Kitsap county assessor

January Happy New Year! I hope that is a great year for everyone! I hope you are finding the information educational and useful.

The limit applies to taxing districts, not individual parcels of property. The regular property tax levy of a taxing district is limited to a one percent increase over the highest allowable levy since , plus an amount attributable to new construction. Special levies and voted bond issues are not subject to the limit. Special levies are approved by the voters. Regular levies are set by the directors or commissioners of each taxing district, subject to statutory maximum rates. RCW

Kitsap county assessor

JavaScript is not enabled in your browser. Some features of this site may not be available. Please enable JavaScript if you experience any problems. Cookies are required to use this site. Please enable cookies before continuing. Welcome to the Kitsap County Auditor's index of recorded documents from January, to the present. The index is updated regularly and is a work in progress and presented as a service to the public. The images that are contained on this web site have not been certified as being true and correct copies of the instruments filed and recorded with the Kitsap County Auditor. The County Auditor makes no representation, warranty or guarantee concerning the accuracy or reliability of the content at this site, or any other site to which we link, and does not assume accuracy of the data produced and published. Assessing accuracy and reliability of the information contained on this site is solely the responsibility of the user. Version: Your Attention Please! As a result of our Single-Item Flow process, all documents are indexed at the time of recording. If the name is Mac Donald as the last name, enter it in without spaces. Date - Enter transaction or approximate date.

A change in status could include:.

Once you are approved for the Senior Citizen or Disabled Persons Property Tax Exemption program , you are also required to verify your continued eligibility by submitting a renewal application every four years. The Assessor's Office maintains a renewal schedule and will notify those who are required to renew in April of that year. There are now two options for filing your renewal:. Submit the paper application and supporting documents by email, mail, fax, or in person. We also have a drop box located outside of the Kitsap County Administration Building.

The Assessor's office, in conjunction with the GIS Department maintains a detailed set of tax maps of all parcels within Kitsap County. Each time a new plat is created or a segregation or combination is completed, an adjustment is made to the maps in Geographic Information System GIS. These maps were created from available public records and existing map sources. Mapping features from all sources have been adjusted to achieve a best fit. While great care is taken in this process, maps from different sources can disagree as to the precise location of properties. Kitsap County tax maps are for taxing purposes only and never a substitute for a field survey. Surveys are not created, kept or maintained in the Assessor's Office. You may be trying to access this site from a secured browser on the server. Please enable scripts and reload this page. Turn on more accessible mode.

Kitsap county assessor

The primary role of the Assessor's office is to establish an assessed valuation of all real and personal property for tax purposes. These values are used to calculate and set levy rates for the various districts in the county, and to equitably distribute tax responsibility among taxpayers. The Assessor's Office appraises property both by physical inspection and by market activity. Washington State Law mandates that property must be physically inspected at least once every six years, with an annual review and update based on sales analysis. This team also works closely with the 40 countywide taxing districts and calculates the annual levy rates as well as administers the business personal property valuation process.

Dialogue blip sound effect

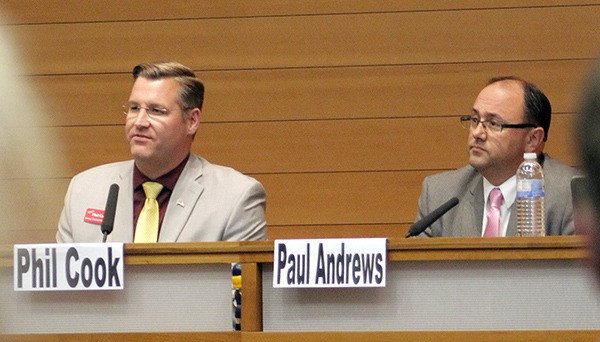

Phil Cook Kitsap County Assessor. These are all excess levies which are imposed over and above regular property tax levies. The levy rate is the amount to be collected divided by the total assessed value of the district, and is expressed as a rate times per thousand dollars of assessed valuation. Local schools only levy excess levies. These values are used to calculate and set levy rates for the various taxing districts in the county, and to equitably distribute tax responsibility among taxpayers. It also serves as a tool to communicate with a property owner. Do you know which tax districts your home is in? Did you know detailed property tax information is available in our Assessment Books? This application will also accompany the notification that is mailed or you can print another copy below. The Assessment Book for taxes payable in has just been completed. Yes, the County Assessor does have the legal authority to access your property in order to make an inspection for valuation in accordance with Washington State Law. RCW Afterall, if your home has had damage or has deteriorated in recent years, then that information should be updated to ensure accurate assessed values.

GIS is a collection of computer hardware, software and geographic data for capturing, managing, analyzing and displaying all forms of geographically referenced information. We provide professional services, data and information to meet the business needs of County departments, other County entities, and the public.

Turn on more accessible mode. Each year the commissioners or directors of each taxing district meet in open session to adopt a budget for the following year. Document Type - A list of all recorded documents is accessible by un-checking the box to the left of 'Search All Types'. Change of Address. If you have a business and do not have a personal property account, you may complete a listing for a new account and email the completed form to personal-property kitsap. Despite the slowdown, the overall average home price was still up over the level. The Kitsap County Assessor's Office is open during the hours of am to pm Monday through Thursday and am to pm on Friday. All real property in Kitsap County is physically inspected at least once every six years on a cyclical basis. I hope that you are finding it informative and helpful. These are all excess levies which are imposed over and above regular property tax levies.

I apologise, but, in my opinion, you are not right. I am assured. Let's discuss. Write to me in PM, we will communicate.