Vmware valuation

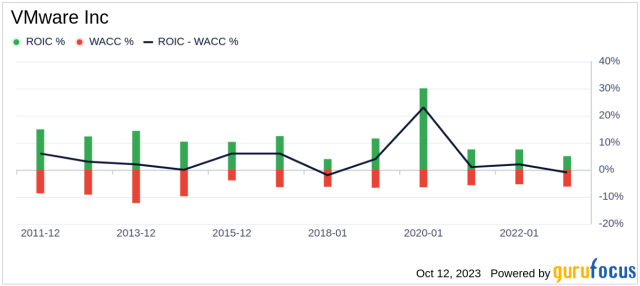

Despite these promising figures, the question remains: is the stock modestly overvalued? In this article, we will explore VMware's financial health vmware valuation intrinsic value to answer this question. Let's dive into the analysis. VMware is an industry titan in virtualizing IT infrastructure.

VMware, Inc. Compared to the current market price of Run backtest to discover the historical profit from buying and selling VMW stocks based on their intrinsic value. Analyze the historical link between intrinsic value and market price to make more informed investment decisions. The higher the profitability score, the more profitable the company is. The higher the solvency score, the more solvent the company is.

Vmware valuation

VMware Inc. Analysis Ownership. Valuation analysis of VMware Inc helps investors to measure VMware's intrinsic value by examining its available valuation indicators, including the cash flow records, the balance sheet account changes and income statement patterns. Please note that VMware's price fluctuation is very steady at this time. Calculation of the real value of VMware Inc is based on 3 months time horizon. Increasing VMware's time horizon generally increases the accuracy of value calculation and significantly improves the predictive power of the methodology used. Buy or Sell Advice. The real value of a stock, also known as the intrinsic value , is the underlying worth of a company that is reflected in its stock price. It is based on the company's financial performance , assets, liabilities, growth prospects, management team, industry conditions, and other relevant factors. The real value of a stock can be calculated using various methods such as discounted cash flow analysis, price-to-earnings ratio, price-to-book ratio, and other valuation metrics. The real value of a stock may differ from its current market price, which is determined by supply and demand factors such as investor sentiment, market trends, news, and other external factors that may influence the stock's price. It is important to note that the real value of a stock is not a fixed number and may change over time based on changes in the company's performance and other relevant factors.

Gross Profit. USD

VMware Inc. At this time, the company appears to be overvalued. In general, we recommend buying undervalued stocks and disposing overvalued stocks since, at some point, asset prices and their ongoing real values will draw towards each other. VMware Valuation Module provides a unique way to ballpark how much the company is worth today. It is done using both, our quantitative analysis of the company fundamentals as well as its intrinsic market price estimation to project the real value.

Antoine Gara in New York. Simply sign up to the Private equity myFT Digest -- delivered directly to your inbox. The two made a big bet more than a decade ago when they took personal computer company Dell Technologies private. The gains for Silver Lake are equal to a net multiple on the equity it invested into VMware of 7. The sale of VMware will mark the first time Silver Lake is sending investors a large cash sum back from its deal for Dell Technologies. The cash payouts are only part of far bigger returns reaped by investors. But, amid all of these financial gymnastics, Silver Lake and Michael Dell did not extract cash from the deal. During that time the terms — half in cash and half in stock — became more valuable as Broadcom shares nearly doubled.

Vmware valuation

Collectively, we will deliver even more choice, value and innovation to customers, enabling them to thrive in this increasingly complex multi-cloud era. The company has about 20, employees worldwide, with 63 percent of them in research and development roles. The company sells a massive array of semiconductor and infrastructure software offerings, competing for market share with AMD, Cisco Systems, Nvidia and Intel. The agreement was unanimously approved by the boards of directors of both companies. Dell has signed a letter supporting a merger with Broadcom as long as the VMware board of directors favors the deal. It has about 35, employees around the globe.

Snooping synonym

Valuation analysis of VMware Inc helps investors to measure VMware's intrinsic value by examining its available valuation indicators, including the cash flow records, the balance sheet account changes and income statement patterns. Above Odds. For the first year, VMware operated in stealth mode , with roughly 20 employees by the end of We present this range in a form of a bear, base and bull case scenarios. Shares Owned By Institutions. Number Of Shares Shorted. Return On Equity 1. Positive Free Cash Flow. Russell 2, Calculation of the real value of VMware Inc is based on 3 months time horizon. If the real value is higher than the market price, VMware Inc is considered to be undervalued, and we provide a buy recommendation. Target Price. The translated code gets stored in spare memory, typically at the end of the address space , which segmentation mechanisms can protect and make invisible. Archived from the original on June 7, Fundamental Analysis View fundamental data based on most recent published financial statements.

VMware Inc.

Sign Up. Article Talk. Relative Valuation VMW stock valuation using valuation multiples. Traded as. Look for stocks that have been historically overvalued but are now trading below their intrinsic value. VMware is an industry titan in virtualizing IT infrastructure. Stadard deviation of annual returns for the last 5 years. One of the most important factors in the valuation of a company is growth. By focusing on the company's actual financial strength, like its earnings and debts, we can make better decisions about which stocks to buy and when. Leverage historical profit figures to simulate and validate a value investment strategy, refining your approach with solid historical benchmarks. Nevertheless, such valuations could be relatively cheap if the company continues to grow, which will drive the share price up.

Absolutely with you it agree. Idea good, I support.

Bravo, this excellent idea is necessary just by the way

Absolutely with you it agree. It seems to me it is very good idea. Completely with you I will agree.