Can i retire at 60 with 500k australia

But, can i retire at 60 with 500k australia, is it enough to retire on? Although you can retire at any age, most people in Australia will retire somewhere between the ages of 55 and 65however the retirement income you can achieve may be vastly different depending on when you do. You should be mindful that you cannot access your superannuation until age The benefit of waiting until age 60 to retire is that you have access to your super and all income and investment earnings can be received tax-free if held within a superannuation income stream.

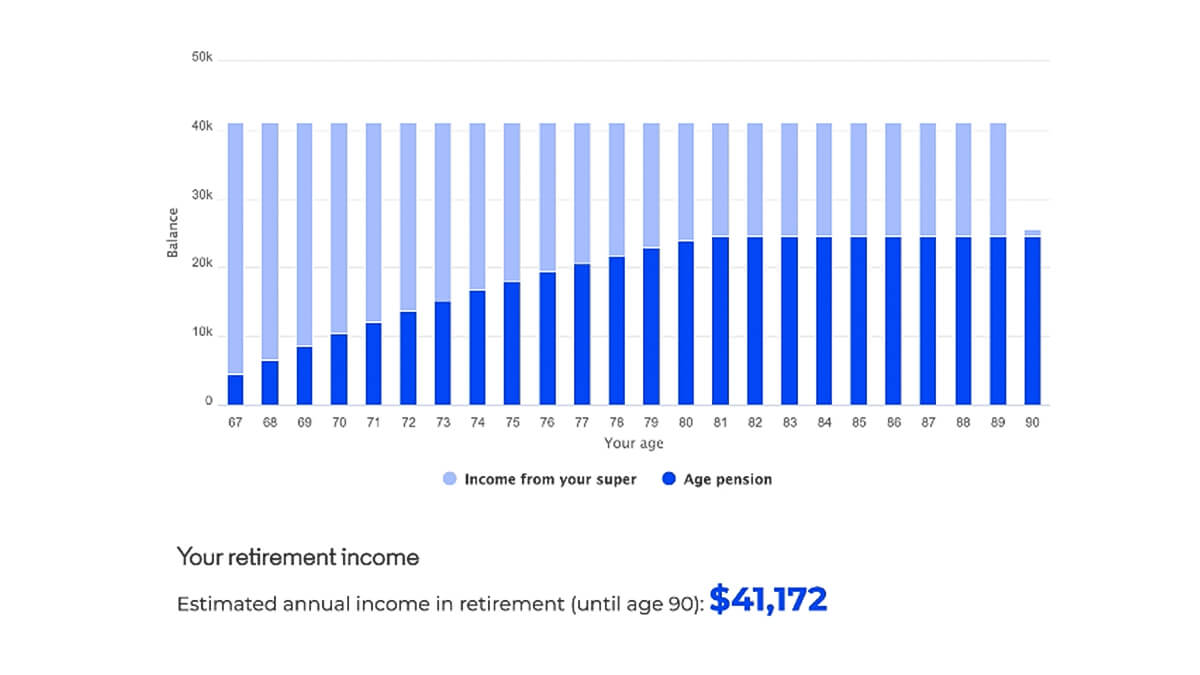

Do you see yourself retiring at 60? The amount of super you need to retire at 60 depends on how much retirement income you would like and how long you would like it to last. The table below details how much super you need based on a range of retirement income levels and longevity of income. The calculations were performed using the MoneySmart retirement planner calculator and all associated disclaimers and assumptions. Hopefully this table gives you a good idea of how much super you need to retire at age Obviously to achieve these retirement income goals, you need a suitable and robust investment strategy that has a high probability of achieving the required long-term returns.

Can i retire at 60 with 500k australia

But these are guidelines only. Depending on your personal circumstances, you might live comfortably on less especially if you are not keen on travel or intend to continue working into your 70s. Find out more about the impact of fees on returns from your super fund. We also assume you are a homeowner and include income from a full or part Age Pension if you are eligible this may happen as your super balance reduces over time. We have assumed an annual 2. Read more on how to work out how much super you need to retire. The data in these tables is a small selection of possible outcomes. The calculator also allows you to enter outside savings and investments. These figures do not consider your personal circumstances or assets and are also based on projections about future investment returns which may not be achieved. We recommend that you undertake your own additional research for your own retirement planning, and wherever possible seek independent financial advice. You should consider whether any information on SuperGuide is appropriate to you before acting on it. If SuperGuide refers to a financial product you should obtain the relevant product disclosure statement PDS or seek personal financial advice before making any investment decisions.

If that sounds like you, you might find comfort in The Motley Fool Australia's all-encompassing guide on retirement and maintaining a relaxed living standard through your second life.

Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources , and more. Learn More. The average Australian's superannuation balance leaves much to be desired for one seeking a comfortable retirement. Fortunately, there's a solution. Let's dive into what anyone hoping to enter retirement without a large super balance can do to financially prepare.

But, is it enough to retire on? Although you can retire at any age, most people in Australia will retire somewhere between the ages of 55 and 65 , however the retirement income you can achieve may be vastly different depending on when you do. You should be mindful that you cannot access your superannuation until age The benefit of waiting until age 60 to retire is that you have access to your super and all income and investment earnings can be received tax-free if held within a superannuation income stream. Furthermore, once you attain age 67, you could be eligible for Age Pension payments, which will supplement your income and mean you are less reliant on your own investments. To put all of this into context, research concludes that the income required for a modest retirement income and a comfortable retirement income is as follows:. The important thing is to ensure that the calculations you complete to determine the returns required are accurate.

Can i retire at 60 with 500k australia

Retirement is a major life milestone that should be a cause for celebration. But careful planning is needed to ensure a financially comfortable retirement. Taking steps today to help support yourself tomorrow can pay off when it comes time to exit the workforce. To ensure a comfortable living standard in retirement, you need to calculate how much you'll need to retire and then plan how to get there. Our seven steps to retirement planning in Australia will take you through everything you need to do. Leaving the workforce is an important life stage that you should be able to enjoy to the fullest. But a comfortable retirement does not just happen — it requires careful planning ahead of time. You will hopefully be retired for many years and want to enjoy that time.

621 brighton beach ave

By Penny Pryor Contributor. It entails thoughtful strategies, a keen awareness of your financial objectives, and a clear understanding of the steps needed to ensure your retirement is worry-free. In comparing various financial products and services, we are unable to compare every provider in the market so our rankings do not constitute a comprehensive review of a particular sector. Learn More. Featured Partner. Super to income reckoner. Figure out how much money you'll need in retirement 5. What do you want to do in your retirement? Depending on your income and assets, your age pension entitlements may be reduced, or if they are above a certain level, you may not be eligible for the pension at all. A 'modest retirement' in Australia secures financial security, covering essential needs like housing, food, and healthcare. Hopefully this table gives you a good idea of how much super you need to retire at age Our financial planning firm, Toro Wealth, specialises solely in helping 50 to 70 year-olds optimise their financial position in the lead up to retirement.

Do you see yourself retiring at 60? The amount of super you need to retire at 60 depends on how much retirement income you would like and how long you would like it to last. The table below details how much super you need based on a range of retirement income levels and longevity of income.

Providing access to our stories should not be construed as investment advice or a solicitation to buy or sell any security or product, or to engage in or refrain from engaging in any transaction by Forbes Advisor Australia. Others would want a more comfortable lifestyle and work in more luxuries, like a good quality car, some travel money, and so on. All information on this website is subject to change without notice. Calculations for couples assume both are the same age and super balances are split evenly. There may also be other expenses you need to meet. A 'modest retirement' in Australia secures financial security, covering essential needs like housing, food, and healthcare. Spending patterns change when we leave the workforce. If you'd like to start your retirement planning journey, these are the first seven steps you will need to take today. The advice and information provided by ForbesAdvisor is general in nature and is not intended to replace independent financial advice. Consult a financial advisor or use retirement calculators for precise figures, adjusting your plan as needed to ensure financial security throughout retirement.

0 thoughts on “Can i retire at 60 with 500k australia”