Woodside buy or sell

Woodside is a beneficiary of continued increase in demand for energy. Behind coal, gas has been the fastest-growing primary energy segment globally. Woodside is favorably located on Asia's doorstep. The global economy is cooling off and demand for energy will follow suit, particularly if Chinese growth rates taper.

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up. While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing. View our latest analysis for Woodside Energy Group.

Woodside buy or sell

Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources , and more. Learn More. Can the ASX energy share turn things around in ? UBS said recently it was cautious about growing risks to the Scarborough and Pluto 2 schedule and, therefore, the capital expenditure. UBS pointed out the successful appeal at Scarborough a few months ago by a traditional custodian of Woodside's regulatory approval to conduct seismic surveying at Scarborough over the quarter was another example of the "heightened pressure on regulatory approvals for hydrocarbon developments. Greenpeace is the latest organisation to take Woodside to court over alleged greenwashing. In what might be another headwind, investors often value blue-chip companies based on how much profit they're expected to make. If this is the case, it's understandable to see the Woodside share price dropping. Based on the current Woodside share price and the current exchange rate, it's valued at 12x FY24's forecast earnings, according to UBS. Whatever happens next with energy prices could have a significant influence, but that seems very unpredictable. It could also pay a grossed-up dividend yield of 9. That's a prediction, however, and price targets can change. There was speculation and recent confirmation that Woodside and Santos are in early talks about a possible merger. It's not guaranteed to go ahead for various reasons — Woodside shareholders may decide to vote against a tie-up if they don't think they're getting a good deal.

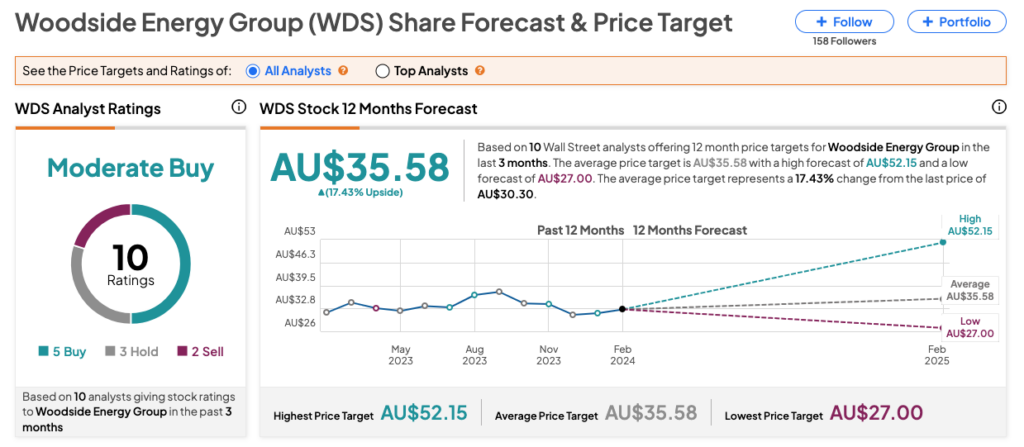

Woodside Energy Group Ltd has a conensus rating of Moderate Buy, which is based on 6 buy ratings, 3 hold ratings and 2 sell ratings. March 4, James Mickleboro.

For beginners, it can seem like a good idea and an exciting prospect to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing. In the last three years Woodside Energy Group's earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. As a result, we'll zoom in on growth over the last year, instead. Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation EBIT margin, it's a great way for a company to maintain a competitive advantage in the market. So it seems the future may hold further growth, especially if EBIT margins can remain steady. You can take a look at the company's revenue and earnings growth trend, in the chart below.

Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources , and more. Learn More. So, are Woodside shares now a buy or sell on the back of those price moves and the company's half-year results? Many of the key financial metrics were down year on year, largely due to lower realised oil and gas prices. But Woodside shares still returned some impressive numbers for the six months ending 30 June H1 But using Wednesday's exchange rate of

Woodside buy or sell

Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources , and more. Learn More. With the landscape for hydrocarbons players shifting substantially over the coming decade, the horizon for Woodside investors is set to be a colourful one.

Dorchester limo reviews

Does WDS pay a reliable dividends? Mr Goyder also served as Chair of the Australian B20 the key business advisory body to the international economic forum which includes business leaders from all G20 economies from February to December Crude Oil Head over to our Expert Center to see a list of the top Wall Street analysts and follow the analysts of your choice. My Watchlist. You can take a look at the company's revenue and earnings growth trend, in the chart below. Fundamentals Data provided by Morningstar. Jul 19, Unknown Analyst Not Ranked. February 23, James Mickleboro. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up. Total Current Liabilities. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals.

Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources , and more. Learn More. The ASX energy stock is currently nursing a loss of 0.

Z Score. Based on the current Woodside share price and the current exchange rate, it's valued at 12x FY24's forecast earnings, according to UBS. Working Capital. Nasdaq 15, Sector Energy. This is based on the ratings of 11 Wall Streets Analysts. Woodside has the potential to become the most LNG-leveraged company globally. Find actively-traded funds from around the world traded on over 30 global exchanges. Volume 1 month. Portfolio Backtesting Avoid under-diversification and over-optimization by backtesting your portfolios. Although Woodside Energy Group certainly looks good, it may appeal to more investors if insiders were buying up shares. Prior to joining Woodside, Ms O'Neill spent 23 years with ExxonMobil in a variety of technical, operational and senior leadership roles. WDS Stock. Macroaxis does not own or have any residual interests in Woodside Energy Group or other equities on which the buy-or-sell advice is provided.

I am sorry, that I interfere, there is an offer to go on other way.