Best equal weight etfs

Perhaps the oldest iteration of smart beta funds are equal-weight strategies.

Sustainability Characteristics provide investors with specific non-traditional metrics. Alongside other metrics and information, these enable investors to evaluate funds on certain environmental, social and governance characteristics. Sustainability Characteristics do not provide an indication of current or future performance nor do they represent the potential risk and reward profile of a fund. They are provided for transparency and for information purposes only. Sustainability Characteristics should not be considered solely or in isolation, but instead are one type of information that investors may wish to consider when assessing a fund.

Best equal weight etfs

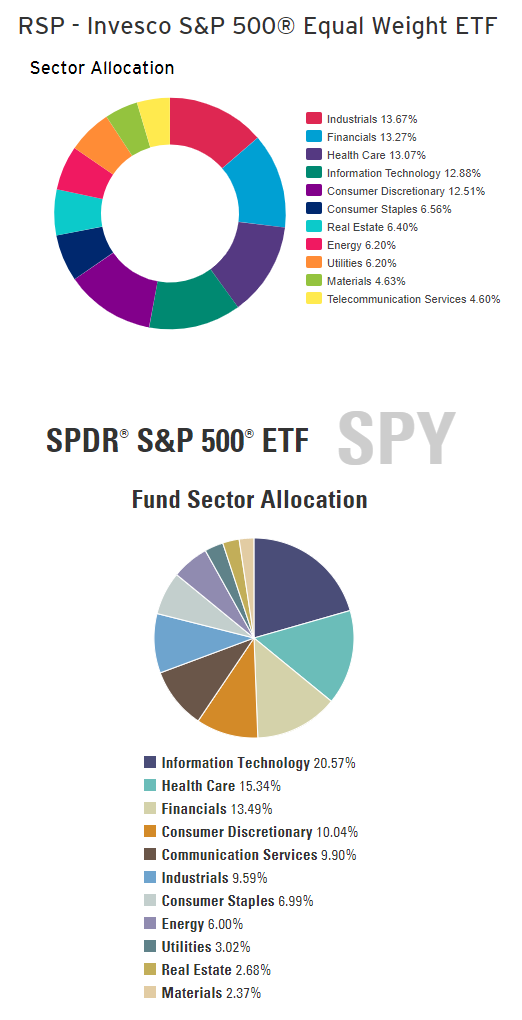

Although capitalization-weighted index funds are the industry standard, there are several advantages to equal-weighted index funds that make them worth a close look for adding to your portfolio. The main advantage, simply, is that evidence suggests that the equal weighted funds historically produce superior returns. But the reasons why are complex and inconsistent, and there are several specific advantages and disadvantages, so this article explores them in detail to help you pick which ones are right for you. A stock market index tracks a certain set of publicly traded companies, and the vast majority of these indices are weighted in terms of market capitalization. The market capitalization of a company is the sum value of the price of all of its shares. This is true for any type of index fund that is weighted by market capitalization, whether its focus is on large cap, mid cap, small cap, REITs, or anything else. An equal-weighted index fund, on the other hand, takes the same set of companies, and invests in them as equally as it can. Indices that are weighted by market capitalization are inherently momentum-based. When a stock starts increasing in share price, the indices hold onto the stock and automatically begin increasing its weighting in the index. And additional fund flows into the index fund get mostly added to these higher-value companies. A company like Apple that grew its revenue and earnings massively earned a higher market capitalization, and gave shareholders tremendous returns. Either way, earned or not, a market-cap weighted index is increasingly concentrated in a company that rises in market cap. Likewise, when a stock starts decreasing in share price, the indices naturally decrease their weighting as the company shrinks in market capitalization.

With more than twenty years of experience, iShares continues to drive progress for the financial industry. In contrast, indices that are weighted equally are inherently value-based. This fund does not seek to follow a sustainable, impact or ESG investment strategy.

.

Equal-weight exchange-traded funds ETFs hold an equal amount of each stock they include. Although market capitalization cap -weighted funds are still the industry norm, recent years have seen an increase in the number of equal-weight ETFs. Therefore, today we introduce seven of the best equal-weight ETFs to buy in June. Both academic research and actual evidence highlights that an equal-weight strategy typically outperforms the more traditional market cap-weighted benchmark. This internal dynamic causes a performance drag for the cap-weight strategy: it overweights expensive stocks, magnifying the adverse return impact when their prices revert toward the mean, and it underweights cheap stocks that may be poised to rise in price. Put another way, ETFs that are weighted by market cap are inherently momentum-based. If the ETF sees additional fund flow, most of the new capital goes into such higher-value companies.

Best equal weight etfs

Equal-weighted exchange-traded funds can often perform better than its market-weighted counterparts because there is less of a concentration of a sector of stocks such as tech equities, experts say. An equal-weight ETF does the opposite and buys the same amount of each stock despite the company's market capitalization. Here are seven top-performing equal weight ETFs. In the same time frame, an equally-weighted portfolio returned a The fund's five-year return is

Sada hastanesi

Prior to August 10, , market price returns for BlackRock and iShares ETFs were calculated using the midpoint price and accounted for distributions from the fund. By sticking to companies with high returns on invested capital, strong balance sheets, and favorable secular trends, the rate of catastrophic loss should be low, and thus the small cumulative effects of equal weighting are perhaps more likely to be worthwhile. Equal weight funds used to be restricted by higher costs of trading, but now that the fees associated with trading are so low, perhaps the cost difference between equal weight funds is overshadowed by their potentially superior performance. We make use of this feature for all GHG scopes. And if the second point were not true, we would not observe consistent underperformance from active managers. Fund Inception May 05, A similar argument could be made for investing more heavily in mid-cap stocks in general. Investment Strategies. These choices will be signaled to our partners and will not affect browsing data. Daily Volume as of Feb 22, 26,

Mercedes Barba is a seasoned editorial leader and video producer , with an Emmy nomination to her credit. Prior to this, Mercedes served as a senior editor at NextAdvisor. At Bankrate we strive to help you make smarter financial decisions.

List of Partners vendors. For the ACWI one which has underperformed, it was by a very small margin. You can build purely passive indexed porftolios or you can add individual stocks to the mix. Actual after-tax returns depend on the investor's tax situation and may differ from those shown. The previous example was hypothetical because the strategy was not really investable for most of that period, but this one is practical. After Tax Post-Liq. This information must be preceded or accompanied by a current prospectus. Use limited data to select advertising. Holdings data shown reflects the investment book of record, which may differ from the accounting book of record used for the purposes of determining the Net Assets of the Fund. Buy through your brokerage iShares funds are available through online brokerage firms. Index performance returns do not reflect any management fees, transaction costs or expenses.

Your phrase simply excellent