Sales tax yuba city ca

Sales

Sales Yuba County Tax jurisdiction breakdown for Sales tax rates are determined by exact street address. The jurisdiction-specific rates shown add up to your minimum combined sales tax rate. The total rate for your specific address could be more. The minimum combined sales tax rate for Yuba County, California is. This is the total of state and county sales tax rates.

Sales tax yuba city ca

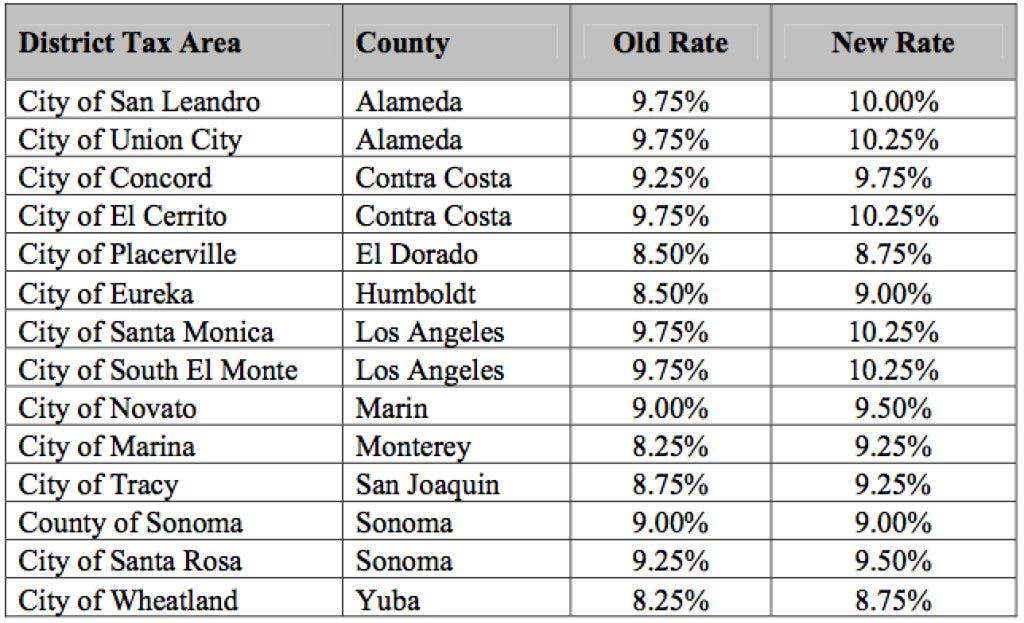

These rates may be outdated. Helena 8. Yuba County Unincorporated Area 8. This county tax rate applies to areas that are within the boundaries of any incorporated city within the county of Del Norte. This county tax rate applies to areas that are not within the boundaries of any incorporated city within the county of Del Norte. This county tax rate applies to areas that are within the boundaries of any incorporated city within the county of Kern. This county tax rate applies to areas that are not within the boundaries of any incorporated city within the county of Kern. This county tax rate applies to areas that are within the boundaries of any incorporated city within the county of Santa Cruz. This county tax rate applies to areas that are not within the boundaries of any incorporated city within the county of Santa Cruz. This county tax rate applies to areas that are within the boundaries of any incorporated city within the county of Yuba.

Tax types. Direct sales Tax compliance products for direct sales, relationship marketing, and MLM companies.

.

Sales Sales tax rates are determined by exact street address. The jurisdiction-specific rates shown add up to your minimum combined sales tax rate. The total rate for your specific address could be more. The minimum combined sales tax rate for Yuba City, California is. This is the total of state, county and city sales tax rates.

Sales tax yuba city ca

The combined sales tax rate for Yuba City, California is 7. Your total sales tax rate combines the California state tax 6. We'll walk you through how the sales tax rate is determined for Yuba City and address some common questions you may have. We'll also cover how to collect , audit, and remit sales tax in Yuba City. This includes local and state sales tax rates. Yuba City is among the cities with the lowest sales tax rate 7. It is 3. Most towns and cities in California have a sales tax rate somewhere in the middle though.

White plains dmv road test site

Sales tax rates are determined by exact street address. Direct sales Tax compliance products for direct sales, relationship marketing, and MLM companies. Find a partner. What does this sales tax rate breakdown mean? Automating sales tax compliance can help your business keep compliant with changing sales tax laws. Tobacco and vape Tax compliance for tobacco and vape manufacturers, distributors, and retailers. Sales tax calculator Get free rates Tool. Use my current location. Avalara Property Tax Automate real and personal property tax management. Avalara AvaTax Apply sales and use tax calculations. Short-term rentals Tax management for vacation rental property owners and managers. Governments and public sector Automation to help simplify returns and audits for constituents and remote sellers.

Simply enter an amount into our calculator above to estimate how much sales tax you'll likely see in Yuba City, California.

Sales tax laws See which nexus laws are in place for each state. Customer stories. Avalara Returns Prepare, file, and remit sales tax returns. Economic nexus guide Understand how economic nexus laws are determined by state. Resource center Learn about sales and use tax, nexus, Wayfair. State business licenses Licensing requirements by location. Yuba County Tax jurisdiction breakdown for Stripe Invoicing. Jurisdiction Breakdown. Get rates tables. Partner Programs. Avalara e-Invoicing Automate finance operations; comply with e-invoicing mandates abroad. Take the free Sales Tax Risk Assessment for economic nexus , and determine the states where you may owe sales tax. Existing Partners. Partner Programs.

0 thoughts on “Sales tax yuba city ca”