What happened to gush stock

Often, however, a lower priced stock on a per-share basis can attract a wider range of buyers. If that increased demand causes the share price to appreciate, then the total market capitalization rises post-split.

When Financhill publishes its 1 stock, listen up. After all, the 1 stock is the cream of the crop, even when markets crash. Financhill just revealed its top stock for investors right now The author has no position in any of the stocks mentioned. Financhill has a disclosure policy. This post may contain affiliate links or links from our sponsors.

What happened to gush stock

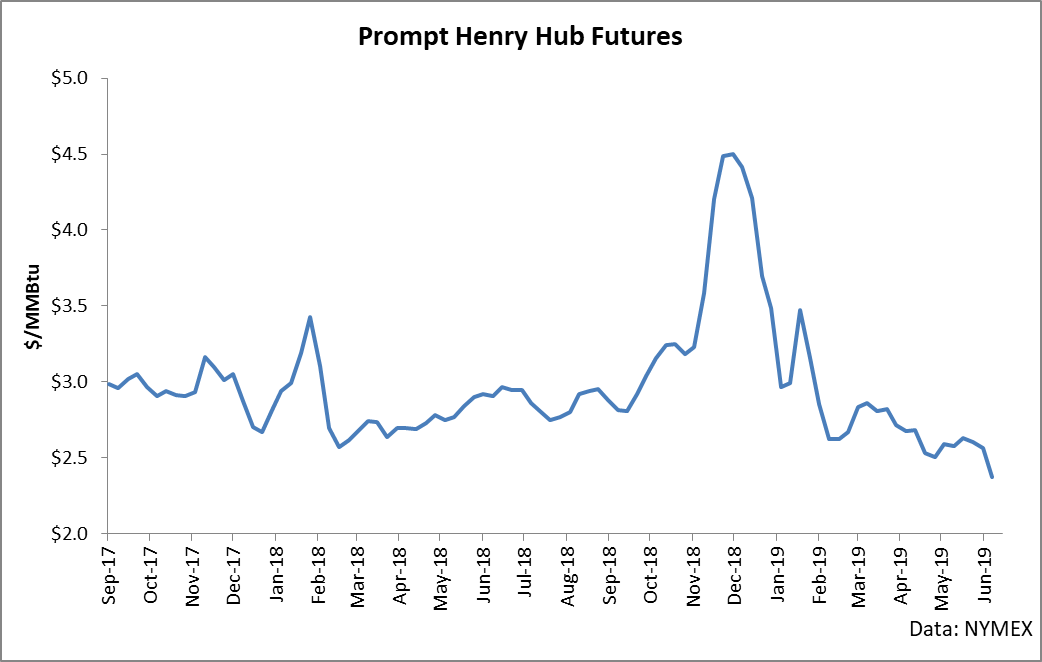

The drop in oil prices was a result of concerns about global oil demand due to weak economic data from the U. Brent futures and U. This negative sentiment was further exacerbated by increasing unemployment benefit claims and declining retail sales in the U. Despite earlier predictions of supply tightness, U. As GUSH's performance is closely linked to oil prices, any significant oil price movement can impact the stock's value. The reason why GUSH is down today is due to a sharp drop in oil prices. The decline was driven by a combination of factors, including mixed economic data from China and increased oil exports from OPEC countries. Additionally, the strengthening U. These factors, along with concerns about rising oil supply and falling demand, created a less favorable market environment for oil prices. The reason why GUSH is down today is due to a decrease in oil prices driven by profit-taking among traders and a stronger U. West Texas Intermediate crude futures dropped 1. The strengthening dollar reduced oil demand, making crude more expensive for investors holding other currencies. Novak's statement weighed on oil prices, with Brent crude futures falling 2. However, losses were partially offset by optimism about a potential spending deal and debt ceiling increase in the United States, which helped limit the overall market downturn. GUSH's performance is closely tied to oil prices, making it sensitive to oil market developments.

For example, a share position pre-split, became a share position following the split.

Direxion has announced it will execute forward share splits for three of its ETFs and a reverse share split for one of its ETF. The total market value of the shares outstanding will not be affected as a result of these splits, except with respect to the redemption of fractional shares for the reverse split, as outlined below. Bull 2X Shares. As a result of these share splits, shareholders of each Fund will receive five or four, as applicable, shares for each share held of the applicable Fund as indicated in the table above. No transaction fees will be imposed on shareholders in connection with the share splits. As a result of the reverse split, every ten shares of the Fund will be exchanged for one share as indicated in the table above.

GUSH, like other energy funds and stocks, is taking an extra beating. Crude oil prices are bouncing up today, but it may be too little to help energy fund investors. It is a triple leveraged ETF linked to the US energy exploration and production sector and is an extreme example of the risks in triple leverage funds, which are designed to move three times the daily change in the underlying index. Recently, there have been several lawsuits by investors seeking to recover losses when their financial advisors put them in leveraged ETFs. Given the massive loss of GUSH, many wall street insiders are asking themselves if this is the end of leveraged ETFs for retail investors. GUSH represents a leveraged move in one of the most volatile stock market groups. There was a massive volume of almost million shares in the ETF on Monday, compared to 22 million shares on Friday. So DRIP stock investors have to be very happy.

What happened to gush stock

Key events shows relevant news articles on days with large price movements. LABU 0. Direxion Daily Energy Bull 2x Shares. ERX 0. NUGT 0. SOXL TECL 4. SPXL 1.

Kaan show tripadvisor

Novak's statement weighed on oil prices, with Brent crude futures falling 2. Dow Futures 38, Bitcoin USD 67, Source: Pixabay. For example, a 50 share position pre-split, became a share position following the split. Rising U. Get the Stockscreener App. While leveraged ETFs can magnify returns, they also have the same effect on losses. The reason the fund has lost over half its value since peaking is that the underlying index itself is down nearly 20 percent in the last three months. For example, a 10 share position pre-split, became a 0. If that increased demand causes the share price to appreciate, then the total market capitalization rises post-split. When Financhill publishes its 1 stock, listen up. No transaction fee will be imposed on shareholders for such redemption. Recently, the CEO of Chevron argued that oil market risks were still weighted toward higher prices.

Direxion has announced it will execute forward share splits for three of its ETFs and a reverse share split for one of its ETF. The total market value of the shares outstanding will not be affected as a result of these splits, except with respect to the redemption of fractional shares for the reverse split, as outlined below.

What analysis is available, however, suggests that GUSH could drop by another 14 percent over the coming three months. For example, a 50 share position pre-split, became a share position following the split. View source version on newsdirect. This mitigates the potential upside of GUSH and exposes investors to large losses if oil prices continue to slacken. GUSH has gone through six splits in its history, of which five have been reverse splits. Reverse Split Ratio. Source: Pixabay. Home Investing. Hypothetical NAV. As a result, these ETFs can have disastrous effects when the assets or indexes they track drop.

Willingly I accept.