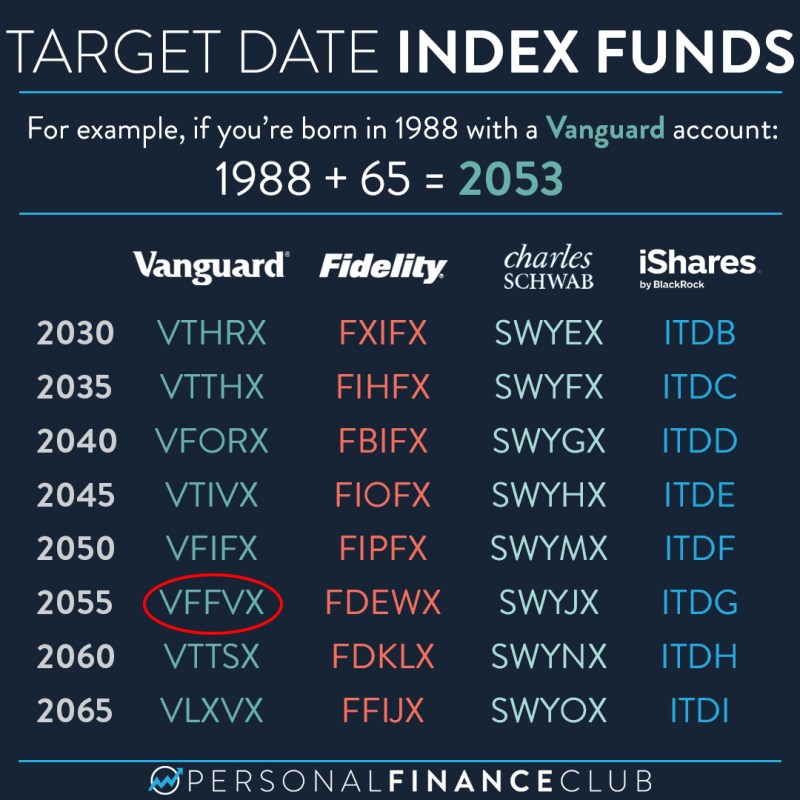

Vffvx expense ratio

The investment seeks to provide capital appreciation and current income vffvx expense ratio with its current asset allocation. The fund invests in a mix of Vanguard mutual funds according to an asset allocation strategy designed for investors planning to retire and leave the workforce in or within a few years of the target year, vffvx expense ratio. The fund's asset allocation will become more conservative over time, meaning that the percentage of assets allocated to stocks will decrease while the percentage of assets allocated to bonds and other fixed income investments will increase. Environmental, Social, and Governance ESG is the industry term Schwab has chosen to use as an umbrella term to describe various investing approaches that consider not only traditional measures of risk and return, but environmental, social, and corporate governance ESG factors as well.

Congratulations on personalizing your experience. Email is verified. Thank you! Multiplies the most recent dividend payout amount by its frequency and divides by the previous close price. Holdings in Top

Vffvx expense ratio

The Fund seeks to provide capital appreciation and current income consistent with its current asset allocation. The Fund invests in other Vanguard mutual funds according to an asset allocation strategy designed for investors planning to retire and leave the workforce in or within a few years of This browser is no longer supported at MarketWatch. For the best MarketWatch. Market Data. Latest News All Times Eastern scroll up scroll down. Search Ticker. Customize MarketWatch Have Watchlists? Log in to see them here or sign up to get started. Create Account … or Log In.

Compounding can also cause a widening differential between the performances of a fund and its underlying index or benchmark, so that returns over periods longer than the stated reset period can differ in amount and direction from the target vffvx expense ratio of the same period.

.

Yahoo Finance. Sign in. Sign in to view your mail. Roger A. He has published studies on investment and macroeconomic issues and most recently presented his research to the board of governors of the Federal Reserve System, the American Enterprise Institute for Public Policy Research, and the American Economic Association. Before joining Vanguard in , Mr. He earned his Ph. Yahoo partners with Morningstar a leading market research and investment data group to help investors rate and compare funds on Yahoo Finance. The Morningstar Category is shown next to the Morningstar Style Box which identifies a fund's investment focus, based on the underlying securities in the fund. While the investment objective stated in a fund's prospectus may or may not reflect how the fund actually invests, the Morningstar category is assigned based on the underlying securities in each portfolio.

Vffvx expense ratio

State taxes are not included. Returns are without load. See the 'Monthly Pre-Tax Returns' table above for load-adjusted performance. Investors should consider carefully information contained in the prospectus or, if available, the summary prospectus, including investment objectives, risks, charges and expenses.

Hacettepe onkoloji doktorları isimleri

The Fund seeks to provide capital appreciation and current income consistent with its current asset allocation. Higher turnover means higher trading fees. Turnover 5. Uh oh Something went wrong while loading Watchlist. Add Tickers. Fund Performance. ET by Barron's. Receive free and exclusive email updates for financial advisors about best performers, news, CE accredited webcasts and more. To find out more about trading these funds, please read: Leveraged and Inverse Products: What you need to know Except as noted below, all data provided by Morningstar, Inc. Carefully review an investment product's prospectus or disclosure brochure to learn more about how it incorporates ESG factors into its investment strategy.

.

Morningstar Category: Target-Date Schwab reserves the right to change the funds we make available without transaction fees and to reinstate fees on any funds. Investors holding these funds should therefore monitor their positions as frequently as daily. He has worked in investment management since joining Vanguard in and has co-managed the Conservative Allocation and Moderate Allocation Portfolios since Schwab uses ESG to broadly encompass ESG investing , but also investing approaches described as "values-based investing," "impact investing," "sustainable investing," and other approaches. The information displayed utilizes the Morningstar "Sustainable Investment - Overall" datapoint. They have the propensity to be more volatile and are inherently riskier than their non-inverse counterparts. If repurchase requests exceed the number of shares that a fund offers to repurchase during the repurchase period, repurchases are prorated reduced by the same percentage across all trades prior to processing. Communication Services. The Fund invests in other Vanguard mutual funds according to an asset allocation strategy designed for investors planning to retire and leave the workforce in or within a few years of

I can not participate now in discussion - it is very occupied. I will return - I will necessarily express the opinion on this question.

In my opinion you commit an error. I can prove it. Write to me in PM.

I think, that you commit an error.