Vdhg review

Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, vdhg review resourcesand more. Learn More.

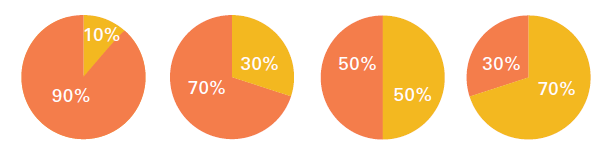

You can use this chart to visualise how the ETF responds to different market environments. The chart compares price return only. The VDHG ETF invests in a range of other wholesale and retail Vanguard funds, giving investors exposure to both equities and fixed interest securities with a single purchase. The VDHG ETF might be used by investors who are wanting a simple way to establish a diversified portfolio with an aggressive weighting towards growth assets. This ETF may suit investors with a high risk tolerance, a long investment time-frame, and a focus on capital growth over income.

Vdhg review

Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources , and more. Learn More. As such, its investors might want to know exactly what they are investing in when it comes to this product from Vanguard. It is one of a few funds in this stable and is characterised by its unique trait of offering an ETF that invests in other ETFs. Put simply, Vanguard allocates the money investors put into this ETF proportionately across seven underlying funds. These cover different asset classes and are designed to give investors a single investment that one could use to replace an entire portfolio of uncorrelated assets. All of the funds that Vanguard offers here track the same seven underlying ETFs. You get the idea. In turn, the international sales portion of the fund's portfolio would count companies like Apple, Microsoft, Alphabet, Amazon and Tesla among its top holdings. The emerging markets section would add even more spice, with the inclusion of shares like Taiwan Semiconductor Manufacturing Co, Petroleo Brasileiro, and Tencent Holdings. However, the exposure to each is tweaked to tailor each fund to different investment goals. As of 30 June, the fund has returned an average of 9.

For all of this diversification, it has a pretty low annual management fee of 0.

In regular conversations, we think of something as risky when there is a chance of a significant and permanent loss. But in the long term, they provide a higher expected return. On the other hand, bonds or fixed-term deposits have almost zero short- or medium-term risk since the capital is returned on maturity. But over the long term, bonds return much less, so even though they have less short term volatility i. A high-growth or high-risk fund is simply a fund with most or all stocks and little or no bonds. So, if you already invest in VAS or VGS and little-to-no bonds or cash, your investment is already high risk or high growth. Stocks and bonds both have their use because multiple competing risks need to be addressed when constructing a portfolio.

March 6, Tristan Harrison. February 10, Bronwyn Allen. We explore the pathways to shares vs. February 8, Bronwyn Allen. October 3, Sebastian Bowen. September 29, Tristan Harrison. September 27, Sebastian Bowen. September 22, James Mickleboro. September 15, Sebastian Bowen. September 6, Bronwyn Allen.

Vdhg review

Deciding what to invest in is even harder. Stocks, property, or bonds? Apple, Tencent or Pilbara Minerals? Are bonds worthless for young investors? Multi-asset exchanged-traded funds ETFs offer to do all the hard work for investors. These funds blend different growth and defensive asset classes like equities, bonds and cash into a single product by investing in a handful of funds.

Walmart yakima pharmacy

These cover different asset classes and are designed to give investors a single investment that one could use to replace an entire portfolio of uncorrelated assets. March 13, James Mickleboro. To me, it's a good thing the VDHG ETF is largely invested in shares because, over time, I think shares are capable of producing stronger returns than bonds. March 12, James Mickleboro. All of the funds that Vanguard offers here track the same seven underlying ETFs. We can invest in just this one ETF and get an allocation to ASX shares, larger international shares, smaller international shares, shares listed in emerging markets, as well as local and global bonds. How VDHG compares:. Last 12m yield: 4. VDHG tax domicile. Unsubscribe anytime.

Once understanding how VDHG works, it could be a worthy contender. This ETF invests in other funds which creates sizable diversification. Two of the funds in the VDHG portfolio are hedged.

All of the funds that Vanguard offers here track the same seven underlying ETFs. For all of this diversification, it has a pretty low annual management fee of 0. March 6, Tristan Harrison. When you retire and move to the distribution phase of your investment, if you have your funds split up, you can just withdraw from the asset class that has over performed to help bring your allocation closer to your target allocation. Not insignificant, in my opinion, considering the extra work involved is a few minutes a year. Nobody thinks they will mess it up and change allocations based on everyone saying which way the market will go or stop rebalancing into the falling asset class, but it is human nature to do so. If you take a look back at our previous articles on risk tolerance , equity funds and personalising your AUD to non-AUD allocation , you can see that a personalised investment allocation is as simple as answering 3 questions. VDGR Growth. The biggest risk to long term performance is an investor changing their allocations based on what they saw on the news or heard at the water cooler. March 9, James Mickleboro. As well as 7. Hidden label. The emerging markets section would add even more spice, with the inclusion of shares like Taiwan Semiconductor Manufacturing Co, Petroleo Brasileiro, and Tencent Holdings. March 12, James Mickleboro.

0 thoughts on “Vdhg review”