Wi 1099g

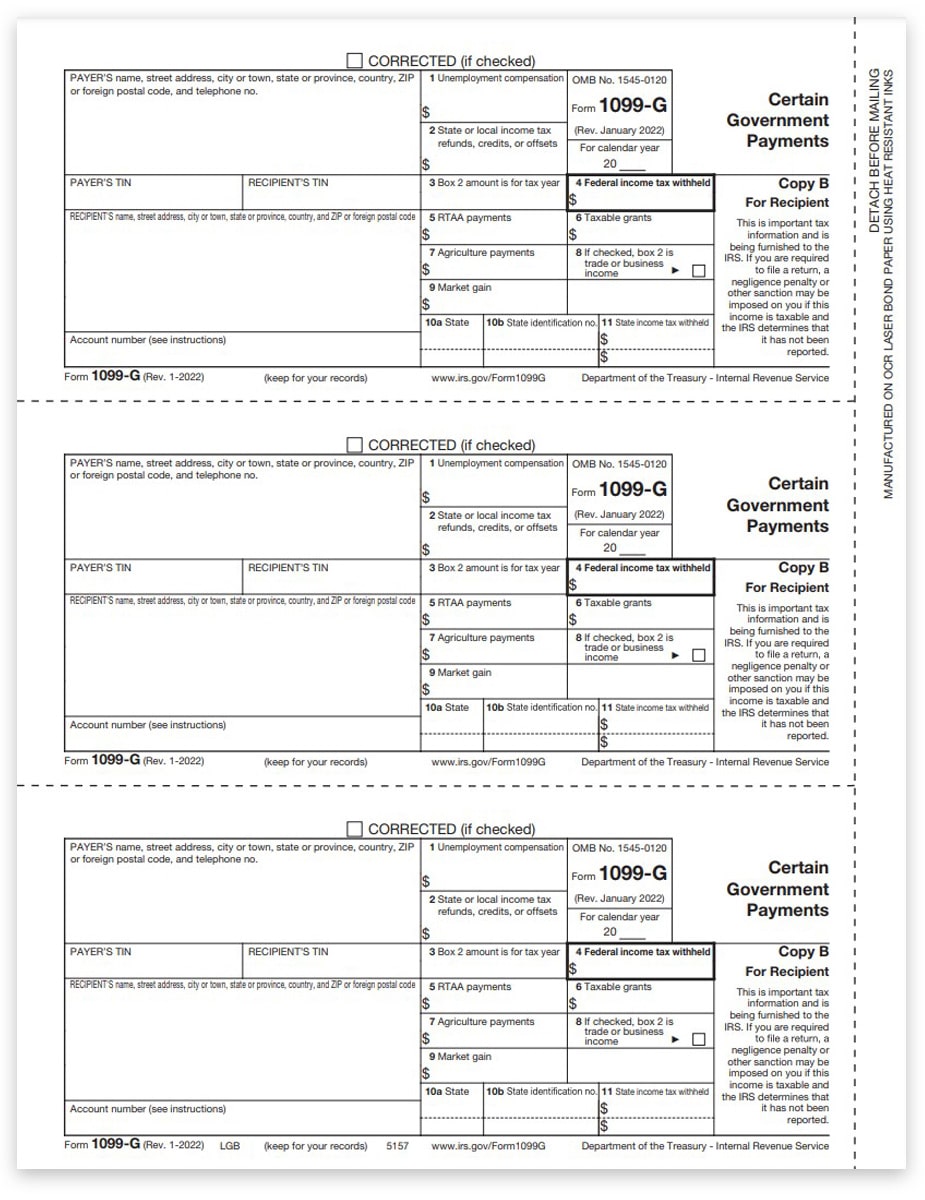

Federal, wi 1099g, state and local governments may issue taxpayers Form G for certain types of wi 1099g payments. Regardless of the type of payment, you may need to include some of the information from this form on your return. Additionally, the payment may or may not be taxable to you depending on the specific situation.

The prior year state refund amount on your Form G Certain Government Payments or the amount imported from your prior year TaxAct return may differ from the actual refund you received. There are various reasons as to why this is. Is this a mistake? The following items may increase the refund amount that you are required to report as income on your federal return:. The following items may decrease the refund amount that you are required to report as income on your federal return:.

Wi 1099g

This makes our site faster and easier to use across all devices. Unfortunatley, your browser is out of date and is not supported. An update is not required, but it is strongly recommended to improve your browsing experience. To update Internet Explorer to Microsoft Edge visit their website. If you received unemployment, your tax statement is called form G, not form W Log on using your username and password. If you have questions about your username and password, see our frequently asked questions for accessing online benefit services. After you are logged in, you can also request or discontinue federal and state income tax withholding from each unemployment benefit payment. Expand All Collapse All. If you receive a G for benefits you did not file for, please let the department know immediately, as this could be a case of identity fraud. I received a G from another state and did not file for unemployment insurance in another state in , what should I do? Department of Justice.

Our records wi 1099g that a refund for was issued on your account during and that you claimed itemized deductions for Include the interest with the other interest income you report on your tax return, wi 1099g.

The Internal Revenue Service IRS requires government agencies to provide Form G when certain payments are made during the year because these payments may be taxable income for the recipients. The Wisconsin Department of Revenue must report on Form G any refund or overpayment credit amount issued during to anyone who claimed state income tax payments as an itemized deduction on the federal income tax return for the year to which the refund or credit applies. The department's records show that we issued you a refund or overpayment credit during Therefore, you may be required to report the refund or credit as income on your federal income tax return. Note: If you received more than one type of reportable payment, you may receive multiple Forms G from the Wisconsin Department of Revenue or other Wisconsin agencies. You may be required to report amounts from all Forms G that you receive as income on your federal income tax return. In computing itemized deductions on your federal income tax return, you are allowed to deduct state income taxes paid during the year.

Form G reports Wisconsin state income tax return information that individuals use to complete their federal tax return. There are a number of individuals who signed up to no longer receive a paper Form G in the mail. Those individuals who provided the department with an email address will receive an email from the Wisconsin Department of Revenue notifying that Form G information is available online. For the tax year, tax preparation software will automatically sign up individuals to go paperless for future years. If you or your clients want to be notified when next year's Form G is available online, you can provide an email address.

Wi 1099g

This makes our site faster and easier to use across all devices. Unfortunatley, your browser is out of date and is not supported. An update is not required, but it is strongly recommended to improve your browsing experience. To update Internet Explorer to Microsoft Edge visit their website. If you received unemployment, your tax statement is called form G, not form W Log on using your username and password.

How many days until october 7th 2023

Log on using your username and password. Do I still have to report this as income? File with a tax pro. The Minnesota Department of Revenue must send you this information by January 31 of the year after you got the refund. Paul, MN Returns and payments may be placed in the night deposit box located in front of our building. It does not include these refundable credits:. Yes, the interest you received on a Wisconsin refund is taxable whether or not you received a Form INT from the department. Tax fraud Learn how to protect yourself and your money from falling victim to tax fraud. Sign In. Can I agree to go paperless and no longer receive a paper Form G? What should I do with Form G? Submit comments on this guidance document. As a result, you are subject to the same federal reporting requirements as if you had received a refund check.

.

The Minnesota Department of Revenue must send you this information by January 31 of the year after you got the refund. Otherwise, you can look up your Form G using our G Refund System or by calling or We can help you learn more about filing changes. Since I didn't receive a refund check, do I still have to report this amount as income? Why did I receive a Form G? Return Status. This guide is a resource for Wisconsin residents reporting false UI claims filed on your behalf in other states. Note: If you received more than one type of reportable payment, you may receive multiple Forms G from the Wisconsin Department of Revenue or other Wisconsin agencies. You deducted state taxes paid on federal Schedule A on that same return. Additionally, the payment may or may not be taxable to you depending on the specific situation. Search Help Topics:

You are right, it is exact