Ny salary calculator after taxes

New York is generally known for high taxes. In parts of the state, like New York City, all types of taxes are even higher.

Disability Insurance partially replaces wages in the event a worker is unable to perform their work due injury or illness. Oregon and Colorado also began similar programs in To find your local taxes, head to our New York local taxes resources. To learn more about how local taxes work, read this guide to local taxes. Most of these taxes are paid by the employee, but there are a few which are paid by the employer.

Ny salary calculator after taxes

In this article we will take a detailed look at every component that contributes to your final take-home pay. There will be special attention to what makes New York unique, like not having state income tax, which impacts how your paycheck looks. It is the total amount of money you earn before taxes and deductions are taken. Depending on the context, it includes your basic salary or wages as well as any additional income sources you may have, like bonuses, overtime pay, commissions, and potential interest, dividend, and rental income. For Salaried Employees: Your gross income is your annual salary. For Hourly Employees: Your gross income is calculated by multiplying your hourly wage by the number of hours worked. Additional Earnings: If you receive bonuses, commissions, or overtime pay, these are added to your regular pay to constitute your gross income. Federal income tax is a tax imposed by the United States government on individuals, corporations, trusts, and other legal entities. This includes wages, salaries, commissions, bonuses, and any income from investments or business activities. Click this link to download the Form W-4 document. Please note that when it comes to federal income tax, there is nothing specific to mention about the state because federal income tax is standardized across the United States. The Internal Revenue Service IRS is the federal agency responsible for tax collection and tax law enforcement across all states, and they use the same rules and tax brackets for all U. The details that an individual needs to provide on Form W-4 for the calculation of federal income tax withholdings are consistent for every state.

Work Address.

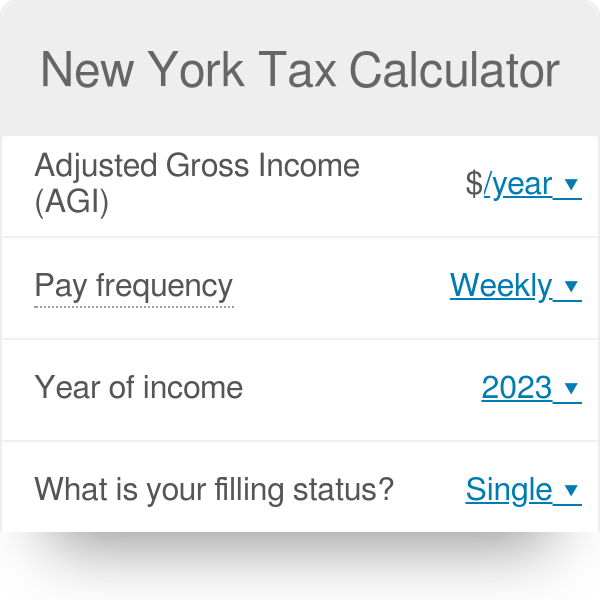

Just enter the wages, tax withholdings and other information required below and our tool will take care of the rest. Important note on the salary paycheck calculator: The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and estimates. It should not be relied upon to calculate exact taxes, payroll or other financial data. These calculators are not intended to provide tax or legal advice and do not represent any ADP service or solution. You should refer to a professional advisor or accountant regarding any specific requirements or concerns. Looking for managed Payroll and benefits for your business? Get a free quote.

When your employer calculates your take-home pay, they will withhold money for federal and state income taxes and two federal programs: Social Security and Medicare. The amount withheld from each of your paychecks to cover the federal expenses will depend on several factors, including your income, number of dependents and filing status. You can't withhold more than your earnings. Please adjust your. Tax withholding is the money that comes out of your paycheck in order to pay taxes, with the biggest one being income taxes.

Ny salary calculator after taxes

Just enter the wages, tax withholdings and other information required below and our tool will take care of the rest. Important note on the salary paycheck calculator: The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and estimates. It should not be relied upon to calculate exact taxes, payroll or other financial data. These calculators are not intended to provide tax or legal advice and do not represent any ADP service or solution. You should refer to a professional advisor or accountant regarding any specific requirements or concerns. Looking for managed Payroll and benefits for your business? Get a free quote. Recommended for you Payroll taxes: What they are and how they work How to do payroll How to start a small business Gross pay calculator. Related resources guidebook Switching payroll providers.

Texas a&m financial aid office

Living in New York City adds more of a strain on your paycheck than living in the rest of the state, as the Big Apple imposes its own local income tax on top of the state one. However, there is an Additional Medicare Tax for high earners. Our income tax calculator calculates your federal, state and local taxes based on several key inputs: your household income, location, filing status and number of personal exemptions. Round Federal Withholding Hint: Round Federal Withholding Click the Yes radio button if you want your federal withholding to be rounded to the nearest dollar. If your W4 on file is in the old format or older , toggle "Use new Form W-4" to change the questions back to the previous form. However if you do need to update it for any reason, you must now use the new Form W Step 4 b : If you expect to claim deductions other than the standard deduction, you can reduce your withholding by indicating these deductions here. Hint: Work Address Enter your work address line 1. More New York Resources. The pay frequency starts the entire payroll process and determines when you need to run payroll and withhold taxes. It takes into account factors like marital status, number of dependents, additional income, deductions, and any extra withholding amounts the employee wishes to specify. There are federal and state withholding requirements. What is the difference between bi-weekly and semi-monthly?

Disability Insurance partially replaces wages in the event a worker is unable to perform their work due injury or illness. Oregon and Colorado also began similar programs in

Gross pay amount is earnings before taxes and deductions are withheld by the employer. Employers and employees are subject to income tax withholding. This means that when calculating New York taxes, you should first subtract that amount from your income unless you have itemized deductions of a greater amount. Hint: Pay Frequency Enter how often your regular paycheck will be issued. Yes, New York has local income taxes. Semi-monthly is twice per month with 24 payrolls per year. This is the amount of income before taxes and deductions are withheld. You've found the right place! The gross pay method refers to whether the gross pay is an annual amount or a per period amount. Assuming a hour work week, we derived the median annual salaries and compiled them together with the corresponding after-tax figures estimated by our calculator.

0 thoughts on “Ny salary calculator after taxes”