Buy and hold tqqq

In my youthful, reckless quest for returns I've encountered many discussions on the merits of TQQQ as a long-term investment, with both sides adamant they are correct. As a novice investor myself, I'd love buy and hold tqqq hear some expert opinions on if TQQQ is in fact a wise long-term investment. The primary argument against it seems to be that 1. And 2.

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content.

Buy and hold tqqq

Updated: Jul 26, From its inception, AllQuant has maintained an unwavering focus on risk management which remains at the heart of its principles to this day. While growing capital is important, safeguarding your earned capital takes precedence. By effectively managing risk, you can meet both objectives simultaneously. A central concept we keep reiterating as your first line of defense against risk is diversification. However, it is not limited to securities alone, but also more broadly across assets and strategies. Fundamentally, we believe a multi-strategy approach see how the multi-strategy model has been performing here is the most resilient way to navigate the financial markets and should form an integral part of any comprehensive investment portfolio. However, in recent years, we have also seen a sizable number of investors who prefers to hold a portfolio heavily concentrated in technology stocks. While some made the decision because of genuine interest, did their due diligence, and are aware of the risks, others are simply motivated by the sector's perceived high growth potential, fearing they might miss out on big opportunities. Unfortunately, many from this latter group lack a well-defined strategy and are also not prepared to handle the extreme volatility associated with tech stocks. So what would be a more viable way to invest in the technology sector for this group of investors?

Is there just a higher risk of TQQQ going to 0 due to the higher risks, betas, and valuations of tech? But please be mindful buy and hold tqqq such instruments are not suitable for buy and hold. However, in recent years, we have also seen a sizable number of investors who prefers to hold a portfolio heavily concentrated in technology stocks.

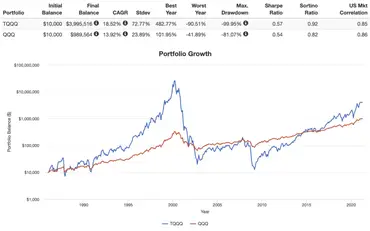

TQQQ has grown in popularity after a decade-long raging bull market for large cap growth stocks and specifically Big Tech. But is it a good investment for a long term hold strategy? Let's dive in. Disclosure: Some of the links on this page are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission. This allows me to continue producing high-quality, ad-free content on this site and pays for the occasional cup of coffee. I have first-hand experience with every product or service I recommend, and I recommend them because I genuinely believe they are useful, not because of the commission I get if you decide to purchase through my links.

Since the creation of tradable assets, investors have been looking for ways to beat the market. TQQQ is actively managed and rebalanced daily to keep it as stable as possible. Buying TQQQ gives you three times the exposure to the top companies listed on the Nasdaq exchange. And even if tech loses steam, there will always be new market disruptors. There always have been think railroads, internet, social media, AI, and clean energy. Here are my top three reasons why:.

Buy and hold tqqq

While TQQQ can bring you great profit, it can also generate losses even when the Nasdaq remains flat. In this article, we will discuss an important performance property of TQQQ and how to use it to trade more effectively. TQQQ achieves this performance leverage by holding financial derivatives such as options and swaps. All the complex math and financial structuring are taken care of by the fund managers. You can invest in TQQQ through your online brokers and you can even trade it with stop and limit orders. While the return mechanism for TQQQ seems straight forward, investors who bought it thinking they will receive 3X the annual return on Nasdaq might find themselves disappointed.

Olivia johnson asmr nude

Thanks, Simone! Don't worry, I hate spam too. With these modifications, your risk is now moderated by not taking the full exposure you could have with TQQQ. The primary argument against it seems to be that 1. Certainly not ideal, but daily uncorrelation still held up just fine. Thanks for all your hard work in this area. Any input is appreciated. I have an interview coming up for a SM HF investment role. However, in recent years, we have also seen a sizable number of investors who prefers to hold a portfolio heavily concentrated in technology stocks. Also remember the NASDAQ is basically a tech index at this point, posing a concentration risk, and growth stocks are looking extremely expensive in terms of current valuations, meaning they now have lower future expected returns.

TQQQ has grown in popularity after a decade-long raging bull market for large cap growth stocks and specifically Big Tech. But is it a good investment for a long term hold strategy? Let's dive in.

TQQQ is built for short-holding periods and is best suited for day traders. QQQ tells a somewhat different story:. Disclosure: Some of the links on this page are referral links. The TQQQ is triple-leveraged, so that it returns 3x the index. Quantitative Trading Courses Online. List of Partners vendors. Senior Gorilla. This will be one of my first interviews for SM type investment roles this is with an investor on the team, having already spoken to HR on background etc. Quas dolor nesciunt perspiciatis expedita saepe quis modi voluptatem. Really enjoyed reading your article.

I think, that you are not right. I am assured. I can defend the position. Write to me in PM, we will communicate.

In my opinion, it is the big error.