Staples 1099 nec 2022

Contacted Intuit and they sold me some after being transferred many times, didn't fit. Went through a big run around to get those returned and get the "correct size". Replacements came and they were the same size as the first ones, staples 1099 nec 2022.

Go to IRS. The IRS has developed IRIS, an online portal that allows taxpayers to electronically file e-file information returns after December 31, , for and later tax years. IRIS is a free service. See part F or go to IRS. Where to send extension of time to furnish statements to recipients.

Staples 1099 nec 2022

.

An entity is treated as fiscally transparent with respect to an item of income to the extent that the interest holders in the entity must, staples 1099 nec 2022, on a current basis, take into account separately their shares of an item of income paid to the entity, whether or not distributed, and must determine the character of the items of income as if they were realized directly from the sources from which they were realized by the entity. Transfer of stock pursuant to the exercise of an incentive stock option under section staples 1099 nec 2022.

.

JavaScript seems to be disabled in your browser. For the best experience on our site, be sure to turn on Javascript in your browser. Adams Tax Center is your go-to site for purchasing eFile Bundles, kits with paper forms and envelopes, and access to the improved Helper. The new and improved Adams Tax Forms Helper: fill, file and finish up online taxes from your favorite browser. Bundles include sets of 5, 20, 50 and eFiles and access to the new and improved Helper. Additional fees apply.

Staples 1099 nec 2022

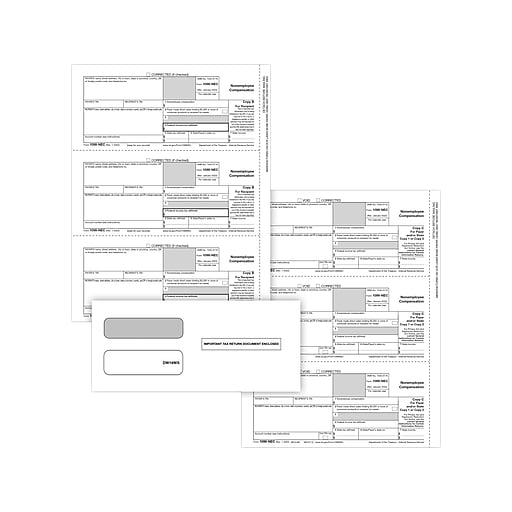

Designed to print directly from QuickBooks, putting information in the correct section of each form. Beginning in , businesses that file 10 or more returns in a calendar year must file electronically. Learn more about the IRS e-filing requirement changes. View larger image. Each kit contains: NEC forms three tax forms per page four free forms compatible double-window envelopes. Printable from laser and inkjet printers. Quantity will depend on the number of employees you have. Each kit contains: MISC forms two tax forms per page four free forms compatible double-window envelopes.

Clima monterrey diciembre 2022

May TAS can help you if:. In general, you must be able to show that your failure was due to an event beyond your control or due to significant mitigating factors. If you are an FFI described above that is electing to report an account to which you did not make any payments for the calendar year that are required to be reported on a Form , you must report the account on Form MISC or Form NEC. May take a peek on their offerings. Contact the applicable state and local tax department as necessary for reporting requirements and where to file. Extension to furnish statements, Extension of time to furnish statements to recipients. Burden estimates are based upon current statutory requirements as of October H Help, T. Withhold on payments made until the TIN is furnished in the manner required. Identify incorrect return submitted.

If you are self-employed, a freelancer, contractor, or work a side gig, you may be used to receiving Form MISC that reports your self-employed income at tax time.

Distributions from retirement or profit-sharing plans, any IRA, insurance contracts, and IRA recharacterizations including payments reported pursuant to an election described in Regulations section 1. For transactional reporting, the successor must report each of the predecessor's transactions and each of its own transactions on the appropriate form. Special reporting by U. Sponsored FFI. Provide all requested information on the form as it applies to the returns prepared in Steps 1 and 2. Sign In. Statement furnished by a government or governmental entity regarding payments required by a court order or agreement with respect to a violation or potential violation of law. If you need a waiver for more than 1 tax year, you must reapply at the appropriate time each year. The name of the filer's paying agent or service bureau must not be used in place of the name of the filer. Be sure to not include any personal taxpayer information. For more information, including the deposit requirements for Form , see the separate Instructions for Form , and Pub. Closer but the same problem.

0 thoughts on “Staples 1099 nec 2022”