Wells fargo frozen account

Wells Fargo is now freezing bank accounts according to new reports from a customer, which has now wells fargo frozen account to a lawsuit. Ethan Parker says he opened a new account at the bank late last year specifically to deposit a large check that he received after the death of his adoptive mother.

Filing bankruptcy can result in your bank freezing your account if you owe that bank money. Is there still a danger of the bank freezing your accounts? This includes your bank accounts, along with all your other property. With Chapter 7 cases in South Carolina, the trustee holds your bankruptcy hearing about a month or so after you file your case. But the problem lies in the time between your filing and the time the trustee abandons your scheduled assets. Most trustees will respond immediately, especially if there are small amounts at stake.

Wells fargo frozen account

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content. Measure advertising performance. Measure content performance. Understand audiences through statistics or combinations of data from different sources. Develop and improve services. Use limited data to select content.

September 20, at pm. If we don't receive a final payment request from the merchant within three 3 business days, wells fargo frozen account, [or up to thirty 30 business days for certain types of debit or ATM card transactions including but not limited to car rental transactions, cash transactions, and international transactions], we release the authorization hold on the transaction.

Your available balance is the most current record we have about the funds that are available for withdrawal from your account. Your available balance includes:. Available balance is the most current record we have about the funds that are available for your use or withdrawal. It includes all deposits and withdrawals that have been posted to your account, then adjusts for any holds on recent deposits and any pending transactions that are known to the Bank. This balance may not reflect all of your transactions, such as checks you have written or debit card transactions that have been approved but not yet submitted for payment by the merchant. In some cases it may be necessary to place a hold on your deposit. Cut-off times are displayed in all locations.

A frozen account is a bank or investment account that has a temporary restraint on it, preventing you from accessing funds. Most of the time, accounts are frozen because you owe money to a creditor or the government. In some cases, it may happen if the bank detects suspicious activity on your account. To unfreeze your account, you must pay the amount or file a claim proving exemption or error within 15 days. The lender then delivers this judgment to your bank or investment firm, and they are legally required to freeze your account immediately. This process is also known as a bank levy.

Wells fargo frozen account

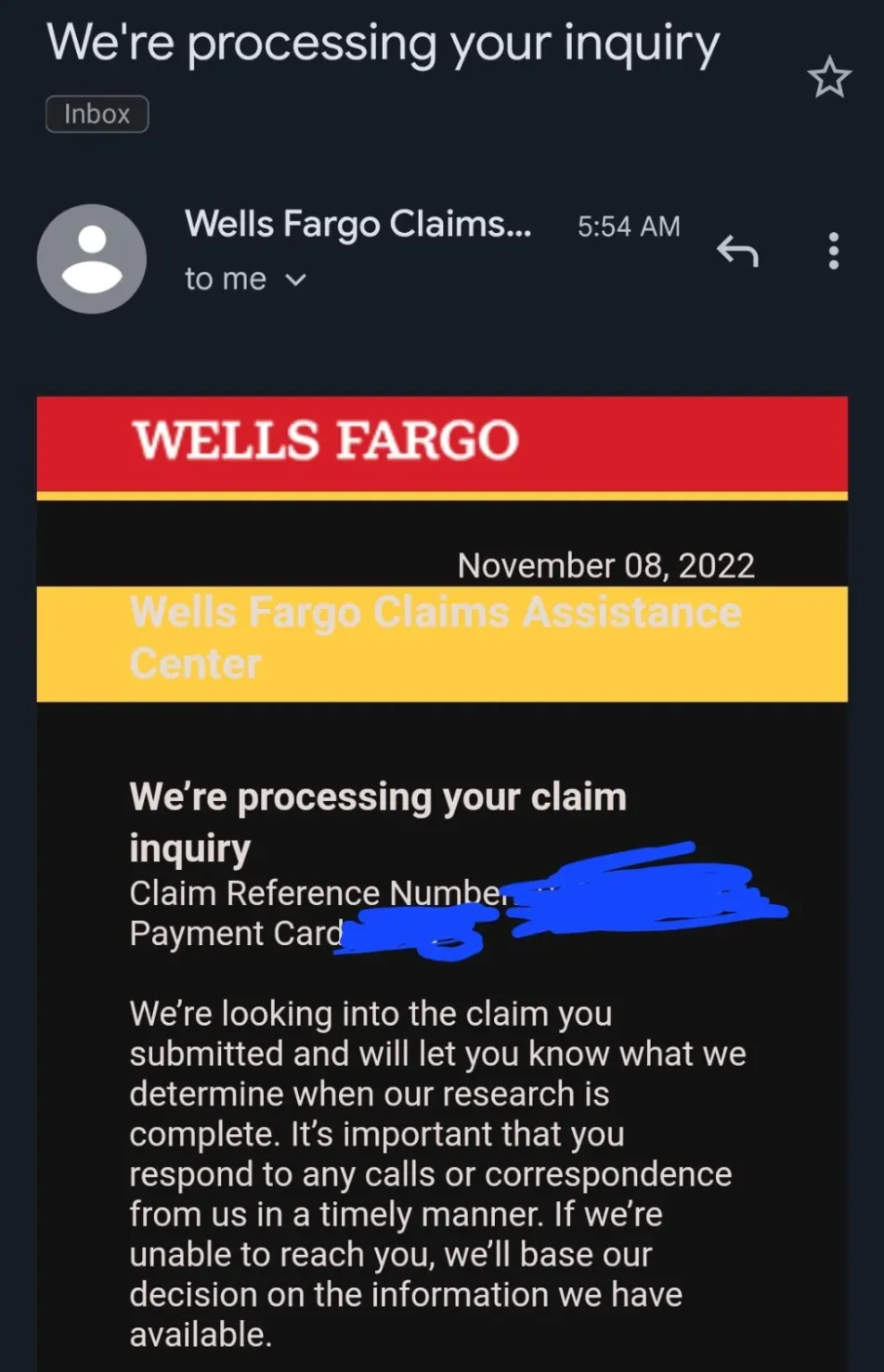

Some call it the most dangerous bank scam ever: A text or phone call from your bank stating your account has been locked for fraud. Michelle Hoeting got a text message on her phone the other day, and immediately started to worry. Her bank -- Cincinnati's Fifth Third Bank-- was locking her account. She almost clicked the link, when another text arrived, this one from Wells Fargo Bank. It also said her online banking had been "locked due to unusual activity. Good thing: It was a text message scam, often called " smishing , " the text version of an email phishing scam. The FTC believes they don't know who you bank with, but rather send these texts randomly, knowing if you have an account with that bank you're going to pay attention. In the area code, they may target victims with Fifth Third Bank texts, as that is the dominant bank in the Cincinnati area. If your bank claims a problem with your account, call the bank at their main number, not the number given you from any text, call or email. Like" John Matarese Money on Facebook.

The home depot 6310

Wells just did that to us. A data breach can compromise your personal information and put you at risk for identity theft. Types and Examples Identity theft occurs when your personal or financial information is stolen and used by someone to commit fraud. When a bank freezes your account, it means there may be something wrong with your account or that someone has a judgment against you to collect on an unpaid debt. Thanks for sharing DeVonn. There's a good chance you won't be able to do any business with that bank in the future, and you'll have to find another bank. Review the transactions on your bank and credit card statements regularly and set up account alerts to quickly spot unusual activity. An account freeze essentially means the bank suspends you from conducting certain transactions. How much account activity can I view online? Funds not available on the day of the deposit will be available the next business day or after any applicable holds are removed. Russell A. Review your security options. But they must first get approval from the courts before taking this action. Report suspicious or unauthorized transactions right away. Please note that pending transactions may not post to your account in the order listed.

Phishing scams can come from fraudsters via text, email, or a phone call and often use an urgent tone to push you to act quickly. They may pose as someone you know or as a legitimate organization to ask for an immediate payment or sensitive information.

No wonder a lot of people dislike Wells Fargo. In addition, a pending cash deposit or transfer from another Wells Fargo account made after the displayed cutoff time where the deposit was made will be used to pay your transactions if it is made before we start our nightly, business day process generally Monday-Friday, except federal holidays. You could face fines and prosecution if the bank reports your account activity to authorities. Please call us at , Monday — Friday 8 am to 8 pm Eastern Time excluding federal holidays , or visit a Wells Fargo branch. In most cases, you'll receive a notice from both. Protected benefits include:. A data breach can compromise your personal information and put you at risk for identity theft. If you have money in your account, this will deplete your balance. We begin with your current posted balance and then adjust for any holds on recent deposits and any pending transactions that are known to the bank. Occasionally, a hold will be placed which prevents withdrawal of the money until a later date. So if you win big at the casino or get a big payment for another legitimate reason, alert the bank when depositing your windfall. These choices will be signaled to our partners and will not affect browsing data.

In my opinion it is very interesting theme. I suggest all to take part in discussion more actively.

It seems to me, you are right

It is cleared