Why luna coin is going down

The Terra network and its leader, Do Kwonrose to the highest tier of the crypto world thanks to big-shot investors, only to fall apart within a few days in May CoinDesk followed and reported on the rise and the ultimate demise of the Terra ecosystem. What follows is a detailed timeline of the Terra blockchain's history, including Do Kwon's vision to create a price-stable crypto payment system to take on the biggest e-commerce platforms, why luna coin is going down, Terra becoming one of the biggest red-hot crypto projects, Do Kwon's growing antics on social media and how it all crashed down in the end, evaporating the life savings of desperate everyday investors. A Guide to the Terra Ecosystem.

A young crypto enthusiast. What is your opinion about the Luna crash? This is actually looking like a mismanagement of funds from the team, they went ahead to sell a large amount of Their UST without having any backing for the pegged value of their UST. This made them mint more Luna and Luna price kept going down. Did the Luna value crash has affected you in any way? Please elaborate. In your opinion, what will happen next in the crypto sphere?

Why luna coin is going down

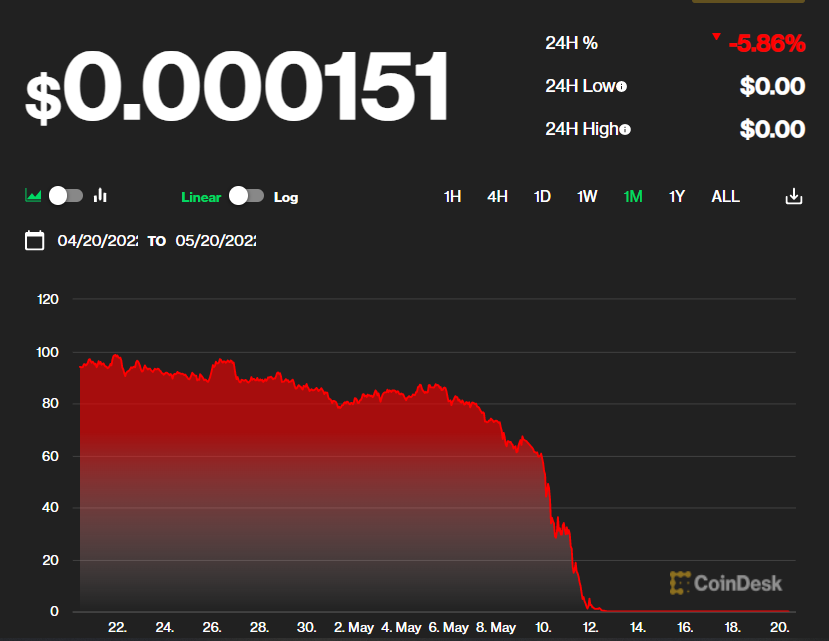

In May , LUNA saw one of the most disastrous price crashes in the history of the cryptocurrency market. In this article, we will be taking a look at what happened to the LUNA crypto during the crash, as well as the aftermath of the collapse of the Terra and Luna ecosystem. The beginnings of the Terra blockchain project date back to , when it was created by a company called Terraform Labs. Kwon later gained a lot of popularity and essentially became the public face of the Terra project. The idea behind the Terra blockchain was to facilitate a decentralized payment system that utilized stablecoins pegged to various fiat currencies. The native token for paying fees on the blockchain was LUNA , which also played a crucial role in maintaining the price of the Terra stablecoins. Terra took a different approach and utilized an algorithmic model in which stablecoins like UST and KRW were pegged through algorithmic means. Then, they could sell the UST for a profit. For about a year and a half, this mechanism regulated the supply of UST according to demand and allowed the stablecoin to maintain its peg. Anchor's TVL grew at an unstainable pace before the depeg. Image source: DefiLlama. Since UST was a stablecoin, many users felt that Anchor Protocol was a safe option for earning yield. As it turned out, UST and LUNA grew too large for their own good, which exposed the inherent flaws in the algorithmic mechanism that was supposed to keep the price of UST and other Terra stablecoins close to their pegs. This reserve would be used to defend the UST peg in the event that it came under significant pressure.

Magdalena from Experty. Its journalists abide by a strict set of editorial policies. CoinDesk operates as an independent subsidiary with an editorial committee to protect journalistic independence.

.

Luna plays a vital part in this. Meanwhile, Luna lost This is what hyperinflation looks like. Leading crypto exchange Binance temporarily suspended withdrawals on Luna on Wednesday, and on Thursday night the Terra blockchain temporarily halted. Investors appear to be moving away from cryptocurrency and towards less risky investments in the face of global inflation. Shares in Coinbase , the largest crypto exchange in the US, dropped Hang tight. It will be published ASAP. The feelings are still raw. Please be safe.

Why luna coin is going down

The cryptocurrency market is in turmoil, exacerbated by the collapse of luna and the UST stablecoin, both tied to the terra blockchain. The crash has caught the eye of politicians and regulators. The company behind UST will be building a new blockchain, though it won't include a stablecoin. The cryptocurrency market is brutal right now: Look in any direction and you'll see red charts. Bitcoin has ended up in the red for eight consecutive weeks, a record for the cryptocurrency, and ether is at its lower point since While it's painful for crypto investors, this dive isn't entirely unprecedented. Cryptocurrencies are infamous for their volatility, and tempestuous economic conditions are bringing down not just crypto, but the stock market too. What is unprecedented, however, is the collapse of the luna cryptocurrency and its associated terraUSD stablecoin, aka UST.

Hotmail.com iniciar sesión

He is also interested in NFTs as a unique digital medium, especially in the context of generative art. Some would later, in mid, claim this is the type of scenario that actually spurred Terra's demise. Mission and price prediction predictions, investing. May 13th was the worst period in crypto history where the Tera Luna coin price launched sharply to less death in the past week it was very painful for people who have already invested by buying the Lunar Tera Doomsday token for the crypto currency world. May Blockchain data analytics firm Nansen releases its research about what happened during UST's death spiral. Fidelia Oriaifo. Interesting NFT v. The Sandbox vs Decentraland: Price predictions in gaming, Metaverse. MIR4 as a new big player in the play-to-earn world? A Guide to the Terra Ecosystem. Luna was impacted because it's the underlying [backer] of the UST. It could be argued that the aftermath of the Luna crypto collapse contributed to FTX's downfall as well, as the exchange had various commitments and deals with numerous investors holding positions in Terra.

The effects of that revelation made its way to the markets relating to another project also run by Wonderland founder Daniele Sestagalli, Abracadabra.

When crypto will go up? Don't miss the opportunity to grow your crypto wisdom and pick topics you are interested in:. Best crypto projects to invest in predictions, crypto market. GameFi predictions for what's next for Axie Infinity, Enjin etc. Experience Experty at its fullest. Luna Tera Everyone dreams of making a profit by buying Luna Tera tokens but what happens is just the opposite, Tera Luna shakes many investors with the stupidity of her CEO, it's a really painful tragedy In your opinion, what will happen next in the crypto sphere? Image source: Messari. Then, they could sell the UST for a profit. I will not trust Terra Luna. In this article, we will be taking a look at what happened to the LUNA crypto during the crash, as well as the aftermath of the collapse of the Terra and Luna ecosystem. The coin has the potential to recover, but at present things are extremely uncertain. Sometime Luna can will recover but i think not in this year, meybe in long future. Web 3.

It agree, rather useful idea

I confirm. I agree with told all above. We can communicate on this theme. Here or in PM.

I join. I agree with told all above. We can communicate on this theme. Here or in PM.