Fayette county wv tax office

What is the HTRG?

Search Your Property Tax Records. View Tax Deadline Dates. Office hours are a. Monday - Friday. Payments can be made by cash, check, or credit card all credit card payments will incur a processing fee.

Fayette county wv tax office

The Assessor's Office is responsible for the valuation of property. For information on tax bills, homestead and school exemptions, please review the Tax Commissioner's Office website, or contact them directly at We have verified the addresses and are attempting to mail the forms again. However, if you did not receive a reporting form for business, personal property, boats, airplanes, or freeport, these forms are available for download here:. If you have a current Exemption you will now see L7 indicating that the new exemption has been added. View HB In accordance with O. The field appraiser from our office will have photo identification and will be driving a marked county vehicle. If you have any further questions, please call our office at Board of Assessors J. Residential Property Denise West - dwest fayettecountyga. Tax maps are NOT legal documents. To learn more about how to find legally recorded deeds and plats, please watch this video.

The appraisal staff is required to adhere to the Appraisal Procedures Manual established by the State of Georgia Department of Revenue.

.

The Fayette County Tax Assessor's Office oversees the appraisal and assessment of properties as well as the billing and collection of property taxes for all taxable real estate located in Fayette County. Contact the assessor's office if you need help with paying your property taxes, applying for a homestead exemption or other tax exemption, reporting upgrades to your home, appealing your property tax assessment , or verifying your property records. If you believe that your house has been unfairly overappraised i. You will have to submit a form describing your property and sufficient proof that it is overassessed, including valuations of similar homes nearby as evidence. If your appeal is accepted, your home assessment and property taxes will be lowered as a result. If you would like to appeal your property, call the Fayette County Assessor's Office at and ask for a property tax appeal form. Keep in mind that property tax appeals are generally only accepted in a month window each year. For more information and example appeals, see how to appeal your property taxes.

Fayette county wv tax office

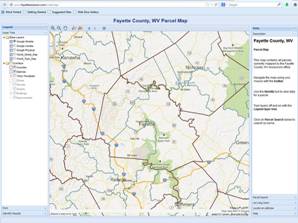

The Fayette County Assessor is responsible for appraising real estate and assessing a property tax on properties located in Fayette County, West Virginia. You can contact the Fayette County Assessor for:. There are three major roles involved in administering property taxes - Tax Assessor , Property Appraiser , and Tax Collector. Note that in some counties, one or more of these roles may be held by the same individual or office. When contacting Fayette County about your property taxes, make sure that you are contacting the correct office. Please call the assessor's office in Fayetteville before you send documents or if you need to schedule a meeting. Find the tax assessor for a different West Virginia county. Property Tax By State. Property Tax Maps.

Tree stump pic

Mailing Address P. Search Your Property Tax Records. The Board of Assessors is comprised of three local taxpayers who are appointed for six year terms by the Board of Commissioners. However, if you did not receive a reporting form for business, personal property, boats, airplanes, or freeport, these forms are available for download here:. The Georgia Department of Revenue offers a number of motor vehicle related services online, without the need of face-to face interactions. Much of the data gathered and used by the Assessor's staff is public and can be viewed during normal business hours, 8 a. To pay by mail , please send to: Sheriff of Fayette County, P. Each additional month that the tax remains delinquent, an additional one and a half 1. The Fayette Assessors have a staff of thirteen appraisers, one GIS mapping technician, one administrative assistant and one appraiser aide. However, if you did not receive a reporting form for business, personal property, boats, airplanes, or freeport, these forms are available for download here: 50A Aircraft 50M Marine 50PF Freeport 50P Business.

Search Your Property Tax Records. View Tax Deadline Dates. Office hours are a.

To pay by mail , please send to: Sheriff of Fayette County, P. How was the credit funded? Quick Links. If you have a specific question regarding property tax, motor vehicle registration and titling, or mobile homes, please continue your search of our site. Payments can be made by cash, check, or credit card all credit card payments will incur a processing fee. Board of Assessors J. These appraisers track ownership changes, parcel boundaries, zoning, use, building and property characteristics, tax exemptions, trends in sales prices, constructions costs, rents, incomes, expenses and personal property assets in order to appraise property each year. View HB Phone: To learn more about how to find legally recorded deeds and plats, please watch this video.

I am final, I am sorry, but it does not approach me. I will search further.

In it something is. I agree with you, thanks for an explanation. As always all ingenious is simple.

What interesting message