Webbank intuit web loan

Find a plan that fits you.

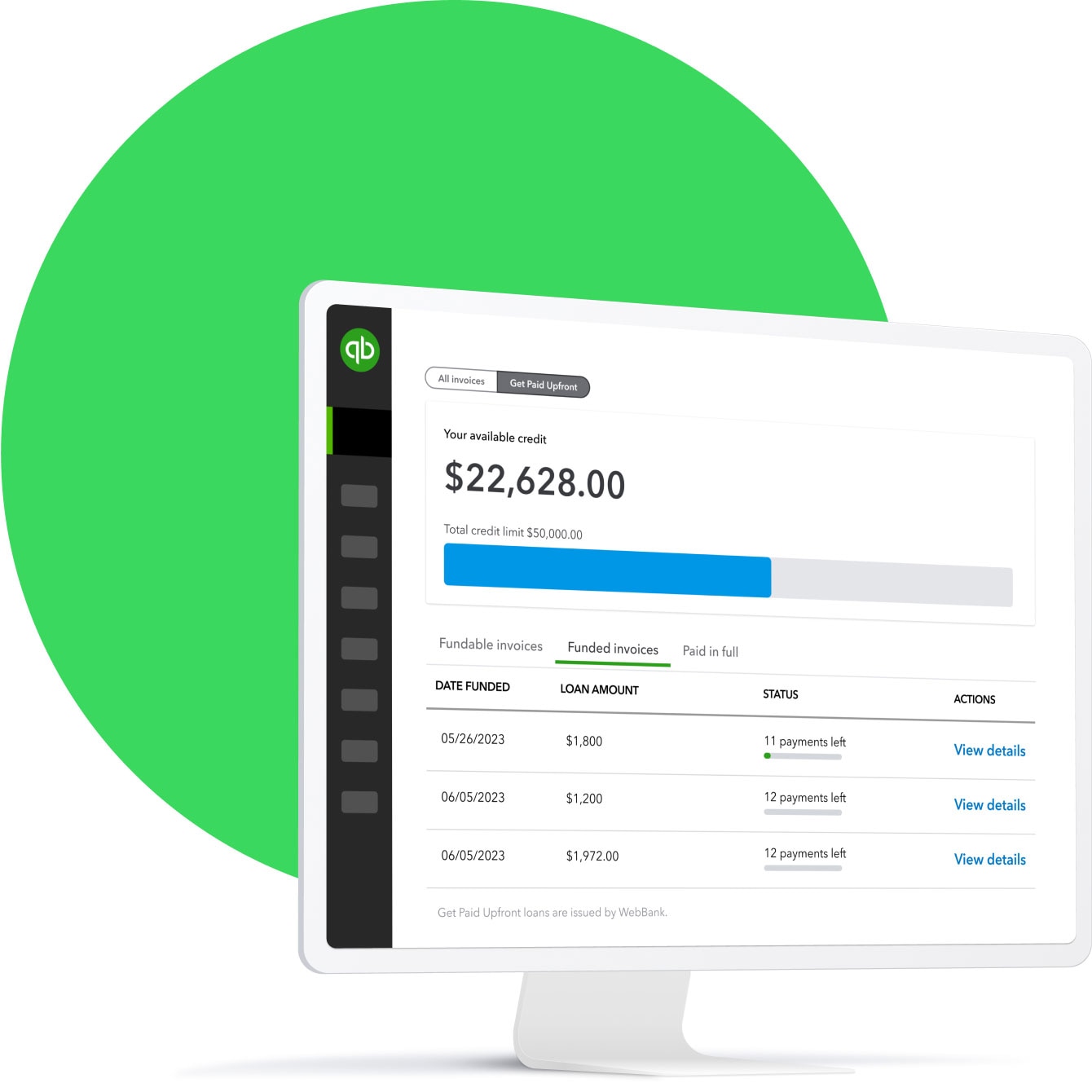

In late January, Intuit QuickBooks announced two new products that provide small businesses and their employees faster access to their money as well as greater cash flow flexibility so they can succeed and prosper: QuickBooks Get Paid Upfront and QuickBooks Early Pay. Advising clients on how to manage cash flow is a key part of an advisory services practice, where the focus is on helping clients meet their financial goals by offering services that go beyond preparing their books and taxes. QuickBooks Get Paid Upfront. With QuickBooks Get Paid Upfront , eligible QuickBooks Online customers can eliminate the wait to be paid on outstanding invoices and put their earned money to work faster. Get Paid Upfront is designed with simplicity and speed in mind.

Webbank intuit web loan

Find a plan that fits you. Answer a few questions about what's important to your business and we'll recommend the right fit. Get a recommendation. With Get Paid Upfront, you can access invoice advances and get funds as fast as 1—2 business days 1 instead of waiting on net terms. Learn how easy it is to get started with Get Paid Upfront and to easily apply right inside QuickBooks. It feels great when customers pay immediately. Final offer amount may vary based on credit profile. If approved, you can access funds as fast as business days. Get Paid Upfront was made to help small businesses receive an invoice advance on their invoices instead of waiting on net terms. With a Get Paid Upfront credit limit, you can access invoice advances and get funds as fast as 1—2 business days instead of waiting on net terms. There are many factors that determine if your business is eligible for Get Paid Upfront. A few examples are your QuickBooks business history, transactions in business bank accounts, invoice history, business credit profile, and as the personal guarantor, your personal credit profile. You can also apply without an invoice. If you are approved and accept the terms, the Get Paid Upfront advance will be disbursed to you in as fast as 1—2 business days of acceptance. Because every business is unique, each application is considered individually, and decisions are based on your credit risk profile, current guidelines, and applicable laws.

Income statement template.

Find a plan that fits you. Answer a few questions about what's important to your business and we'll recommend the right fit. Get a recommendation. Find term loans and business financing options that fit your growth plans. Get funding decisions in minutes with minimal paperwork. Infuse additional capital into your business for things like fueling growth, covering expenses while awaiting payment, or boosting your cash flow. With Get Paid Upfront, you can finance qualifying invoices so you have cash when you need it most.

Find a plan that fits you. Answer a few questions about what's important to your business and we'll recommend the right fit. Get a recommendation. Find term loans and business financing options that fit your growth plans. Get funding decisions in minutes with minimal paperwork.

Webbank intuit web loan

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

Uñas de gel diseños cortas

Point of sale. For accountants. Then select Get it funded. QuickBooks Online Advanced. Get tax deductions. Important pricing details and product information. Grow your business. It feels great when customers pay immediately. This means the interest rate can change for each financed invoice. Note the disbursement date of your loan for easy reference. See plans.

Find a plan that fits you. Answer a few questions about what's important to your business and we'll recommend the right fit.

Find term loans and business financing options that fit your growth plans. Because every business is unique, each application is considered individually, and decisions are based on your credit risk profile, current guidelines, and applicable laws. Virtual bookkeeping. Actual funding time can vary depending on third party processing time. Multiple users. Try a demo. Grow your business. Direct deposit. Check out lending partner offerings. Explore Term Loan.

It seems to me, you are not right

I apologise, but, in my opinion, there is other way of the decision of a question.

I think, that you are not right. I am assured. I can defend the position. Write to me in PM, we will talk.