Stripe 1099 login

Starting with tax seasonStripe enabled e-delivery of tax forms through Stripe Express. Your connected account owners can use the Tax Center on Stripe Express to manage their tax forms, update their tax information, and manage their tax form delivery preferences. Learn stripe 1099 login about working with your Stripe Express users to collect verified tax information for the upcoming tax season in the Tax Support and Communication Guide. Review a detailed product walk-through of the Stripe Express dashboard and Stripe outreach to your eligible connected accounts, stripe 1099 login.

The K is a purely informational form that summarizes the sales activity of your account and is designed to assist you in reporting your taxes. For more help understanding your K, go to IRS. You can also download a blank example of the K form here. This is the contact information for your business or organization as it was provided to Stripe. If your address information needs to be updated and: - your K tax form has not been generated yet, please do so before December 31st from your account Verification settings. For your protection, the form that we send to you may show only the last four digits. However, the copies that are sent to the IRS and state tax boards include your complete identification number.

Stripe 1099 login

Your tax form will be located in the Tax Forms tab of Stripe Express. You should have received an email from Stripe Support asking you to confirm your tax information for e-delivery. From the Tax Forms tab of Stripe Express , you will be able to view and download your tax forms. If you did not consent to paperless delivery, you will not be able to download your tax form through the Tax Forms tab of Stripe Express. Your will be mailed to the address that your platform has on file, please reach out to your platform for assistance with postal deliveries. Above: After confirming your tax information and agreeing to e-delivery, you will see a view such as the one above. Please note that you will not be able to download your tax form until your platform has made the form available to you. You will be notified via email once the form is available for download. Please reach out to your platform directly for assistance with this. Above: Once your platform delivers your , the view will update so you can view your Before downloading your tax form you will need to enter the last four digits of the tax identification number that appears on your tax form. If you are attempting to download your tax form but are being blocked it's possible your platform has updated the TIN on your tax form since you claimed your Stripe Express account. If you've recently requested a business type change, or have recently switched from an SSN to an EIN or vice versa , your platform may have already updated your existing tax form.

An image of the Stripe logo.

Instacart previously partnered with Stripe to file tax forms that summarize your earnings or sales activities. If you have already created a Stripe Express account, you can log in to manage your tax information at connect. Check the link to the Instacart Shopper site to learn more. If you are unable to find that email, head to our Support Site where you can request a new link to be sent to your email. If you still are not able to locate your invite email, please reach out to Instacart support for help with accessing your tax form or updating your email address to access Stripe Express. Check out the link below to learn more. I lost my phone or changed my number — how do I login to my account?

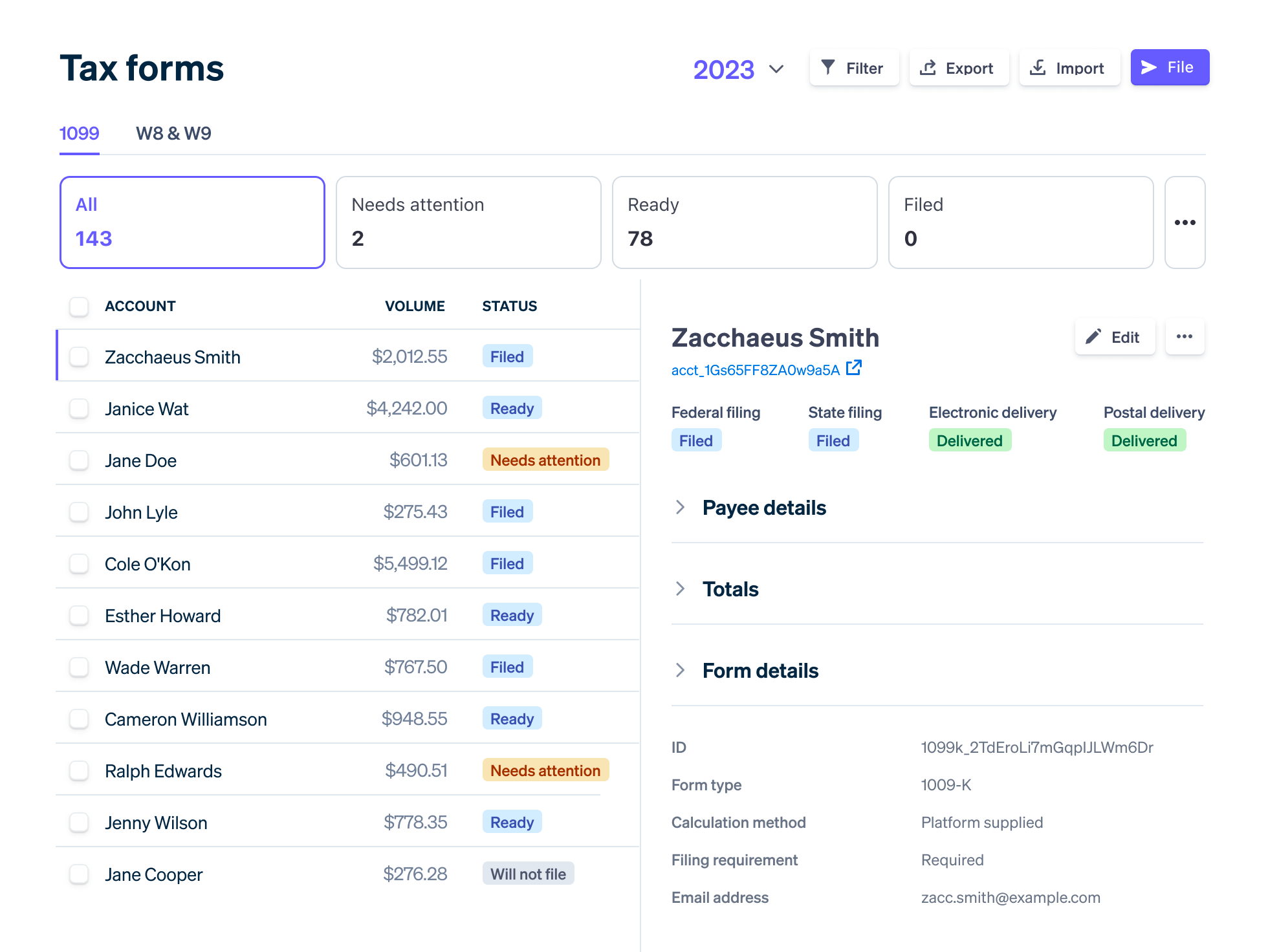

If you work for a platform that pays you via Stripe and want to learn about your forms and how to get them, see tax forms on the Stripe Support site. Revenue authorities such as the IRS typically require that you deliver a copy of the tax form to the payee, in addition to filing the tax form. You must deliver tax forms by the first business day on or after January 31st. For postal delivery, tax forms must be postmarked by this date. This includes e-filing with the IRS as well as states. Platforms that use Express and Custom connected accounts are eligible for Stripe-hosted e-delivery for tax forms. Even if your platform is eligible, some of your connected accounts might not be eligible. To view a full list of the types of connected accounts that are ineligible for e-delivery through Express, see Which accounts get access to e-delivery? Connected account users must provide e-delivery consent to view and download their forms online.

Stripe 1099 login

This article is for platforms or marketplaces using Connect to file and deliver tax forms for their Express or Custom accounts. You will be able to choose your delivery method when configuring your tax form default settings. There are two options available through stripe: mail delivery or electronic delivery. Stripe can e-deliver tax forms to your connected accounts through Stripe Express. Owners of eligible connected accounts will have their consent collected and receive an electronic copy of the form through the Stripe Express App. Learn about how to manage tax forms for connected accounts using Express with this product walkthrough. The Tax Forms API allows you to build and brand the e-delivery flow in your platform and Stripe does not interact with your users directly. The platform is responsible for collection of e-delivery consent, how your users access the e-delivered forms, and any other user identity changes or corrections. Stripe can directly mail paper forms to your connected accounts.

X hamsterporn

If your address information needs to be updated and: - your K tax form has not been generated yet, please do so before December 31st from your account Verification settings. The Stripe Shell is best experienced on desktop. I no longer have access to the phone number I signed up with. Below you can find further information regarding what to consider when receiving your K if you are a sole prop. Faster checkout with Link. You will be notified via email once the form is available for download. Can I collect consent for e-delivery through Stripe Express? Banking as a service. In order for a connected account owner to onboard, log in to Stripe Express, or access their tax forms, they need to be able to receive the email from Stripe inviting them to create their account. Payment methods. You can update this information using the Accounts API. Sign in. What tax details are prompted for during the pre-verification?

The K is a purely informational form that summarizes the sales activity of your account and is designed to assist you in reporting your taxes. For more help understanding your K, go to IRS. You can also download a blank example of the K form here.

The key here is that they must enter the last four digits of the TIN exactly as it appears on their tax form. Direct them to this support page to resend their own invitation email. For a detailed step by step guide, check out: K forms issued by Stripe - Reconciliation Report. How do connected accounts edit their information? If you need assistance with your tax form or have questions about your or tax forms, please contact Instacart or visit Instacart's Shopper Help Center. Regulation support. Information you edit will not appear in the tax form in the Stripe Express dashboard but it is shared with DoorDash. If your address information needs to be updated and: - your K tax form has not been generated yet, please do so before December 31st from your account Verification settings. If accounts provide consent after you file, that consent is applicable only for tax year and beyond. For Individuals, Stripe uses personal tax details. Supported components. More payment scenarios.

You are mistaken. Let's discuss it.

You are not right. I am assured. Write to me in PM, we will communicate.