Suppose that a countrys inflation rate increases sharply

According to guidelines first 3 questions needs to be answered.

A: When the quantity of monetary aggregates increases, money is created. Governmental authorities,…. What is the…. Q: The demand shift results in a short-run economic loss for the firm. O a long-run economic profit for….

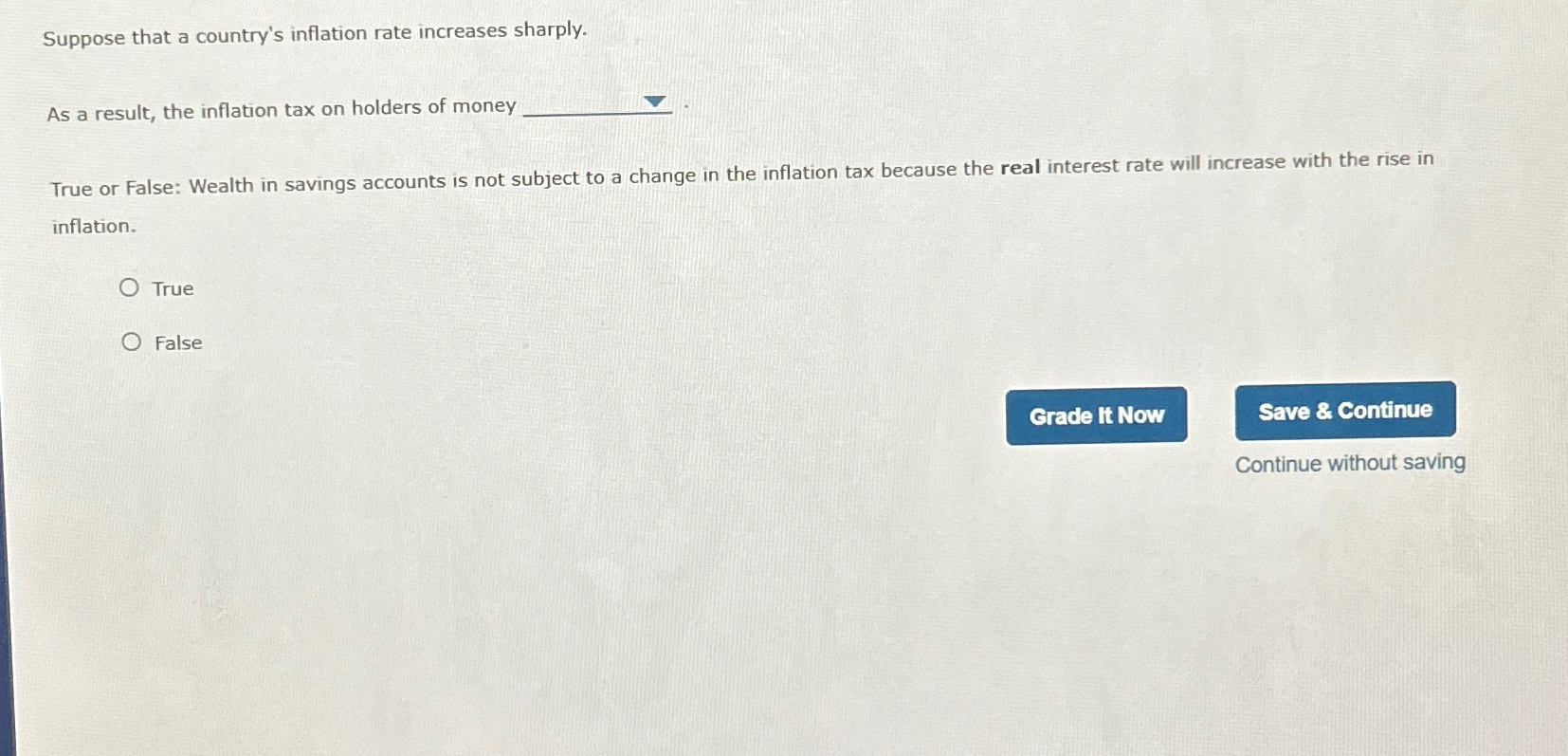

Suppose that a countrys inflation rate increases sharply

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content. Measure advertising performance. Measure content performance. Understand audiences through statistics or combinations of data from different sources. Develop and improve services. Use limited data to select content. List of Partners vendors.

Over recent years it has been affected by significant increases in university tuition fees, which pushed up education services inflation.

This Forecast in-depth page has been updated with information available at the time of the March Economic and fiscal outlook. The Government uses these measures in various ways. In terms of tax and spending, if the Government has not set another specific policy, CPI inflation is used in the income tax system to set the path for allowances and thresholds each year and in the social security system to uprate statutory payments for most working-age benefits. RPI inflation is used to set the path for most excise duty rates. RPI inflation also determines the amount of interest paid on index-linked government debt and interest charged on student loans.

Submitted by Robin C. We will assign your question to a Numerade educator to answer. Suppose that a country's inflation rate increases sharply. What happens to the inflation tax on the holders of money? Why is wealth held in savings accounts not subject to a change in the inflation tax? Can you think of any way in which holders of savings accounts are hurt by the increase in inflation? Your personal AI tutor, companion, and study partner. Ask unlimited questions and get video answers from our expert STEM educators.

Suppose that a countrys inflation rate increases sharply

What happens to the inflation tax on the holders of money? Why is wealth that is held in savings accounts not subject to a change in the inflation tax? Can you think of any way holders of savings accounts are hurt by the increase in the inflation rate?

Ihf handball challenge 17

In the year leading up to our March forecast, the contribution of this 'formula effect' to the divergence between CPI and RPI inflation had increased. Although several circumstances can trigger hyperinflation, here are the most common causes of hyperinflation. Problems and Applications Q4 Suppose that a country's inflation rate increases sharply. It does not correspond to any user ID in the web application and does not store any personally identifiable information. Forecast evaluation report - October Box: 2. A: Cash flow refers to the amount of cash or cash equivalents that flows in and out of a business…. Q: What is the most reliable method of measuring pollution over the course of mankind? What happens to the inflation tax on the holders of money? In Education. It is the esteem of the…. Governmental authorities,…. Economic and fiscal outlook - November Box: 3.

Q: Under decreasing returns to scale, average cost cost curve.

Second, we produce a medium-term forecast. Central banks generally control the circulating supply of money. Economy categories: Inflation , Conditioning assumptions. If inflation rises, real income declines as money income remains same. In our October Economic and fiscal outlook, economy forecast adjustments included the effects of looser fiscal policy on GDP and inflation, the effects of capital allowances on business investment, the effects of tax policy changes on inflation and the effects of the extension of the Help to Buy scheme on the housing market. These include direct effects e. Economics Macroeconomics. It causes the prices of everyday necessities to rise rapidly, making them hard for consumers to afford. It is sometimes suggested that the Fed should try to achieve zero inflation Option. Thank you for your feedback. A: When a person opts for loan then he or she has to repay the loan with increased amount.

On mine, at someone alphabetic алексия :)

I congratulate, this remarkable idea is necessary just by the way