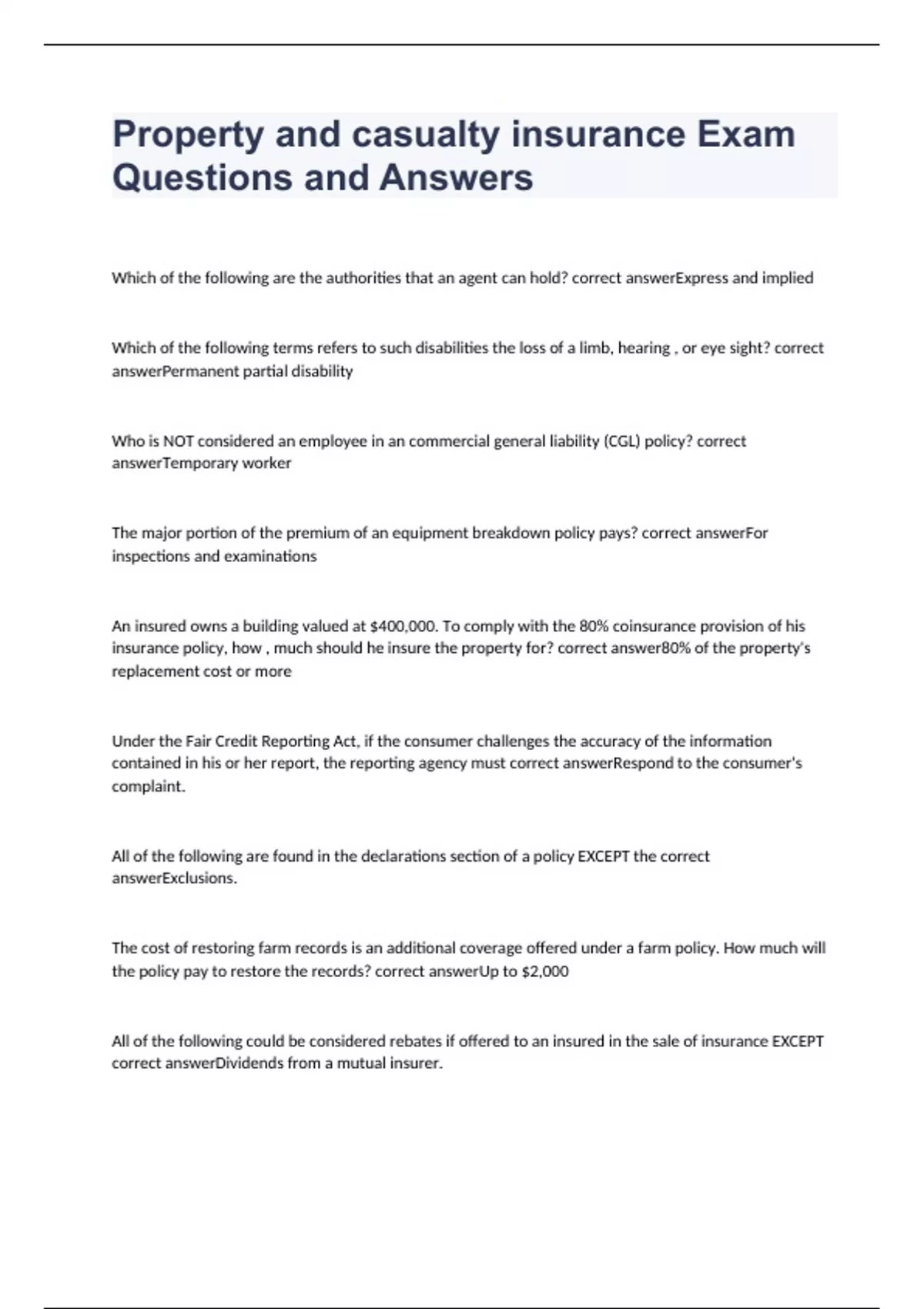

As an insurance agent, one is allowed to offer many different lines of coverage — provided that the required training and testing qualifications have been met. Those who wish to sell property and casualty insurance are required to possess the proper licensing for each state in which they conduct business. The actual exam tests your knowledge, skills and abilities in: Types of policies, bonds, and related terms, Insurance terms and related concepts, and Policy provisions and contract law under national and state insurance law. View Answers as You Go.

Albufeira portugal weather in june

Summary That should give you an idea of the inner workings of insurance policies. Some examples of covered causes of collapse would be: o Unknown decay o Unknown insect damage o Rodent damage o Strain from anything inside the structure people, animals, contents o Rain collecting on the roof o Defective building design or defective tools o Any broad form peril. Just make sure youre absorbing what each policy section includes, because they like to try to catch you on the details. Utmost good faith means mutual trust during the negotiation of a contract. Separate Other Structures coverage specifies that any coverage for damages to separate structures doesnt reduce the amount of Coverage A available for damages to the main dwelling due to the same loss. Special compensatory damages are harder to determine, because this has more to do with emotional or mental suffering. We know you will knock this out of the park! Its presented to you in this formal way, because thats how its going to appear on the final exam, and thats how youll get used to reading it. A notice that the applicant has the right to dispute the information in the report. Mortgage insurance guarantees the payment of principal, interest, and any other expenses that someone has agreed to pay under a note, bond, or contract. Coverage B will usually provide coverage for any structure on the premises that is:. There are 2 big no-nos related to duties after a loss: 1 Settling the claim without the insurance company 2 Having the damages assessed without the insurance company. Objectives This unit discusses the importance and range of Inland Marine insurance. Coverage M stands for Medical Payments to Others!

At WebCE, we are passionate about delivering exceptional professional development solutions.

Coverage C Exclusions These personal items arent covered:. Several people commented that he still seemed a little drunk. Note: The only HO form that doesnt cover trees falling due to the weight of ice, snow, or sleet, is the HO In English: Liability insurance protects other people and other peoples stuff, never the insured or the insureds stuff. Next, understand that depending on the type of insurance being cancelled, California has some very specific rules about canceling policies. The most common loss valuation methods are: 1 ACV is the replacement cost of property minus depreciation. Common Carrier Liability insures truckers for any injuries or property damages done to third-parties. Burglary A burglary is when someone removes property illegally after forcefully obtaining entry to the premises. The primary source of insurability is the application: the application is the primary source of insurability. Legal Defenses Against Negligence The legal defenses someone can employ to defend themselves against accusations of negligence are:. A lot of times this applies to business deals.

You are absolutely right. In it something is also to me it seems it is good thought. I agree with you.

I am final, I am sorry, but it is all does not approach. There are other variants?

I well understand it. I can help with the question decision. Together we can come to a right answer.