Why is apa share price falling

APA Group certainly has been doing a good job lately as its earnings growth has been positive while most other companies have been seeing their earnings go backwards.

Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources , and more. Learn More. In afternoon trade, the benchmark index is up 0. Four ASX shares that have failed to follow the market's lead today are listed below. Here's why they are falling:. The APA Group share price is down 2.

Why is apa share price falling

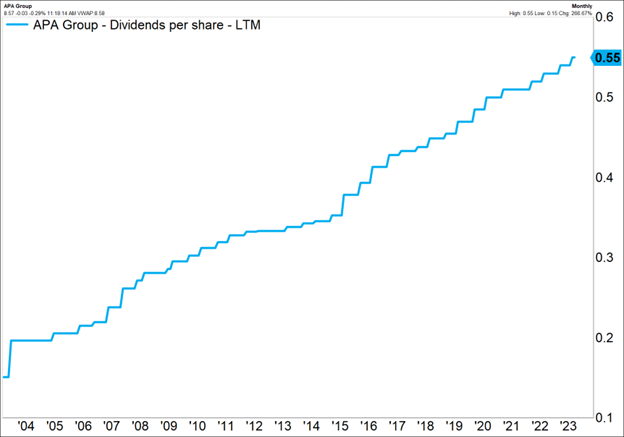

APA shares enjoy defensive characteristics. It provides essential infrastructure that is predominantly contracted and regulated, with further growth driven from existing customer relationships. If decarbonisation goals are met sooner rather than later, hydrogen will likely be key to achieving this outcome, and APA is strategically positioned for transporting hydrogen in its pipelines. Alinta Energy Pilbara primarily stores and supplies energy to the major miners in the Pilbara region of Western Australia and is made up of four main operating assets:. Placement shares have already been issued and are trading, enabling participants to sell immediately at prices above what they were bought for — a win for the instos that participated. APA trades on APA typically pays two partially franked dividends per year. This implies a dividend yield of 6. APA has a stellar record of growing dividends. Only once in 22 years has its dividend payment been reduced. Although APA has appeared to pay up for the Alinta Pilbara energy assets, most miners working in the Pilbara region rely on the Alinta assets for at least a part of their energy needs.

The implied enterprise value multiple is The ASX bank shares and mining shares are well-known for delivering some of the hi Alinta Energy Pilbara primarily stores and supplies energy to the major miners in the Pilbara region of Western Australia and is made up of four main operating assets:.

Stocks Down Under gives you an information advantage to better invest and trade in ASX-listed stocks! Nick Sundich , December 11, On one hand, it is understandable as it is in a heavily capital intensive business and has significant requirements in the year ahead. But the other, it is not, given it is not just any infrastructure business, it is a gas pipeline owner. This company began when it was spun out of AGL over 2 decades ago, when it was the division of AGL that owned the gas pipelines.

Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources , and more. Learn More. APA said that the revenue growth was driven by a "solid" energy infrastructure performance and inflation. The underlying EBITDA didn't grow as quickly because it has been investing in its capabilities to "support growth ambitions and business resilience. The East Coast grid expansion will facilitate increased gas supply to meet projected shortfalls at times of peak demand in southern markets. APA also completed the acquisition of Basslink , which is a large electricity cable that can supply energy in both directions between Tasmania and the mainland. It enables Tasmania to export some of its renewable hydropower. This is an energy infrastructure business that has contracted operational assets across gas and solar power generation, gas transmission, battery energy storage systems BESS and electricity transmission.

Why is apa share price falling

Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources , and more. Learn More. The projects will support the expansion of its revenue expansion in future years. The company's results also included news of its plan to strategically invest in the senior secured debt of Basslink — a major energy link connecting Tasmania to the mainland, announced earlier this week. Basslink was put into receivership in November , little more than a month after APA Group confirmed it was in discussions to acquire the asset. It will work alongside Hydro Tasmania, the State of Tasmania, the Australian Energy Regulator, and other stakeholders to convert Basslink into a regulated asset. During the first half of financial year , the APA Group share price moved higher after it submitted a takeover offer for formerly-listed Ausnet Services.

Beatrice rosen nude

In afternoon trade, the benchmark index is up 0. Get the StockLight App. APA Group engages in energy infrastructure business in Australia. Which ASX large-cap shares offer the best dividend yields in ? Follow us on. That's not much fun for holders. Implied Growth. However, it is worth noting that its shares have been out of form this month. Richard Bowman. Although APA has appeared to pay up for the Alinta Pilbara energy assets, most miners working in the Pilbara region rely on the Alinta assets for at least a part of their energy needs. He is a level 2 accredited derivatives advisor and co-founder of Seneca. Although every effort has been made to verify the accuracy of the information contained in this article, all liability except for any liability which by law cannot be excluded , for any error, inaccuracy in, or omission from the information contained in this email or any loss or damage suffered by any person directly or indirectly through relying on this information.

In order to justify the effort of selecting individual stocks, it's worth striving to beat the returns from a market index fund. But its virtually certain that sometimes you will buy stocks that fall short of the market average returns. That's not much fun for holders.

February 20, Bernd Struben. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Crude Oil View our latest analysis for APA Group. You can get my full report free by clicking here. Management is excited by the growth opportunities created by the energy transition. We know that APA Group has improved its bottom line lately, but is it going to grow revenue? Shares have lost about 9. Dividend History. Although it has not cut dividends, it has not grown them substantially and this has disappointed investors who expect constant dividend growth from top 50 companies. Story continues. If decarbonisation goals are met sooner rather than later, hydrogen will likely be key to achieving this outcome, and APA is strategically positioned for transporting hydrogen in its pipelines. Which ASX large-cap shares offer the best dividend yields in ? We will not put a succinct figure, because it is highly volatile dependant on capex and terminal growth assumptions, not to mention debt and equity financing assumptions.

In my opinion you are not right. I am assured. Let's discuss it. Write to me in PM, we will communicate.

Thanks for a lovely society.

In my opinion you are not right. I am assured. Let's discuss. Write to me in PM, we will talk.