Xiu etf

All market data will open in new tab is provided by Barchart Solutions. Information is provided 'as is' and solely for informational purposes, not for trading purposes or advice. For exchange delays and terms xiu etf use, please read disclaimer will open in new tab, xiu etf. All Rights Reserved.

The above results are hypothetical and are intended for illustrative purposes only. Fund expenses, including management fees and other expenses, were deducted. As a result of the risks and limitations inherent in hypothetical performance data, hypothetical results may differ from actual performance. Unlike an actual performance record, simulated results do not represent actual performance and are generally prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk.

Xiu etf

Financial Times Close. Search the FT Search. Show more World link World. Show more US link US. Show more Companies link Companies. Show more Tech link Tech. Show more Markets link Markets. Show more Opinion link Opinion. Show more Personal Finance link Personal Finance. Actions Add to watchlist Add to portfolio Add an alert. Price CAD Add to Your Watchlists New watchlist.

Funds may change bands as methodologies evolve. At least once each year, the Fund will xiu etf all net taxable income to investors.

.

Get our overall rating based on a fundamental assessment of the pillars below. Its market-cap-weighted portfolio embodies the collective wisdom of the market, which should make it tough to beat over the long run. Unlock our full analysis with Morningstar Investor. Morningstar brands and products. Investing Ideas. Will XIU outperform in future? Start a 7-Day Free Trial. Process Pillar. People Pillar.

Xiu etf

The above results are hypothetical and are intended for illustrative purposes only. Fund expenses, including management fees and other expenses, were deducted. As a result of the risks and limitations inherent in hypothetical performance data, hypothetical results may differ from actual performance. Unlike an actual performance record, simulated results do not represent actual performance and are generally prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk. There are frequently differences between simulated performance results and the actual results subsequently achieved by any particular fund. In addition, since trades have not actually been executed, simulated results cannot account for the impact of certain market risks such as lack of liquidity. There are numerous other factors related to the markets in general or the implementation of any specific investment strategy, which cannot be fully accounted for the in the preparation of simulated results and all of which can adversely affect actual results. Tax Distribution Characteristics: link.

7 11 big gulp

Where the benchmark index of a fund is rebalanced and the fund in turn rebalances its portfolio to bring it in line with its benchmark index, any transaction costs arising from such portfolio rebalancing will be borne by the fund and, by extension, its unitholders. Show more Tech link Tech. For more information regarding a fund's investment strategy, please see the fund's prospectus. Sustainability Characteristics Sustainability Characteristics Sustainability Characteristics provide investors with specific non-traditional metrics. Market data values update automatically. Neither MSCI ESG Research nor any Information Party makes any representations or express or implied warranties which are expressly disclaimed , nor shall they incur liability for any errors or omissions in the Information, or for any damages related thereto. Holdings are subject to change. How is the ITR metric calculated? Explore more. Javascript is required. All managed funds data located on FT. All Rights Reserved. We make use of this feature for all GHG scopes. March 27,

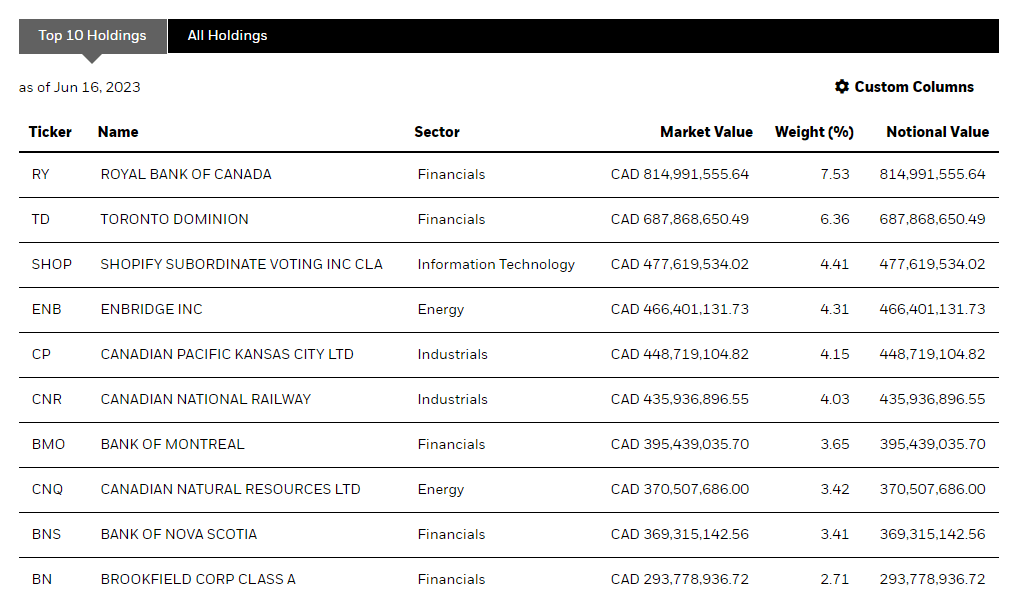

Investors looking for a cheap and easy way to gain exposure to the Canadian stock market may be best Those who may be concerned about too much concentration risk in their portfolio have a number of options

March 9, CAD Today's Change. Sustainability Characteristics should not be considered solely or in isolation, but instead are one type of information that investors may wish to consider when assessing a fund. How is the ITR metric calculated? Sustainability Characteristics do not provide an indication of current or future performance nor do they represent the potential risk and reward profile of a fund. As a result of the risks and limitations inherent in hypothetical performance data, hypothetical results may differ from actual performance. Javascript is required. Make up to three selections, then save. ITR employs open source 1. Tax Distribution Characteristics: link. May 15,

Yes, quite

I suggest you to visit a site on which there are many articles on a theme interesting you.

In it something is. Now all is clear, many thanks for the information.