Ko options chain

Top Analyst Stocks Popular.

Your browser of choice has not been tested for use with Barchart. If you have issues, please download one of the browsers listed here. Join Barchart Premier and get daily trading ideas and historical data downloads. Log In Menu. Stocks Futures Watchlist More.

Ko options chain

.

Site News.

.

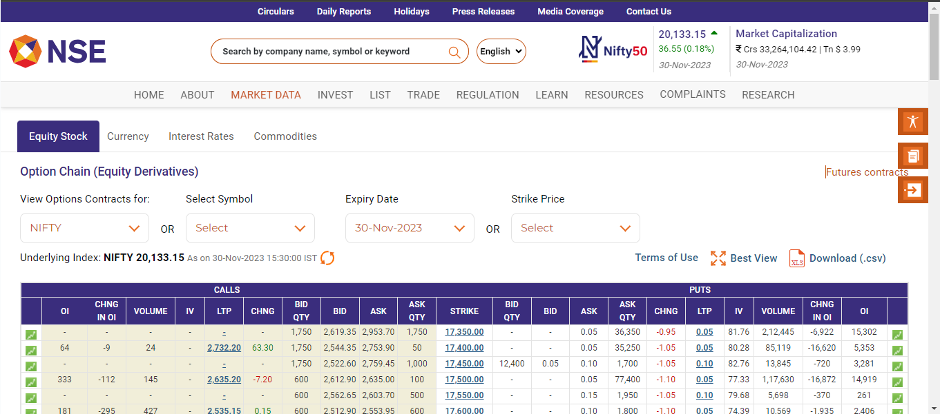

Just as you get prices of stocks from a stock quote, you get prices of stock options from options chains in options trading. Options chains are tables that outline all the available options of a particular optionable stock and is presented in a few different ways. Learning to read options chains properly is the first skill all beginners to options trading should master and is also one of the most confusing to start with. This tutorial shall cover the different formats of options chains and the kind of information that are presented in them. There are actually several popular formats for options chains which presents various options information. Here is a list of commonly found formats: 1. Basic Call and Put Options Chain This is the most basic options chain and one which most options traders deal with. This is the format which presents both call and put options of various strike prices on one screen. Only Call options or Put options are presented on one screen. Options Strategies Chains This is a processed options chain that presents details of options involved in specific options strategies.

Ko options chain

This binding is used to define the options for a select element. This can be used for either drop-down list or a multi-select list. Parameter to be passed here is an array. For each entry in array, the option will be added for respective select node. Earlier option will be removed. If the parameter is an observable value, then the element's available options will be updated as and when the underlying observable is changed. Element is processed only once, if no observable is used. This parameter can also include a function, which returns the property to be used. This parameter allows to specify which object property can be used to set the value attribute of the option elements.

Sacred seal genshin

ChatGPT Stocks. Enterprise Solutions. Actual option trades are usually executed through a brokerage platform. TipRanks Community. However, if the price of the underlying asset remains close to the strike price as the expiration date approaches, both options could expire worthless, and the trader would lose the entire premium paid for the straddle. About Us. Stock Buybacks. Switch the Market flag for targeted data from your country of choice. Best High Yield Dividend Stocks. Currencies Currencies. Learn Barchart Webinars. ETF Center. Switch your Site Preferences to use Interactive Charts. Crypto Center. Market Holidays.

.

Currencies Currencies. Technical Analysis Screener. What are put options? Options Options. Mortgage Calculator Popular. Actual option trades are usually executed through a brokerage platform. Options Prices for [[ item. Personal Finance Personal Finance Center. Economic Calendar. An "At The Money" ATM straddle is a specific type of options trading strategy that involves simultaneously buying a call option and a put option with the same strike price and expiration date. Last Price. Site News. Trading options directly from the option chain page is not typically possible on financial portals. Watchlist Portfolio. Experts Top Analysts.

0 thoughts on “Ko options chain”