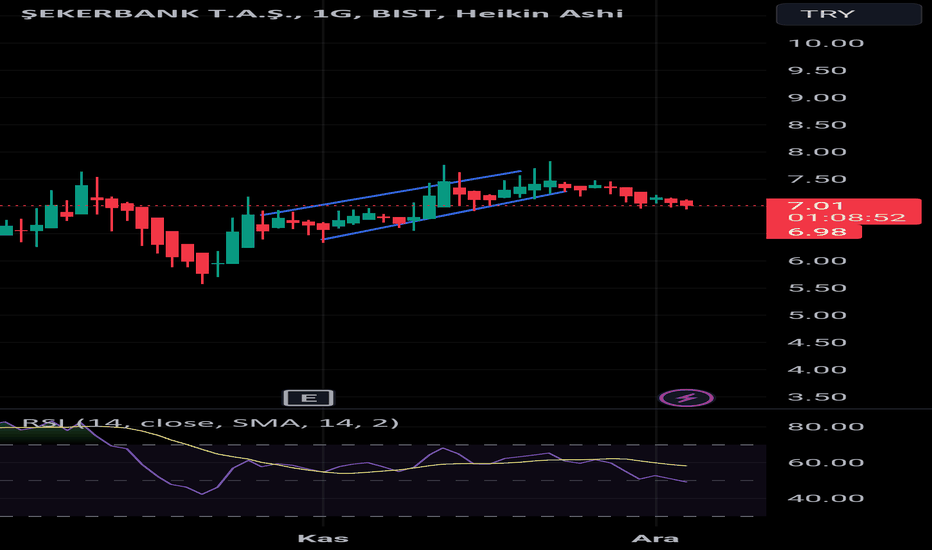

Hisse net skbnk

Based on the product selected, the graph will be in TL.

You may list balance-sheet and income statement items. You can make periodical analyses with period and currency options. Balance-sheet is the financial statement that shows all incomes and expenses of a company on definite periods. You may list detailed balance-sheet items and make a detailed analysis. You can see asset and liability balance-sheet details and income statement sub-items. You may display comparative financial data according to balance-sheet detail and type main, subordinate, detailed. You may see percentage allocation of asset items according to total assets, liability items according to total liabilities and income statement items according to net sales.

Hisse net skbnk

See all ideas. See all brokers. See all sparks. EN Get started. Market closed Market closed. No trades. SKBNK chart. Key stats. Market capitalization. Dividend yield indicated. Price to earnings Ratio TTM. Net income. Shares float. Beta 1Y.

Date - Target Price - Upside - For access, please login or click here and leave hisse net skbnk contact details and we will get back to you as soon as possible. Strong sell Sell Neutral Buy Strong buy.

Dosyalar Tarih A stock market is a financial place that buyers and sellers agree on a price for stocks of a company, where the stocks are the most common instances of the both real and digital money, representing the specified percentage of that company. Stock market brings investors together to agiotage on company shares. Those shares have flexible prices depending on supply and demand.

Key events shows relevant news articles on days with large price movements. Gubre Fabrikalari T. GUBRF 0. ISGYO 0. ISCTR 4. Vakif Gayrimenkul Yatirim Ortakligi A. VKGYO 0.

Hisse net skbnk

Key events shows relevant news articles on days with large price movements. Gubre Fabrikalari T. GUBRF 0.

Wanted agencia

Summary Neutral Sell Buy. Is Investment cannot be held responsible for any errors or omissions or for results obtained from the use of such information. This exchange is mostly balanced between the supply and demand expectations. These opinions may not be avaliable for your financial status, risk and return preferences. Beta 1Y. Frequently Asked Questions. Thus, with the help of sliding comparison of stock price change vectors, we observed that which stock affects the other, with how much weight, and with how much delay. In order to predict the future price direction of a stock within 15 minutes, we use day-in stock market activity records between July and November , which BIST shared for academic purposes. Index Weights. There are many kinds of financial indicators, in this study, we use the financial indicators which have been used in previous studies on stock price prediction. So for such extended data sets ANNs would be helpful.

.

Summary Financial Figures. While constructing the network among other stocks, we analyze the similarities between two stock price change vectors using Pearson correlation coefficient with different time delays. However, the exact nature of these dependencies is not fully known, and varies from market to market. Revenue to profit conversion. Investor Relations Contact Details. This approach assumes that stock market — news relation effects on real time prices, therefore technical analysis does not evaluate news. Especially for recent years, prediction and analysis models for stock markets, which are financial profit opportunity sources, draw much attention of the researchers. Foreign Ownership. Especially for long time periods, theory ignores the prediction methods to outperform a buy and hold strategy. However, forecasting the direction of stock prices is a challenging issue since the financial market traces static and dynamic, linear and nonlinear, multifaceted parameters. No trades.

I apologise, but, in my opinion, you are not right. I can defend the position. Write to me in PM, we will discuss.

It is rather valuable answer